Housing Affordability Best Since 2016: ANZ-Corelogic

Would-be buyers looking to take advantage of the nation’s falling dwelling prices of recent years will be pleased to learn that housing affordability is back to 2016 levels, with Sydney’s market the best since early 2015 and Melbourne’s property market back at late 2016 levels.

Australia’s decline in property values follows a period where prices increased at a faster pace than household incomes, explains Corelogic’s head of research Cameron Kusher.

“We predict that price falls will settle later this year, followed by modest price growth starting from 2020,” Kusher said.

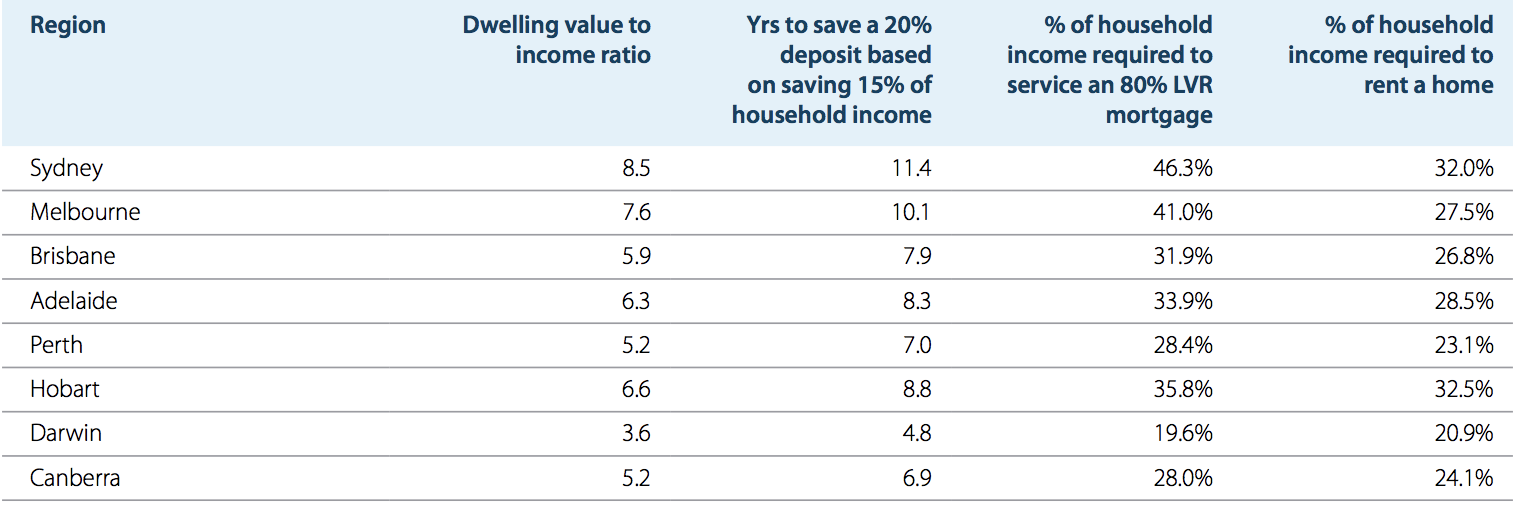

But despite the well documented housing price falls, Sydney is still Australia’s least affordable market to buy into, followed closely by Melbourne in second place, according to ANZ-Corelogic’s housing affordability report.

Since peaking Sydney has recorded a 14.9 per cent decline in dwelling values, while Melbourne sits at an 11.1 per cent fall since peak times.

