Boutique Hotel Brands Dominate Booming Pipeline

As large hotel chains now become old hat, boutique hotels targeted at tech-savvy travellers are increasing in popularity and now represent 20 per cent of the current hotel pipeline.

Emerging online platforms, such as Airbnb, enticing guests seeking authentic, flexible and real-world experiences, continue to cannibalise hotel sales, with many high-end hotels being directly affected due to higher operating costs.

According to new research by CBRE, new concepts and potential brand repositioning are expected to accelerate boutique offerings as hoteliers look to define their products with independent, lifestyle and soft-brand collections.

The shift in traveller needs over the recent years has now allowed hotel operators to roll out refined offerings providing innovation and personality-based offerings.

CBRE's latest research report, "Are Boutique Hotels Becoming Mainstream?", has identified the systemic shift in traveller demands with new designs, new technologies and new guest-centric services aligning with the needs of would-be guests and turning the accommodation sector on its head.

Related: All Eyes On Victoria's Hotel Sector

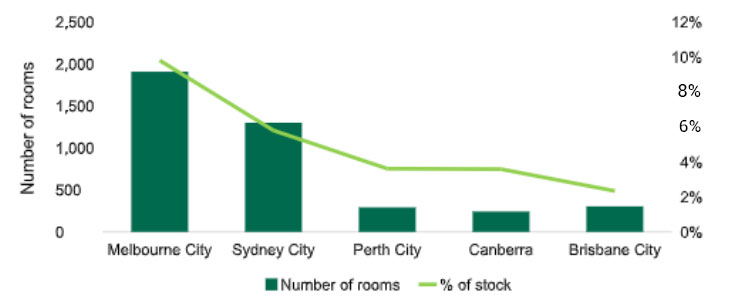

Number of rooms and percentage of stock as boutique hotels over the next five years

CBRE Hotels national director Wayne Bunz said that while Australia was yet to see a large influx of major international brands target the boutique market, several acquisitions and launches had highlighted interest from the bigger players in this segment of the market.

“As the hotel environment witnesses an increasing level of competition between sharing platforms, independents and hotel chains, hoteliers are focusing on innovation and personality-based offerings in order to differentiate and retain market share,” Bunz said.

The changes emphasise trends such as localism, individualism, art and sustainability, and come at a time when the Australia hotel sector is undergoing its largest-ever expansion.

New hotel developments are now being designed to complement the local landscape, with street art, edgy design and a focus on local produce on restaurant, bar and function menus.

Cities such as Perth, Brisbane, Canberra, Adelaide and Melbourne have already witnessed a significant rejuvenation of their hotel stock, while the Sydney hotel sector is at the start of its most dramatic expansionary phase since the 2000 Olympics.

“The success of independent local boutique brands over the past decade has supported the case for both international groups and smaller players to undertake boutique hotel developments,” Bunz said.

“Developments such as Ovolo The Valley, Brisbane; The Old Clare Hotel, Sydney; Veriu, Sydney; Little National Hotel, Canberra; Emporium, Brisbane; The Calile Hotel, Brisbane and the Jackalope Hotel on the Mornington Peninsula.”

Related: Chippendale Set to Receive $100 Million Boutique Hotel

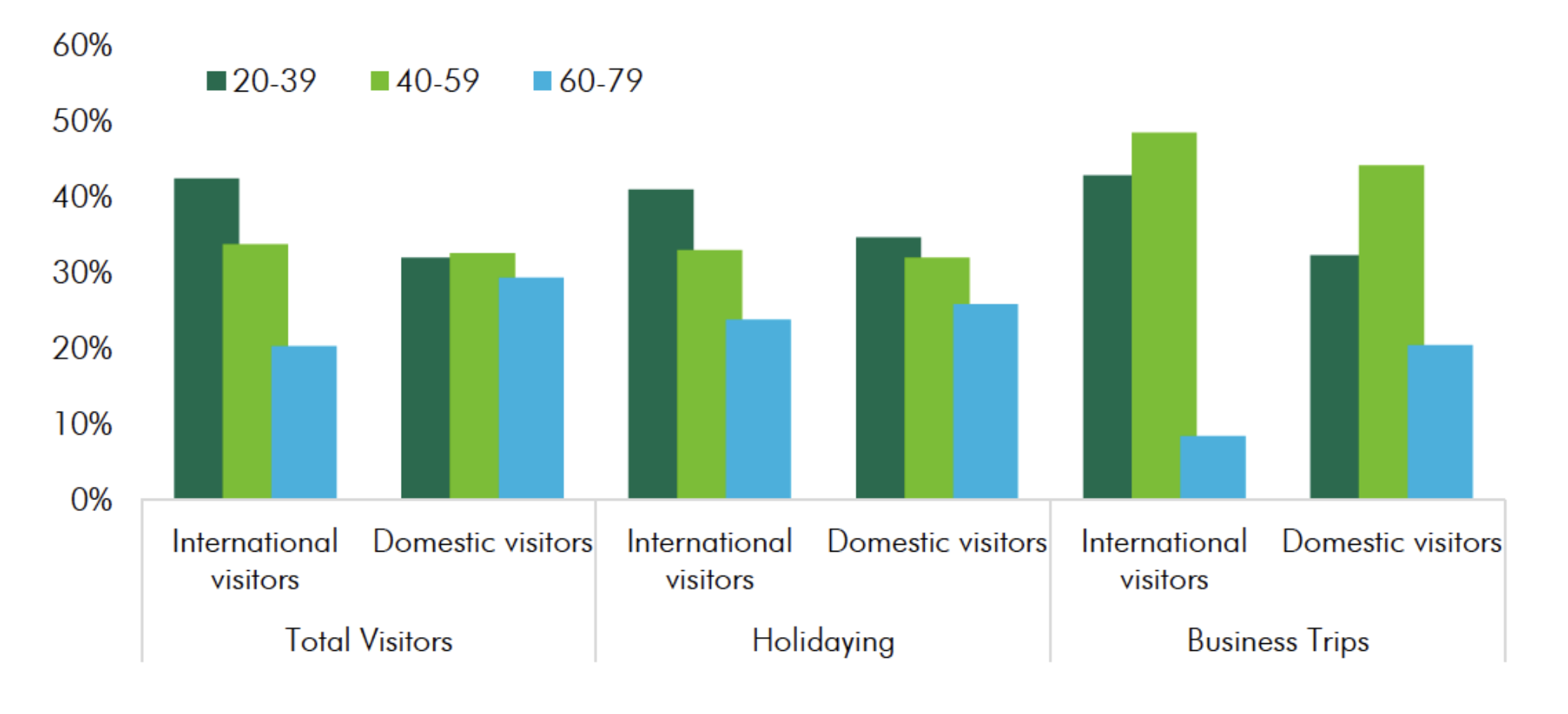

Share of visitors in 2018 by purpose and age group

“Personalisation has become the new thing to attract and retain modern travellers; winning their loyalty means brands must deliver the experience,” CBRE's report concluded.

Accor's recent acquisition of Tribe, an Australian brand that focuses on accessibly priced, high-quality hotel experiences, signals the company's foray into boutique brands in Australia.

Art Series is another Accor boutique brand that is making waves across the country due to its colourful concepts and theming based on Australian contemporary artists.

Marriott Hotels is also due to launch its own boutique brand, Moxy, in 2021.

The company hopes to entice the millennial market into these boutique experiences.

Newcastle also looks poised for its first five-star boutique hotel after Newcastle City Council completed the sale of the Newcastle roundhouse to internationally-backed hotelier Crystalbrook Collection.