Why Is Melbourne Property Leading the Downswing?

The Melbourne property market is the worst capital city performer since the onset of Covid- 19, according to July's Corelogic index results.

June marked the third consecutive month of value falls across the city. This sees values down 2.3 per cent from the previous quarter, when the market hit a record high.

The results may be surprising, particularly when considering that the Sydney growth rate, which often moves quite closely with Melbourne property, was less than half this rate in the same period (at -0.8pc).

Several factors may explain why Melbourne in particular has experienced a more rapid decline.

Change in dwelling values Covid-19

| City | Month | Quarter |

|---|---|---|

| Sydney | -0.8% | -0.8% |

| Melbourne | -1.1% | -2.3% |

| Brisbane | -0.4% | -0.2% |

| Adelaide | -0.2% | 0.7% |

| Perth | -1.1% | -1.4% |

| Hobart | 0.3% | 1.0% |

| Darwin | 0.3% | 0.4% |

| Canberra | 0.1% | 0.7% |

^ Source: CoreLogic results for June

Melbourne has sometimes ‘led’ cycles, and has often been more volatile

Data suggests that the Melbourne market has experienced a turn in its market before others. This was evident in the most recent upswing, where Sydney and Melbourne saw peak growth rates around November 2019, while other capital cities continued to see a more moderate but accelerating growth rate.

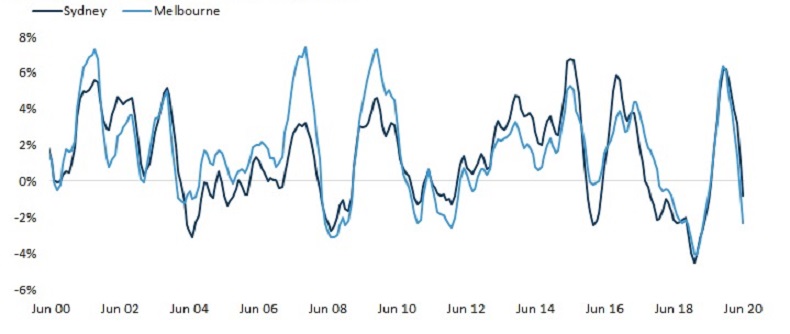

The chart below shows quarterly growth of Sydney and Melbourne dwelling markets over the past 20 years. This longer-term view suggests it is not uncommon for Melbourne to outpace capital growth in Sydney, or to see deeper rates of decline. The divergence is particularly evident through the 2010-2012 downturn, following a substantial over-performance from Melbourne during the post-GFC stimulus fuelled growth phase.

The most recent upswing before Covid-19 also saw Melbourne growth rates peak higher than in Sydney. The Melbourne quarterly growth rate peaked at 6.4 per cent, compared with 6.2 per cent across Sydney.

Rolling quarterly growth in dwelling values

^ Source: CoreLogic

Cyclically then, it is not unreasonable to see Melbourne values slip at a greater rate than other capital cities. Research also suggests that property markets where incomes are higher, households are more indebted and investor activity is higher can also be more sensitive to changes in economic conditions.

This has been consistently evident in the upper quartile of values across the Melbourne market, which had the strongest value increases amid the last upswing, and are currently showing the largest falls.

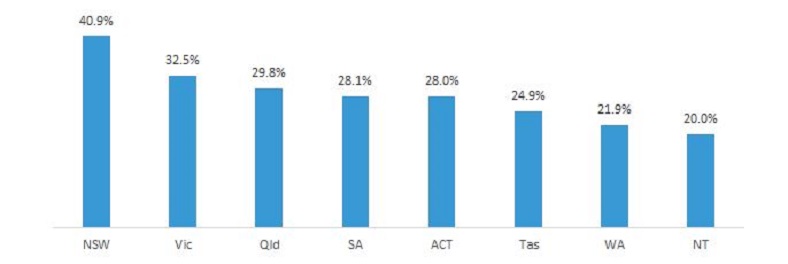

High levels of investment are also evident in the Melbourne market, which may be contributing to volatility, though this is present in Sydney too. ABS finance data shows investor lending has comprised an average 32.3 per cent of total mortgage lending across Victoria for the past 5 years. As demonstrated in the chart below, this is higher than most other states and territories.

