Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

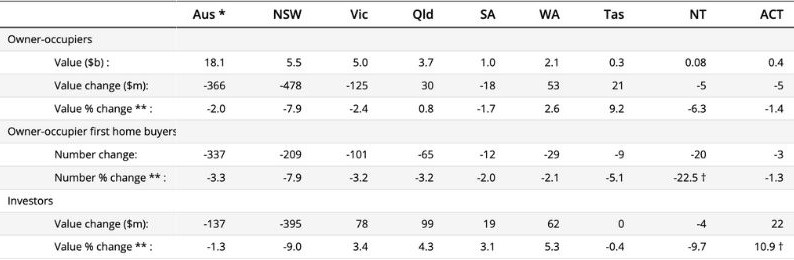

The value of new home loans slid across May, down 1.7 per cent to $28.8 billion.

According to new data from the Australian Bureau of Statistics, the value of new investor loans fell 1.3 per cent in May to $10.7 billion.

Owner-occupier loans (excluding first home buyers) fell 1.6 per cent to $12.9 billion, while first home buyer loans 2.9 per cent to $5.2 billion.

ABS head of finance statistics Fiona Cotsell said that despite the falls across all types of buyers in May, the value of new home loan commitments rose18 per cent over the past 12 months.

“Loans to investors have continued to see stronger than owner-occupiers over this period,” Cotsell said.

Since May, 2023, the value of new loans to investors has trended upwards across most states and territories, the ABS said.

The largest rises were in New South Wales (up 24.8 per cent), Queensland (up 48.2 per cent) and Western Australia (up 73.9 per cent).

“In May, the value of new loans to investors in Queensland reached an all-time high of $2.4 billion, exceeding Victoria for the third consecutive month,” Cotsell said.

Housing finance loan commitments, May, 2024

“This is mainly due to investors taking out larger loans in the Sunshine State compared to this time last year.

“We saw the average loan size for investors in Queensland increase by 14.3 per cent since May 2023, from $508,000 to $580,000.

“Comparatively, the average loan size in Victoria fell 3.2 per cent over the same period, from $584,000 to $566,000.”

The value of new loan commitments for total fixed term personal finance fell 0.7 per cent to $2.6 billion, but was 12.7 per cent higher compared to a year ago. Lending for the purchase of road vehicles rose 0.8 per cent in the month.