Australia’s House Prices Rise Amid Slower Pace of Growth

Australia’s house prices continued its upward climb in January, increasing across every capital city, amid a slower pace of growth.

Corelogic’s national home value index increased by 0.9 per cent for the first month of the year, taking the annual growth rate to 4.1 per cent.

Sydney and Melbourne lead the capital city growth, up 1.1 per cent and 1.2 per cent in January, following price declines experienced in the recent market downturn.

Factoring in January's seasonal affect, Corelogic's Tim Lawless says the latest results indicate “a reduction in the speed of growth across most markets”.

“Especially for Sydney and Melbourne where affordability constraints are once again becoming more pressing,” Lawless said.

“As advertised stock levels rise over the early part of the year, we could see further dampening of growth rates.”

Corelogic's house price index

| Month | Quarter | Annual | Total Return | Median Value | |

|---|---|---|---|---|---|

| Sydney | 1.1% | 5.6% | 7.9% | 11.5% | $862,814 |

| Melbourne | 1.2% | 4.9% | 8.2% | 11.7% | $681,925 |

| Brisbane | 0.5% | 2% | 1.1% | 5.6% | $499,691 |

| Adelaide | 0.2% | 1.3% | 0.4% | 4.9% | $437,411 |

| Perth | 0.1% | 0.4% | -5.7% | -1.7% | $440,965 |

| Hobart | 0.9% | 3.4% | 5% | 10.5% | $481,665 |

| Darwin | 0.1% | -1.6% | -8.1% | -0.4% | $390,143 |

| Canberra | 0.3% | 2% | 3.1% | 7.9% | $630,078 |

| Combined Capitals | 0.9% | 4.2% | 5.2% | 8.8% | $632,408 |

| National | 0.9% | 3.7% | 4.1% | 8.1% | $545,622 |

^ Index results as at January 31 2020: Corelogic

Housing values increased across every capital city and region in January, with exception to regional South Australia.

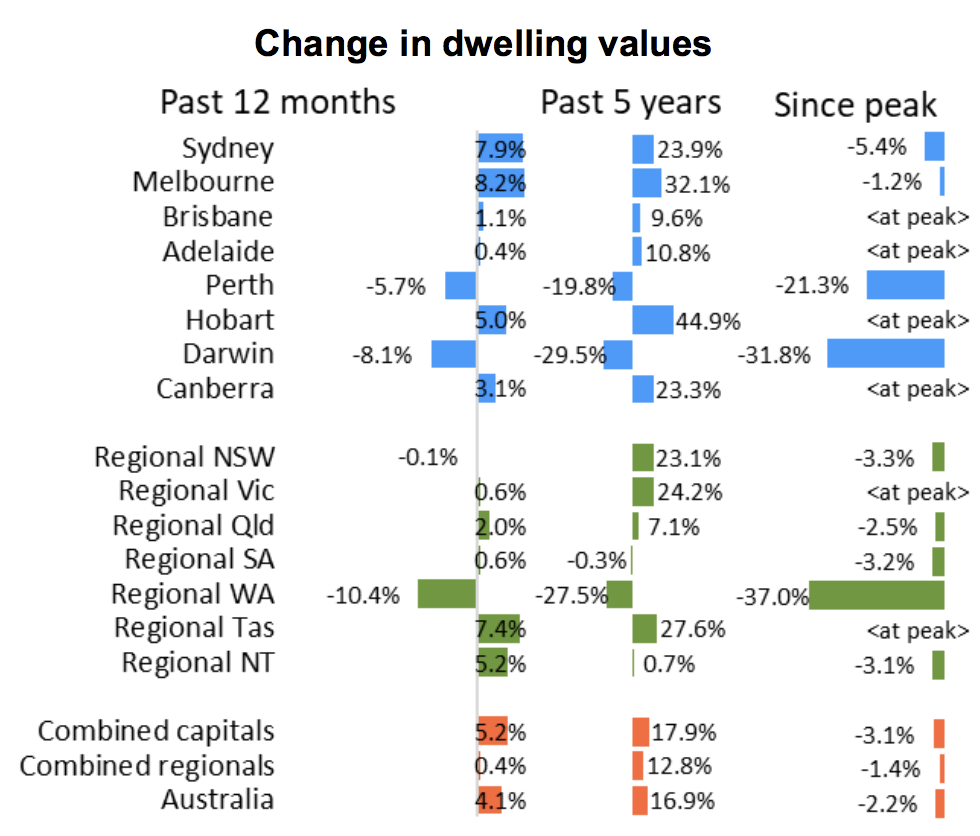

Across the country, housing values have now recovered 6.7 per cent since hitting a floor in June last year, although Corelogic notes that its national index remains 2.2 per cent below 2017 October peak.

“Despite the seasonality, there is evidence to suggest that housing value growth rates are tapering in Sydney and Melbourne,” Lawless said.

“Although with values rising at more than 1 per cent month-on-month, this pace is still unsustainable considering household income growth is sluggish and housing affordability challenges are worsening.”

The data shows that Perth's housing values are slowly recovering from the five-and-a-half year slump, with values posting a slight 0.1 per cent rise in January, and a lift of 0.4 per cent for the quarter. Although Perth's housing values are still 21.3 per cent below their 2014 peak.

Further rate cuts, fuel to the housing market?

The RBA, which slashed the cash rate to a record low of 0.75 per cent last year, will meet for its interest rate decision on Tuesday.

While money markets expect the RBA to hold this week, some economists have forecast the cash rate to hit 0.5 per cent by mid-year – just one cut from the 0.25 point where the RBA said it would consider a quantitative easing program.

Last month, AMP economist Shane Oliver said he expects the RBA to cut the cash rate to 0.5 per cent in February with rates down to 0.25 in March, and “quantitative easing likely from mid-year,” Oliver notes.

Capital Economics forecasts house price growth to slow from 8 per cent this year to 5 per cent next year. The research house also expects the Reserve Bank of Australia to cut interest rates twice in 2020.

“Indeed we think annual house price growth will reach 10 per cent by the middle of the year. However, there are now tentative signs that this will mark the peak in price growth,” Capital Economics economist Ben Udy said.

CBA Economics expects national dwelling prices to rise by 6 per cent this year. While ANZ revised up its forecasts last week, saying it expects an 8 per cent rise on average through 2020.