Australian House Prices ‘Closer to the Bottom’: AMP’s Shane Oliver

The past few weeks have seen a number of developments that suggest property prices could bottom earlier and higher than has been widely expected.

The election outcome removed a key threat explains AMP Capital's chief economist Shane Oliver, along with several other factors “that also help”.

“The combination of the removal of the threat to property tax concessions, earlier interest rate cuts, financial help for first home buyers and APRA relaxing its 7 per cent interest rate test, points to house prices bottoming earlier and higher than we have been expecting,” Oliver said.

“As a result, we now expect capital city average house prices to have a top to bottom fall of 12 per cent, of which they have already done 10 per cent, rather than 15 per cent and to bottom later this year.

“However, given still high house prices and poor affordability, still very high debt levels, tighter lending standards, and rising unemployment a quick return to boom-time conditions is most unlikely,” Oliver added.

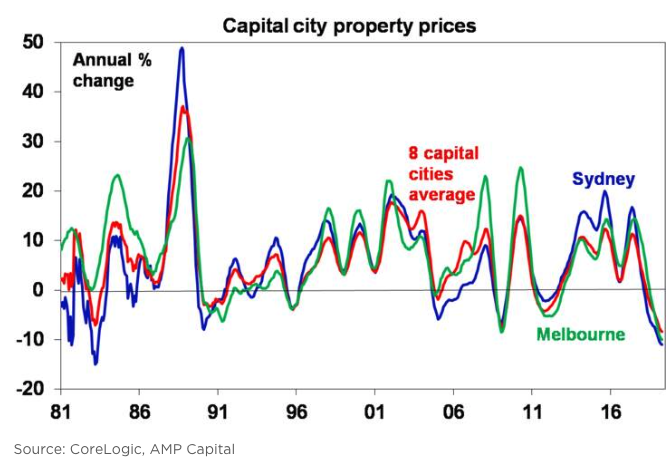

Capital city dwelling prices are down 9.7 per cent from their September 2017 high, according to Corelogic data, the worst decline in the past 40 years.

“Of course, there is a huge range here with prices down from their top by 15 per cent in Sydney, 11 per cent in Melbourne, 28 per cent in Darwin, 18 per cent in Perth, 2 per cent in Brisbane, less than 1 per cent in Adelaide and at record highs in Canberra and Hobart,” Oliver said.

Revising house price forecasts

Earlier this year AMP Capital forecast top to bottom falls of 25 per cent in Sydney and Melbourne, noting Sydney had already declined by 15 per cent and Melbourne was down by 11 per cent.

It also tipped that prices would bottom in 2020, but now Oliver expects the worst will be over this year.

“We are revising the estimate for Sydney home prices to a 19 per cent top to bottom fall, Melbourne to 15 per cent top to bottom, partly because it has been holding up much better likely reflecting stronger population growth, and the national average to 12 per cent top to bottom with prices likely to bottom by year end,” he said.

This week the RBA signalled that rate cuts could be on the way after governor Philip Lowe's comments “at our meeting in two weeks’ time, we will consider the case for lower interest rates” as a measure to prevent unemployment rising.

As a result, Oliver says AMP Capital expects 0.25 per cent rate cuts in June and August.

“And that the bulk of these will be passed on to borrowers given the recent reduction in bank funding costs,” Oliver said.