A-REITs Robust Despite Declining Property Values

Property values would need to fall at least 34 per cent to have an impact on Australian Real Estate Investment Trusts, according to a Moody’s report.

A-REITs have good gearing buffers to withstand the looming property value declines due to weak demand and slowing economic activity caused by the coronavirus pandemic.

Covid-19 hit the sector hard with stock prices falling almost 50 per cent from 20 February to 23 March on the S&P/ASX 200 A-REIT Index (XPJ); it has since recovered 27 per cent.

According to the report, retail properties would see the largest decline in value in response to Covid-19, at 10 to 30 per cent.

Office values were likely to experience moderate declines at 3 to 8 per cent and industrial properties would steam along, supported by

e-commerce and a focus on supply chains, either staying at the same value or dropping slightly by 3 per cent.

Related: Infrastructure Construction Key to Economic Recovery

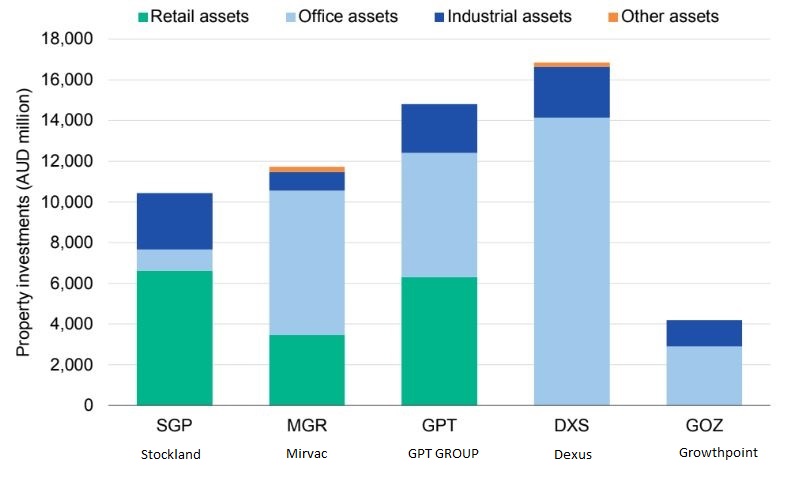

Breakdown of A-REIT property portfolios

^ Source: Moody’s Investors Service, as at 31 December 2019

Moody’s Investors Service vice president Saranga Ranasinghe said property values would need to fall significantly for A-REITs to breach gearing and covenant thresholds.

“We expect retail property values to decline in the next 12-18 months. Office property values will fall to a lesser degree, and continued demand will support industrial property values.

“But average property values would need to fall 34 per cent to breach the top end of the rated REITs’ target gearing (debt/asset) ranges and fall 55 per cent to breach their covenant thresholds,” Ranasinghe said.

“The REITs came into the downturn with balance-sheet buffers to withstand an increase in gearing.”

Despite uncertainty in the market and A-REITs withdrawing guidance during Covid-19, the big companies have moved forward with mega projects and transactions including the amalgamation of three sites in central Parramatta, completion of a “ground-scraper” in South Eveleigh and the sale of a $530 million tower in the Sydney CBD.

The A-REITs were expanding into the emerging build-to-rent and co-living sector in a bid to strengthen portfolios.