Approvals Shoot Up as Policy Changes Move Dial

Home approvals shot up 6.3 per cent in January as planning reforms began to gain traction.

The total number of homes for the month was 16,579, according to the Australian Bureau of Statistics.

The rise follows a more modest lift in December of 1.7 per cent.

Private sector house approvals were up 1.1 per cent to 9042 homes, which was 8.9 per cent higher than January of 2024 and followed a 2.8 per cent fall in December.

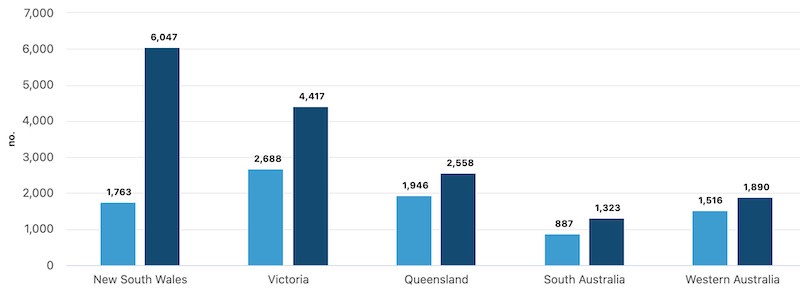

Results across the states were mixed.

The biggest rises were in Queensland (4.6 per cent), Western Australia (3.3 per cent), and South Australia (2.9 per cent). Victoria was down 1.2 per cent and New South Wales slid back 0.8 per cent.

Apartments lead the way

A rise in large apartment buildings approved in NSW, up a stunning 39.6 per cent on the previous month, has fuelled the upward movement of approvals over the past two months, according to the ABS.

The number of approvals of private sector homes excluding houses continued to rise in January, up 12.7 per cent to 7213 homes, after a 17.4 per cent rise in December.

The overall result for apartment approvals was 41.6 per cent higher than a year ago.

The value of total buildings approved fell 6.9 per cent in January to $14.73 billion after an 8.9 per cent rise in December, the second highest on record.

Approved non-residential building values slid 0.7 per cent to $5.69 billion, after a 19.7 per cent December jump, in seasonally adjusted terms, pointing to a possible decline in new infrastructure projects.

Despite the fall, the result is 11.3 per cent higher than January of last year.

Home approvals by state, January 2025

Total residential building value rose 4.5 per cent to $9.04 billion, an all-time high for a January.

This comprised a 5 per cent gain in the value of new residential building approved to $7.9 billion, and a 1.1 per cent rise in the value of alterations and additions to $1.14 billion.

Property Council NSW executive director Katie Stevenson said that “after months of poor results, it’s encouraging to see an uptick in approvals”.

“January’s increase again suggests recent planning reforms may be starting to gain traction and came close to the 6283 approvals we need every month until July 2029 to meet our National Housing Accord target—but we’ve still a long way to go,” she said.

Stevenson said that although reforms such as NSW’s Housing Delivery Authority, Low and Mid-Rise Housing Policy, and Transport Oriented Development Program were important steps, their impact would need to be seen beyond two months of stronger approvals.

Oxford Economics Australia economist Michael Dyer said further modest improvement was expected during 2025.

“However, an elevated dropout rate to commencements is set to persist near term,” he said.

“Cash rate cuts are now in play. This [will] aid the release of pent-up housing demand, supporting a more meaningful double-digit recovery from 2026.

“Supply policy traction will also become increasingly tangible.

“However, a speed limit will likely be applied on the recovery by utility connection bottlenecks and trade labour shortages.”