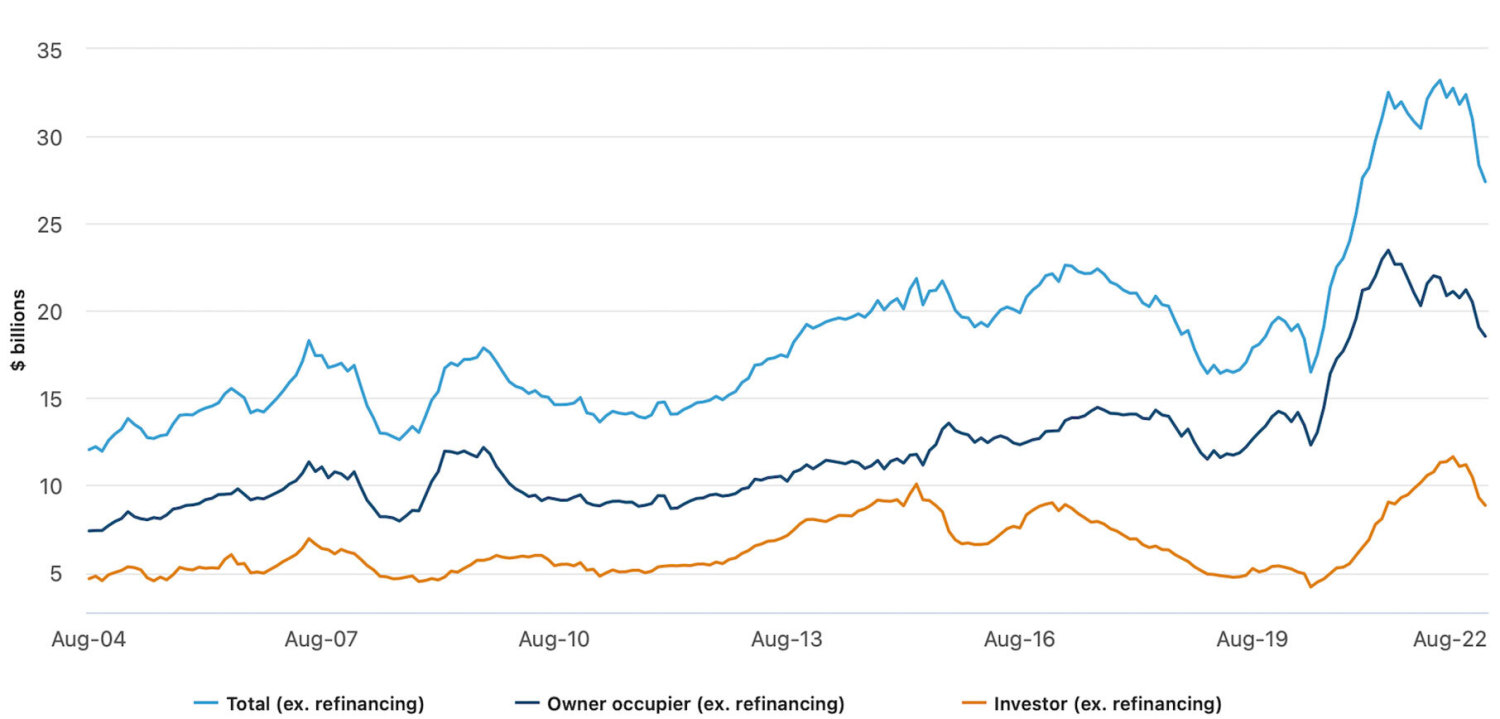

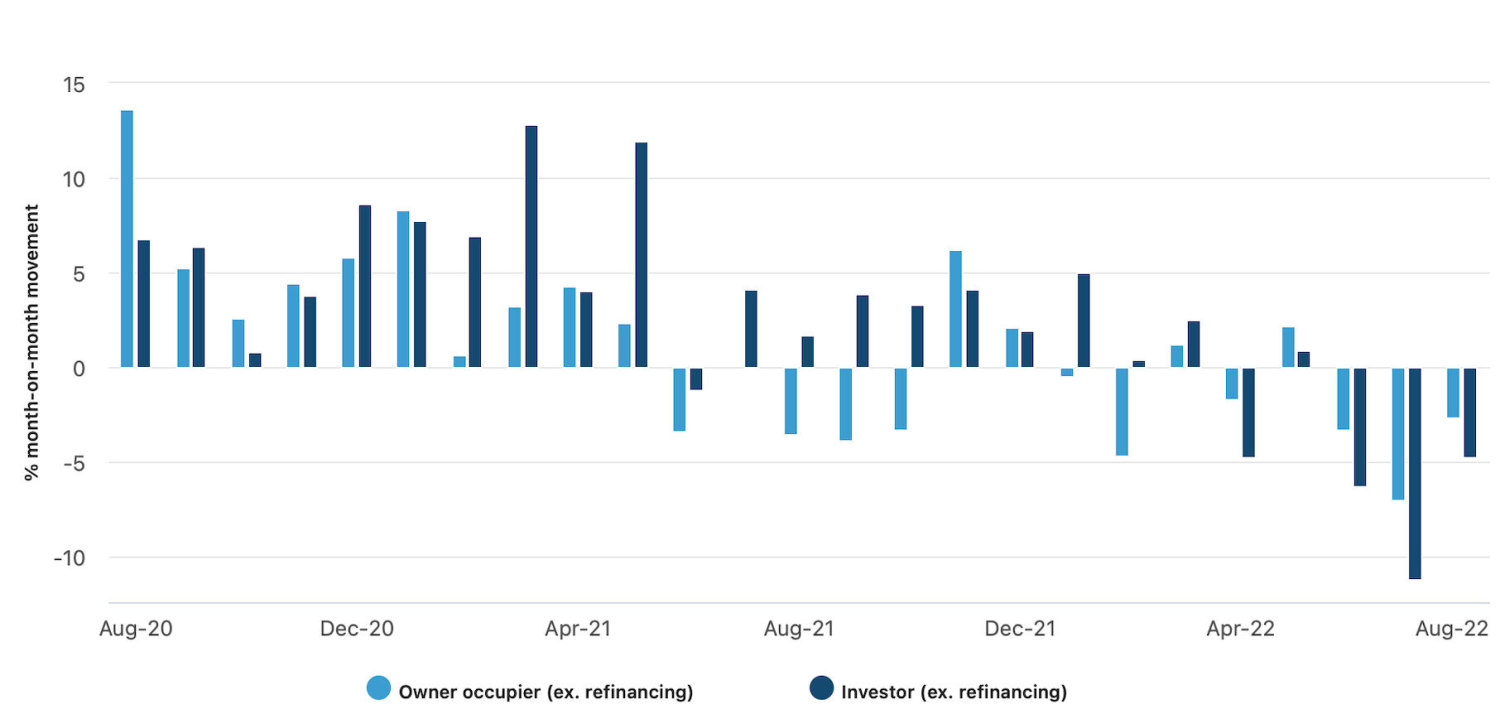

The Australian housing industry has received more sobering news with latest figures from the Australian Bureau of Statistics showing the total value of housing loans in August fell 3.4 per cent—the third successive monthly drop.

The bureau’s Lending Indicators data revealed cumulative total new lending nationally fell to $27.39 billion in seasonally adjusted terms, down 15.4 per cent from May this year when the Reserve Bank of Australia began hiking the cash rate.

The value of new owner-occupier loans fell 2.7 per cent while investor lending slid 4.8 per cent.

Surprisingly, first home buyer lending gained 7 per cent.

“The credit availability outlook has continued to worsen in recent months,” Bis Oxford Economics head of property Timothy Hibbert said.

“The RBA is expected to hike the cash rate to 3.1 per cent by the end of this year, pushing the average new mortgage rate to near 6 per cent and causing a 25 to 30 per cent deterioration in borrowing power for home buyers, compared to the third quarter of last year.”

The Reserve lifted rates by a smaller than anticipated 0.25 of a percentage point to 2.6 per cent this month, the highest level since July, 2013. It was the sixth rise in a row.

Bis Oxford Economics, a provider of macro-economics and industry forecasts, said it expected an all-dwelling peak-to-trough fall of 12 per cent, Australia-wide.

“This price correction is driven completely by credit availability,” Hibbert said.

New loan commitments, total housing values

The ABS said the number of loans for the construction or purchase of new homes also declined by 4.5 per cent in August. That is the lowest level since March 2020—the first month of the pandemic in Australia.

The Housing Industry Association said the data was consistent with other leading indications, such as their new home sales survey, showing new home sales dropped in July and August in response to higher interest rates.

HIA economist Tom Devitt said if the trends were sustained, which he expected, then the increases in the cash rate would have brought the pandemic building boom to an end.

