Why Didn’t the Australian Housing Market Crash?

It has been a devastating year for many households and small businesses as Australia moves through its first recession in more than 28 years.

ABS payroll data suggests wages are down 4.3 per cent between Australia’s 100th case of Covid on 14 March 14, and 31 October and payroll jobs decreased 3.0 per cent.

At the onset of the pandemic, consensus seemed to be building that the national decline in property values could reach 10 per cent, with worst-case scenarios suggesting prices could fall by as much as a third.

But between March and October, Australian home values have fallen just 1.7 per cent and October marked a 0.4 per cent increase in values, with the trend over November suggesting a further acceleration in growth.

Although housing values are once again rising, it’s important to highlight that Melbourne housing values remain around 5.4 per cent below their recent high.

Sydney housing values are still 4.8 per cent below their 2017 peak and values in Perth and Darwin are more than 20 per cent below their 2014 peaks, while the remaining capital cities have seen housing values move to new record highs through the Covid period.

As Australia enters the start of a gradual recovery from the largest economic downturn since the 1930’s, how can this be reconciled with such a mild downturn in property values?

A few factors that may explain the relative stability in housing, at a high level, are put forward below.

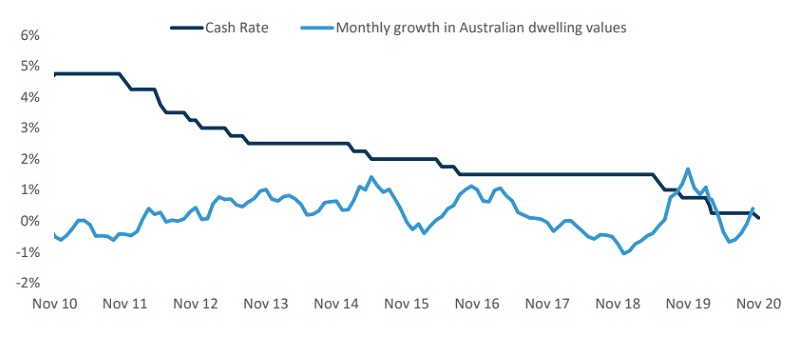

Low-cost debt

The cost of borrowing money is probably one of the most important factors influencing property values.

Over 2020, the RBA have reduced the official cash rate target (which influences lending rates) by 65 basis points, to 0.1 per cent.

In a bid to stimulate economic activity, the reduced cash rate has lowered bank funding costs, leading to record low mortgage rates.

This relationship has held up historically, with RBA research previously suggesting that a 100 basis point reduction in the cash rate can lead to an 8 per cent increase in property values over the following two years.

RBA cash rate v monthly change in national dwelling values

^Source: RBA, Corelogic

In fact, it is not uncommon for housing markets to increase in value during negative economic shocks, or periods of rising unemployment.

This is because the monetary response to rising unemployment and falling consumption, is often to lower the price of debt.

Those that still have a secure income during these shocks may be more inclined to borrow and buy as a result.

Mortgage repayment deferrals

The Australian household debt to income ratio is an eye-watering 185 per cent.

This high level of debt is a vulnerability amid severe economic contractions, because sudden job loss reduces the ability of households to service this debt.

In the April Financial Stability Review, the RBA highlighted that each 100 basis point increase in the unemployment rate could lead to an 80 basis point increase in the portion of mortgages in arrears.

In the case of large-scale mortgage debt, ongoing arrears can lead to forced sales, which in turn fuel risks associated with higher supply in the housing market, lowers values, and higher rates of negative equity, where the borrower sells their property for less than what they owe the bank.

Mortgage repayment deferrals have acted as a temporary stopper on this vicious cycle.

Those that did not want to sell amid economic uncertainty due to an inability to repay their mortgage, did not have to.

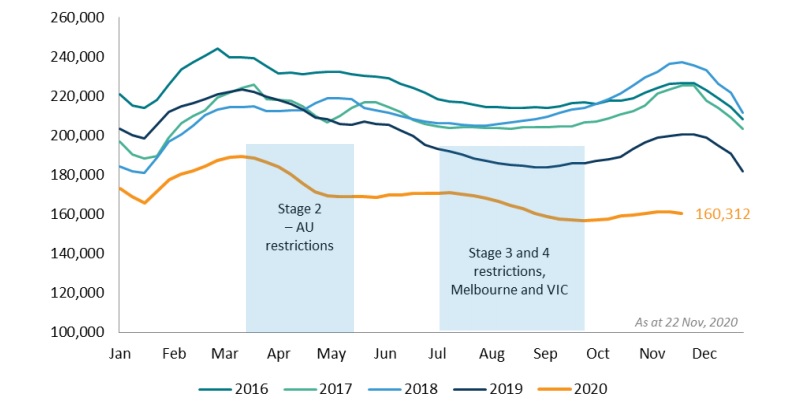

This may have contributed to very low levels of stock throughout 2020, which only reduced further amid stage 2 restrictions from March.

