Australian Retail Space to Decrease 10pc by 2024: Report

The Australian retail sector is struggling as companies big and small deal with numerous challenges, including legacy lease arrangements, the rise of e-commerce and weak consumption growth.

Times are tough for department stores all over the country. The rise of online retail has also led to the decline in the bricks and mortar shops with foot traffic declining as people’s fingers do the browsing and shoppers buy direct from online retailers.

Close to $2 billion has been wiped off the balance sheets of major brands including David Jones, Myer and Target, over the last two years.

South-African owner of David Jones, Woolworths Holdings, wrote down the value of the upmarket department store by $437 million, blaming what it said was a retail recession.

Woolworths purchased David Jones for $2.1 billion in 2014 and has written it down twice in the last 20 months, wiping $1.1 billion off its value.

Groups like Myer have embraced a strategy of downsizing as an alternative to store closures, but that may be simply delaying the inevitable.

According to global consulting firm McKinsey, against the backdrop of a changing market, retailers will be now be tasked with the paradox of shrinking physical space to grow overall sales and profit and will have to redefine their offerings for the digital age.

“Despite these market conditions, many retailers continue to increase selling space in the hopes of maintaining top line growth,” McKinsey partner Jenny Cermak said.

“The emergence of online retail is transforming the shopping habits of Australian consumers and, as a consequence, will profoundly impact traditional brick and mortar retailers.”

“As more consumers migrate to digital channels companies will invest in improving their digital offerings, creating a better experience, resulting in higher levels of customer migration from brick and mortar to digital.”

The retail crisis comes amid a swathe of assets hitting or listed on the market as consumers retreat with wage growth stagnating and house prices coming down.

While yields are tightening for office and industrial properties, they seem to be softening for the weaker retail properties.

Trying to counteract the flagging sales and online onslaught, mall owners are increasingly rebranding their properties into “living centres” and “town centres” offering visitors internet-proof services of beauty and cosmetic salons, office spaces and gyms.

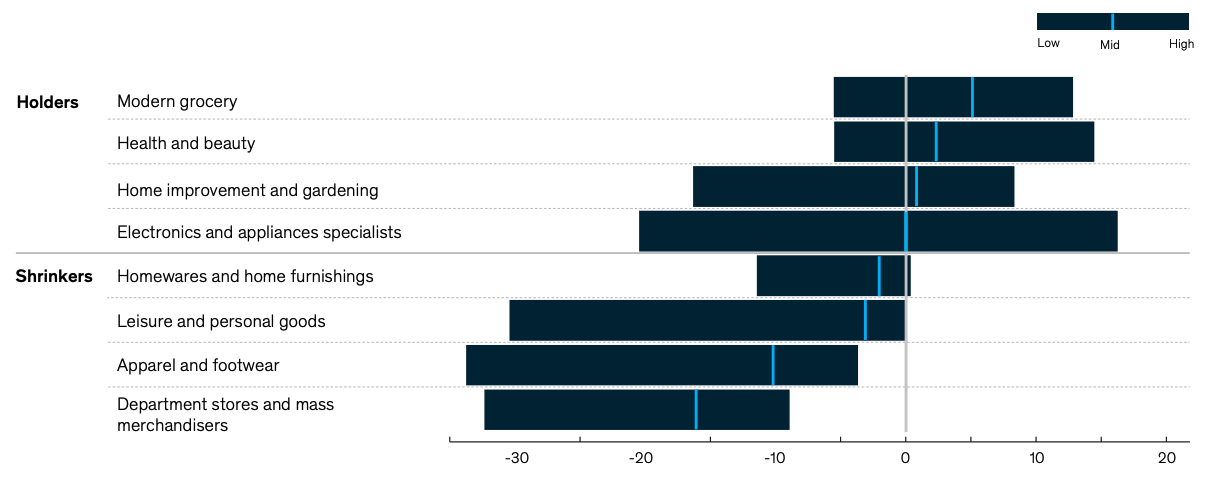

“Over the next five years, we expect the need for selling space to decline by more than 10 percent for homewares and home furnishings, leisure and personal goods, apparel and footwear and department stores,” Cermak said.

“In these categories, e-commerce players offer strong benefits to consumers versus stores, through convenience and endless aisles.”

Change in square metres of selling space, %

^ Projected change in the need for retail space in Australia between 2018 and 2024 . Source: McKinsey & Company

“Our research shows that some stores still offer what online cannot: shoppers prefer to see and feel the merchandise, for example beauty, gardening products, and value stores for sales advice like electronics and home improvement,” Cermak said.

“While these categories are likely to maintain selling space, the format of stores may change to better cater to customer missions, for example, by shifting to smaller format stores in high-foot traffic locations.”

Australian retail sales rising but remain weak

Despite the Government's $158 billion income tax cuts and the Reserve Bank's two consecutive interest rate cuts, retail sales figures remain weak.

Sales rose 0.4 per cent in June, marginally ahead of market expectations. Hardly robust growth and largely driven by a rebound off the 0.1 per cent rise in May.

Turnover rose slightly in every division, except in department stores, where sales fell 0.6 per cent, the Australian Bureau of Statistics said.

Meanwhile, retail sales rose in all states and territories, except for South Australia, where they fell 0.3 per cent, and in the Northern Territory, where sales declined 0.2 per cent lower.

However, retail volumes failed to meet forecasts with the annual growth rate in retail volumes only 0.2 per cent, in seasonally adjusted terms. Retail volume growth per capita has been in decline in year-on-year percentage terms.