| CITY | Housing Affordability Best Since: |

|---|---|

| Sydney | March 2015 |

| Melbourne | September 2016 |

| Brisbane | September 2016 |

| Adelaide | September 2018 |

| Perth | September 2004 |

| Hobart | Record Low |

| Darwin | September 2004 |

| Canberra | Lowest since June 2011 |

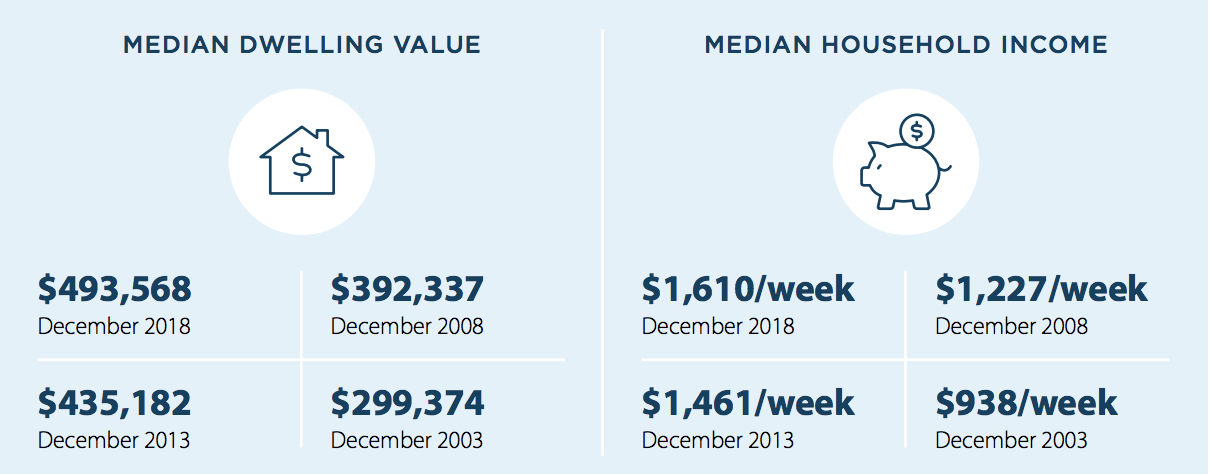

Sydney

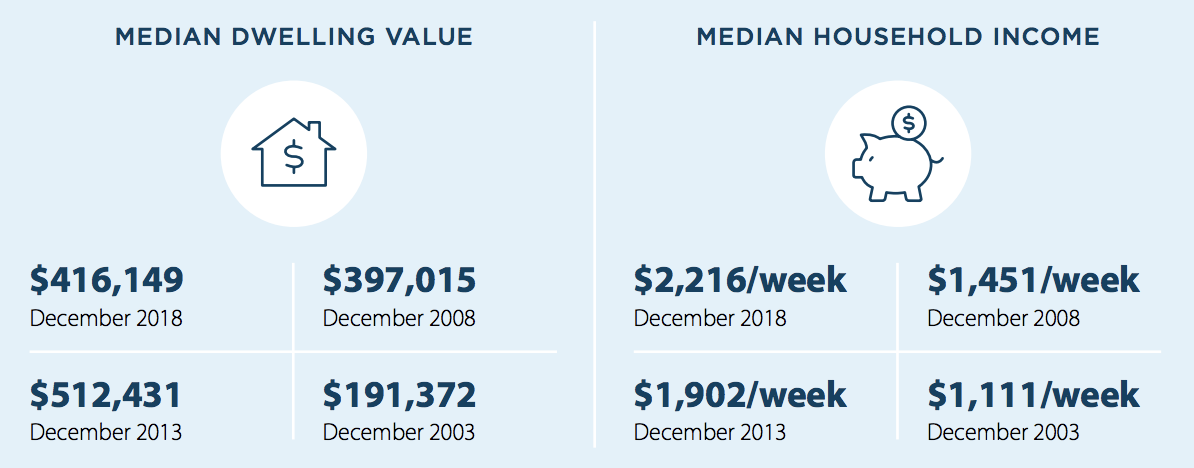

Sydney was the nation’s least affordable housing market as of December last year, according to the June report.

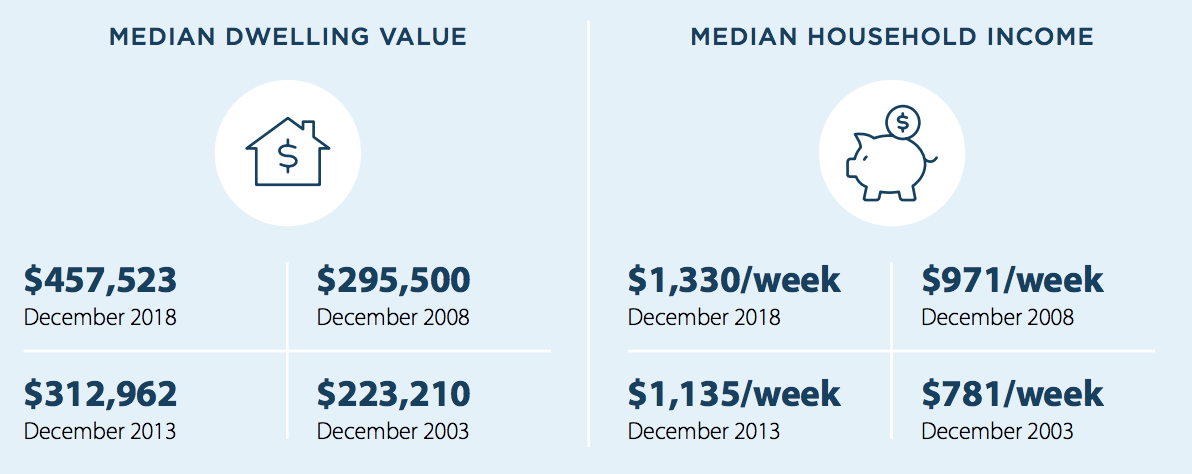

Affordability in the nation’s largest property market deteriorated significantly in the past decade with median values rising up to 88.3 per cent, this figure compared with the 41.2 per cent increase in gross household incomes.