The low level of stock on market likely helped to insulate dwelling values during this time.

Number of total listings

^Source: Corelogic

The April Financial Stability Review also noted that over half of owner-occupiers with a mortgage had at least three months of pre- payments on their mortgage.

Indebted households are further supported by the record-low cash rate, which is lowering the cost of servicing debt as incomes have fallen.

APRA data on loan deferrals show borrowers are becoming less dependent on these policies.

As jobs and incomes slowly recover across the economy, the portion of housing loans deferred has come down from a peak of 11 per cent in May, to 7 per cent in September.

More recent updates from lenders indicate the number of mortgages on deferral arrangements fell sharply through October and November.

Continued leniency for mortgage repayment deferral, particularly for owner-occupiers, is in the interest of the banking sector, and extends the “bridge to recovery” as the economy gradually recovers.

It is worth noting indebted households do ultimately pay for mortgage repayment “holidays”.

With unpaid interest capitalising on their loans, these households will be further indebted down the line, which may constrain their future consumption, particularly in the event of another shock to the economy.

For now, however, it is a policy which has helped to stave off further deterioration in housing markets.

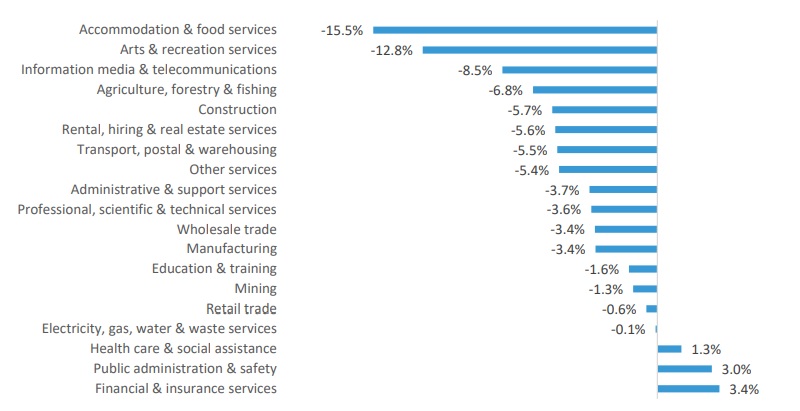

This economic downturn was different

A third, important factor that may have insulated parts of the housing market is the specific nature of the economic downturn.

Severe job loss across hospitality, tourism and the arts resulted from the purposeful slowdown of “social consumption”.

Change in payroll jobs

^Source: ABS, 14 March to 31 October

Those working in food and accommodation and arts and recreation, have seen devastating job loss through the pandemic.

However, those working in this industry are less likely to have mortgage debt.

The decline of employment in these sectors likely contributed to severe pockets of rental income decline, but the investor servicing debt may be able to hold on to the asset while it is temporarily vacant.

It is worth noting that prolonged declines in rental markets do ultimately pose risk to values.

An example is Inner-city Melbourne, which has high exposure to rental demand from overseas migrants.

Median asking rent values across the Melbourne SA2 market have fallen 24.2 per cent between March and October.

This highlights re-opening international travel and migration as a key part of bolstering rental income from property.

Housing markets did not hold up everywhere

These aforementioned factors may have contributed to stability in the housing market at an aggregate level in the face of Covid.

The many markets that make up the Australian property market still add complexity in evaluating its performance.

There have in fact been significant corrections in property values since March, such as in the inner-east of Melbourne, which fell -9.6 per cent in value over the period.

Covid has affected property markets, but severe loss in housing values has so far been contained.

Looking forward, despite further reductions in fiscal support, dwelling values are likely to continue rising off the back of the November cash rate reduction, converging with a recovery in consumer sentiment and economic conditions.

A strong institutional response and the manufactured nature of the current downturn has moderated the impact of Covid on the housing market, and would be further buoyed by the ongoing containment of the virus.