What will the Construction Downturn Actually Look Like?

Recent indicators present a mixed picture of the Australian construction sector. The latest data on housing finance and approvals are better than expected – according to seasonally adjusted figures from the ABS the total number of dwellings approved rose by 10.9% in June, reversing the 5.4% drop the previous month.

In an analysis on the Australian Housing Market released on Wednesday, the Economist Intelligence Unit reported that residential construction activity, after a slow and disrupted first quarter, will return to growth in the second quarter of 2017. The positive sentiment was fleeting, however, as the EIU confirmed that the Australian residential construction cycle had indeed "passed its peak".

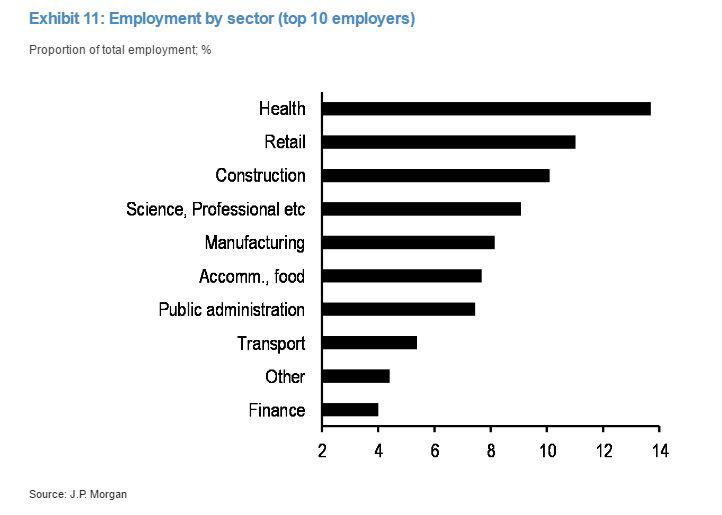

The construction sector accounts for 13 per cent of the world's GDP, and 8.1 per cent of Australian GDP. The boom in residential construction, which helped cushion the impact of the downturn in mining investment in recent years is expected to wane as the construction cycle reaches maturity.

And that's not all for bad news, because the construction industry apparently has a productivity problem.

According to a report published earlier this year by consulting firm McKinsey, the global construction sector’s labour-productivity growth has averaged 1 per cent over the past 20 years in contrast to the total world economy growing at 2.8 per cent and the manufacturing industry growing at 3.6 percent.

It is perhaps important to note that the productivity performance of global construction is not uniform. The sector is clearly split with large-scale players engaging in construction including civil and industrial work and also large-scale housing. There are a large number of firms engaging in fragmented specialised trades such as mechanical, electrical and plumbing work. Civil, industrial and housing sectors show 20 to 40 per cent higher productivity while fragmented specialised trades drag down the productivity of the sector as a whole.

We've reported on the Australian construction slowdown, and few dispute that the industry will experience lower growth in the coming years but perhaps the better question is how it will occur? Will the slowdown be drastic or will it be modest?

In Queensland, the building industry is already showing signs of struggle - more than 30 companies have collapsed this year and, as revealed by a recent report by insolvency group SV Partners, nearly 450 construction businesses face "severe to high risk of financial failure".

The Australian Bureau of Statistics estimates that every $1 million spent on residential construction generates 17 full-time jobs. Any fall in the level of construction could put tens of thousands of jobs at risk.

Other measures

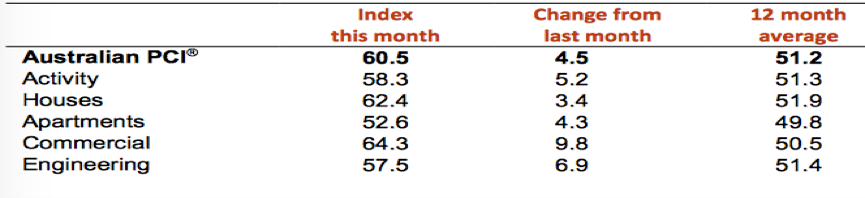

The Australian Performance of Construction Index (Australian PCI) has shown the 12-month average to be 51.2 indicating an expansion in the construction sector performance – albeit at a low rate. More recently the Australian PCI increased 4.5 points to 60.5 in July, signalling the strongest pace of overall industry growth since September 2005. This upturn in industry conditions reflects the expanding activities across all four major construction sectors. Survey respondents to the Australian PCI attributed July’s pick-up to an improvement in demand conditions citing a lift in new orders and an increase in tendering opportunities.

AI Group Australian PCI IndexIn contrast to the global trend the Australia sector shows variety in performance across different sectors of the industry. Over the past 12 months there has been an expansion in housing, commercial and engineering sectors while there has been a slight contraction in the apartment sector.

In its Building in Australia 2017-2032

report, BIS Oxford Economics reported that high-rise apartment construction will halve and overall building will decline 17 per cent over the next three years.

This comes alongside RBA’s prediction of a construction slowdown due to the decrease in the number of new residential building approvals since 2016.

For what it's worth, the EIU predict that the downturn in residential construction will be gradual and uneven and could flatten out at a higher level that previously expected.