Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Australia’s housing market reached a record high in March as lower interest rates helped lift prices for a second straight month, but the gains were far from evenly spread.

New data from CoreLogic and PropTrack showed a modest but clear turnaround after values slipped in late 2024, as economists pointed to the Reserve Bank’s February rate cut—its first in four years—as the key driver.

CoreLogic’s national Home Value Index—which tracks estimated home values—rose 0.4 per cent in March, while PropTrack’s Home Price Index, based on sales data, lifted 0.27 per cent.

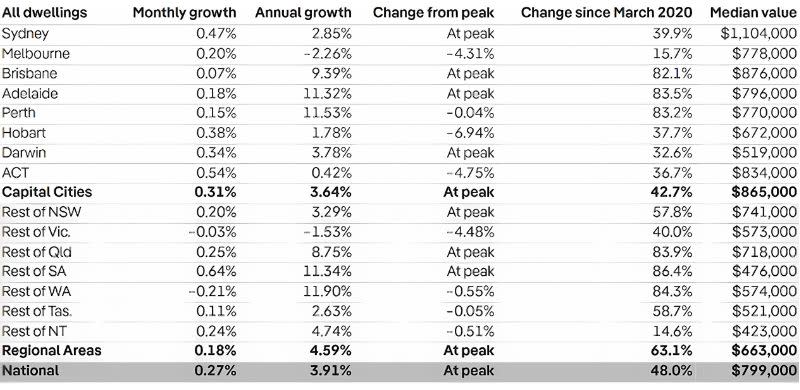

PropTrack put the national median home value at $799,000.

“Improved sentiment following the February rate cut is likely the biggest driver of the turnaround in values,” CoreLogic research director Tim Lawless said.

PropTrack senior economist Eleanor Creagh said the cut had revived buyer confidence but added the rebound was likely to remain modest.

Rents also climbed to a new record, with CoreLogic’s rental index rising 0.6 per cent in March.

Higher-priced homes in Sydney and Melbourne also recorded stronger gains, although affordability pressures remained across the board.

While both data sets showed national home prices at record highs, not all cities were sharing equally in the recovery.

Price growth was strongest in the mid-sized capitals and regional areas.

CoreLogic recorded gains across all capitals except Hobart in March, with Darwin (+1 per cent) and Adelaide (+0.8 per cent) posting the largest monthly rises.

Melbourne values climbed 0.5 per cent, with a median home value of $778,000, while Brisbane rose 0.4 per cent to $876,000 and Sydney lifted 0.3 per cent to a median of $1.1 million.

PropTrack showed a similar pattern, with Canberra and Sydney leading its March growth figures, up 0.54 per cent and 0.47 per cent respectively.

Over the past year, Perth (+11.5 per cent), Adelaide (+11.3 per cent) and Brisbane (+9.4 per cent) have driven much of the momentum, according to PropTrack.

Melbourne remained the only capital still recording prices lower than a year ago, down 2.3 per cent.

Regional markets also held firm.

CoreLogic recorded a 0.5 per cent monthly rise across the combined regions, slightly ahead of the capitals, while PropTrack reported a softer 0.18 per cent increase.

Over the year, PropTrack recorded regional prices up 4.6 per cent, with the median regional home value now sitting at $663,000, still well below the capital city median of $864,000.

While prices for existing homes lifted, new home sales held steady in February, despite the boost from the Reserve Bank’s rate cut.

HIA economist Maurice Tapang said sales volumes were largely unchanged month-on-month, although some states showed signs of improvement compared to last year’s weak conditions.

In the three months to February, new home sales in NSW rose 55.4 per cent compared with the same period a year earlier, while South Australia and Queensland recorded annual gains of 18.9 per cent and 14.6 per cent respectively.

But Tapang said the lift was coming off a very low base, and sales in Victoria and Western Australia continued to decline.

“It may take a few more months to see the effects of this rate cut on the market,” Tapang said.

He said strong population growth and low unemployment were supporting demand, but high building costs and land supply shortages—particularly in NSW and Victoria—were still limiting activity.

Both CoreLogic and PropTrack expected prices to keep rising this year, but warned stretched affordability and tighter lending conditions would likely cap the pace of growth.

“With the rate-cutting cycle expected to be drawn out, it will be interesting to see if this turnaround can be sustained,” Lawless said.

Meanwhile, the total number of homes approved fell 0.3 per cent to 16,606 in February, on the heels of a 6.9 per cent rise in January, according to seasonally adjusted data released by the Australian Bureau of Statistics.

ABS head of construction statistics Brock Hermans said approvals were varied across the building types.

He said private homes excluding houses fell 1.5 per cent, while private sector house approvals were up 1 per cent.

The latter was 5.2 per cent higher than February of 2024 and followed a 1.4 per cent rise in January.

NSW was the main driver of the overall rise in detached house approvals, growing 5.1 per cent.

Private sector homes excluding houses fell 1.5 per cent (to 7113), after reaching a two-year high in January.

Despite the drop, the series is 73.1 per cent higher than the same period last year.

There were 313 new apartment approvals in NSW in February, in original terms. This followed 2694 new apartment approvals in January, which was the highest result since May of 2023.

Meanwhile, Victoria recorded a rise in apartment approvals with 2294 new apartments approved in February, compared to 1228 approved the previous month.