Australian Home Loan Approvals are Looking Up

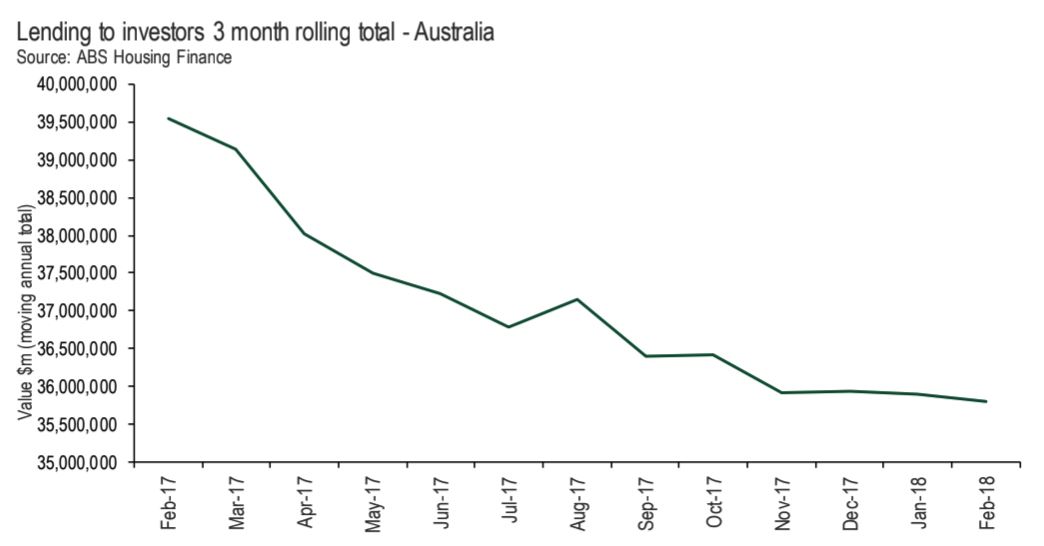

The value of lending to housing investors has dropped nearly 10 per cent since Australia’s banking regulator tightened lending standards and reduced investor participation in the housing market.

The Australian Bureau of Statistics latest housing finance figures for February showed that while housing finance approvals fell 0.2 per cent – less than economists’ expectations – the value of loans for investment housing rose 0.5 per cent from January.

The value of housing finance rose 1.0 per cent to $33.5 billion in February – the highest level since August 2017. The figures were driven by stronger investor lending.

Related reading: Housing Crash ‘Remains Unlikely’: AMP Capital

HIA principal economist Tim Reardon said that investment activity may be levelling out.

“Over the three months to February 2018, the value of investor lending slipped by 0.3 per cent compared with the previous quarter, which suggests that investment activity may be starting to stabilise,” Reardon said.

Softening house prices in Sydney and Melbourne may also be a factor behind the moderation, according to JP Morgan economist Henry St John.

“Through the cycle, investor lending has tended to be fairly responsive to trends in property price growth, and declining returns in the two major investment markets of Sydney and Melbourne is working to lower the expected rate of return for these buyer types, lowering their demand for new financing,” he said.

The fall in owner-occupier housing finance reflected the falling demand for new loans and stricter lending practices. The value of investor loans is still down six per cent on a year ago,

Reardon said that the decline in investor participation has been partially offset by a rise in first home buyers.

“The value of first home buyer loans has increased by $1.4bn to $8.8bn in the three months to February 2018.

“Unfortunately, the value of loans to investors dwarfed the rise in first home buyer loans which fell by $3.7bn over the three months to February this year.

“This means that there has been a significant reduction in investment in new homes, which will impact of affordability over the long run.

Residential building work also fell in the early months of 2018, as gains in commercial construction and infrastructure work supported the larger sector.

“If we see investor activity stabilise and the approved projects continue to progress through to work on the ground then residential building work could potentially make a stronger contribution to economic growth this year than we are expecting,” Reardon said.