Average Share of investor lending in value of new house finance

^ Source: ABS

Given that Melbourne has also experienced higher growth rates before the onset of Covid-19, and may be approaching a trough more quickly, Melbourne may not be the "worst performer" over the entire cycle, but just based on a snapshot view of the past couple of months.

However, there are some key structural factors creating added downward pressure on Melbourne property prices.

Parts of Melbourne have been hard-hit by falls in employment and migration

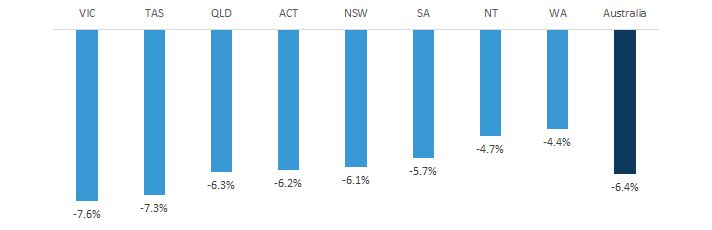

Melbourne property markets may be disproportionately affected by demand shocks in employment and migration. The latest ABS payroll data shows that Victoria has had the largest decline of payroll job positions of the states and territories as a portion of jobs by 14 March.

Labour force conditions are particularly impactful in the current downturn, where the cash rate target and mortgage rates are at record lows.

The most impacted sectors of employment are arts and accommodation and food and recreation services. In the year to February 2020, these sectors made up a relatively large portion of the workforce in the Melbourne–inner region (at 11.8pc), where dwelling value declines were -2.9 per cent in the June quarter.

Furthermore, the payroll jobs data from mid-March to the end of May suggests that one of the largest portion of payroll job losses by SA4 in Australia was across the Melbourne–inner region.

Change in payroll jobs

^Source: ABS 14 March-13 June

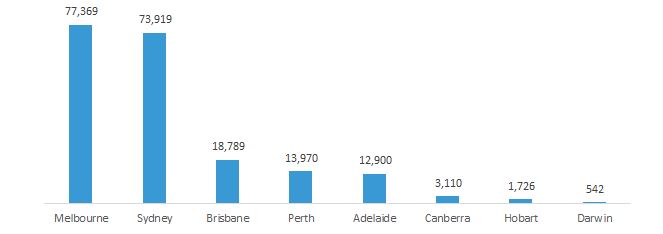

Additionally, the Melbourne housing market has been the most exposed to demand from net overseas migration. Over 2018-2019, Melbourne had the highest level of net overseas migration, at 77,369. This accounts for 38.2 per cent of net overseas migration to Australia.

The highest volume of net overseas migration through 2019 was recorded across the SA4 regions of Melbourne–inner, Melbourne–south east and Melbourne–west.

While the June quarter results show the current decline across Melbourne being led by the inner-east, which was down almost 4 per cent in the period, the shock of closed international borders may be accelerating a more broad-based decline in the region.

Net overseas migration by capital city

^ Source: ABS 2018-19

High exposure to net overseas migration over 2019 is weakly, negatively correlated with a decline in dwelling values between the end of March, and the end of June.

However, there are evidently other factors creating a drag on property prices. For Mandurah, Ipswich and inner Perth, June quarter declines in value do not appear to be related to a sudden withdrawal of high volumes of overseas migration.

Finally, it is worth noting that in the coming months, a second spike in Covid-19 cases across Melbourne will be an added blow to the economy and housing market. Amid this unique, engineered downturn, the level of government stringency has been the key determinant of economic performance. The longer businesses and households are subject to social distancing, the greater the impact will be on the housing market.