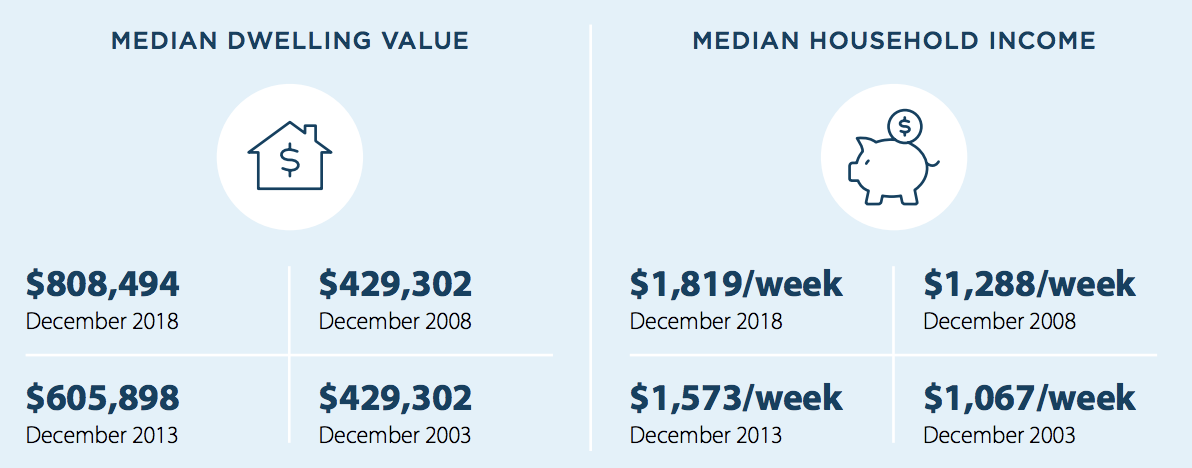

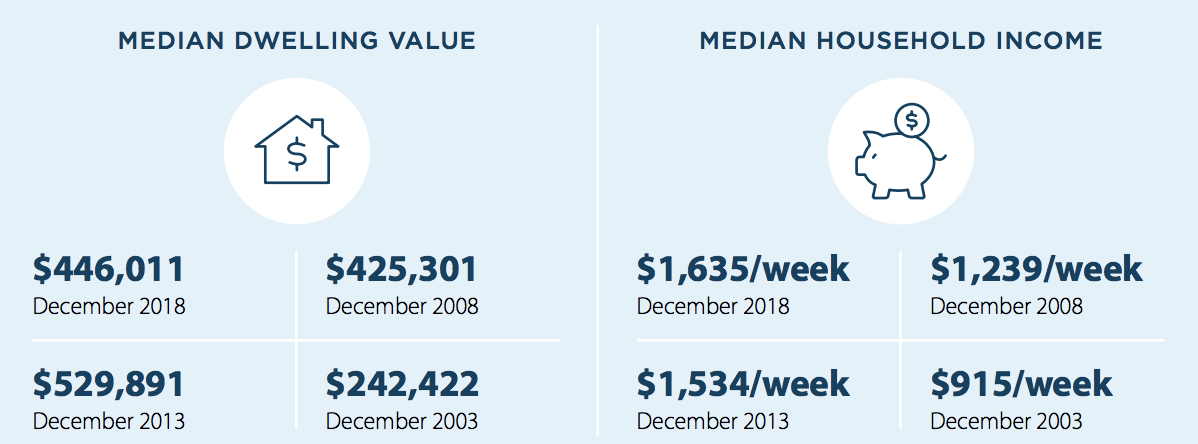

Melbourne

While home ownership is expensive in Melbourne, the report says renting in Melbourne is much cheaper and aligned with rental costs across other Australian capital cities.

“Over the decade to December 2018, median dwelling values in Melbourne have risen by 67.9 per cent compared to a 37.5 per cent increase in household incomes which has led to the deteriorating affordability of owning a home,” ANZ’s Kate Gibson said.