“There is still a significant volume of work under construction that is driving economic activity across the economy and keeping the unemployment rate at exceptionally low levels,” Devitt said.

“When this pool of work is completed, the full impact of this rate rising cycle will emerge.

“There remains a risk that this volume of ongoing work will obscure the adverse impact of rising interest rates.

“These treacherous lags that characterise this housing cycle could result in the RBA weighing too heavily on household finances and jeopardising the housing industry’s future soft landing.”

Monthly growth, new loan commitments, housing by purpose

Oxford’s Hibbert said there were positive fundamentals in play that they expected would prevent a deeper decline.

“On the demand side is the very tight stock balance of residential property going into the downturn and sustained pressure that will arise from the recovery of overseas migration,” he said.

“On the supply side, a continued strong labour market is set to keep the level of forced or pressured sales relatively low, with the environment primed for many owners to sit on their hands, depressing the volume of new listings into 2023.”

Elsewhere, the latest figures showed the total number of dwelling approvals across Australia rebounded in August off a weak July, rising 28.1 per cent in seasonally adjusted terms—the strongest monthly result since February.

“The typically more volatile private attached dwelling segment drove the bounce, almost doubling,” Hibbert said.

National private house approvals continued to gain in August, up 4.1 per cent.

Largely driven by apartments, the biggest gains for total dwellings were in NSW—up 70.6 per cent—and Victoria (19.4 per cent).

“We expect approvals to mostly hold their ground to the end of 2022, with support coming from the flow through of a record volume of greenfield land being sold in 2021, a burgeoning build-to-rent sector, and rising social housing development,” Hibbert said.

The ABS says their statistics are based on borrower-accepted commitments made for the purposes of housing, personal and business lending.