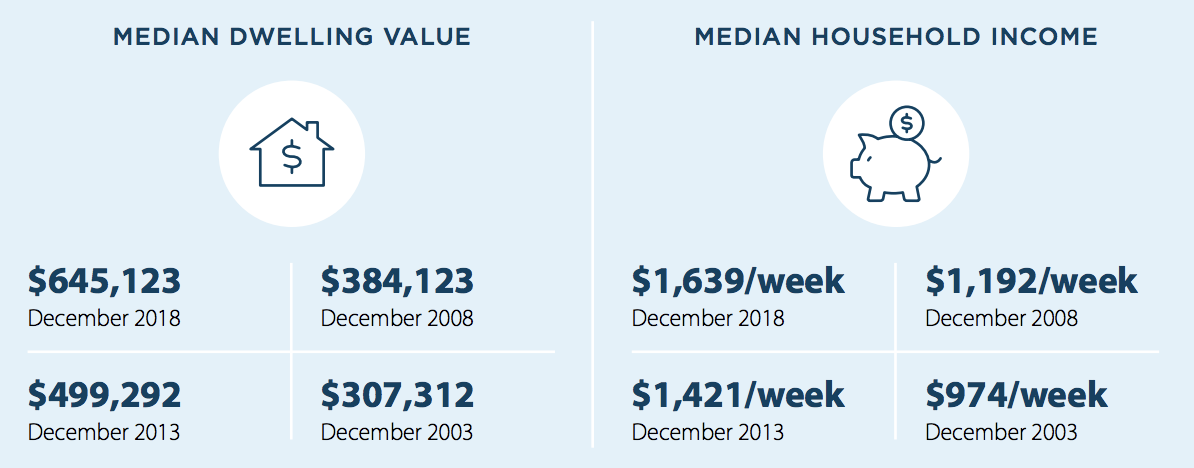

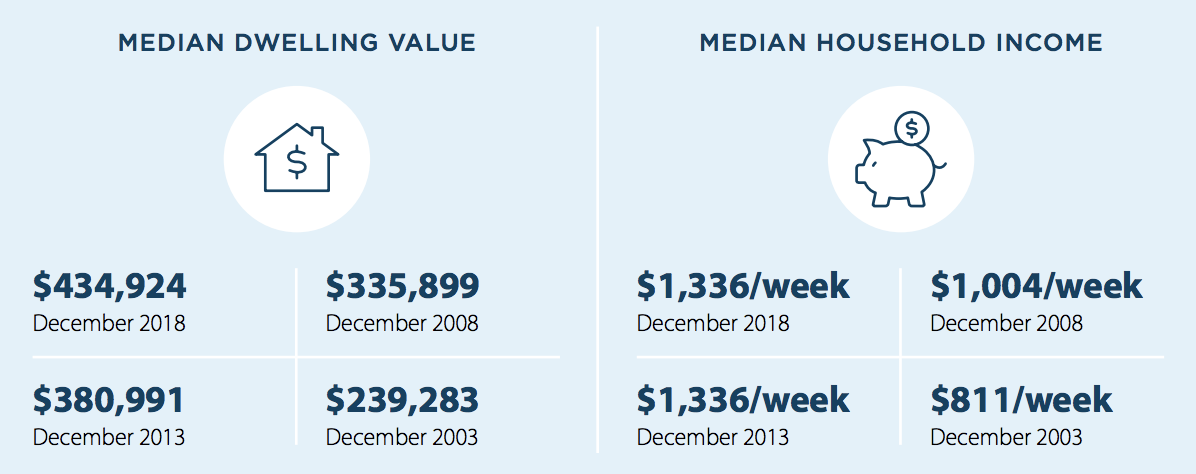

Brisbane

Brisbane’s housing affordability has improved over the most recent quarter due to increasing household incomes rising faster than dwelling values.

Over the past decade, affordability has improved because household incomes have increased by 31.2 per cent while median values have increased by a lower 25.8 per cent,” the report notes.

Perth

Perth’s dwelling values have been in decline since 2014. Sluggish growth has seen property prices rise a mere 4.9 per cent over the past decade, while household income has been much stronger for the same period at 31.9 per cent.

“The decline in both dwelling values and rents over recent years have resulted in a significant improvement in housing affordability which is now the best it has been in many years,” the report notes.

Adelaide

While the South Australian capital has recorded a moderate reduction in affordability for the December quarter, dwelling values are now 29.5 per cent higher while household incomes are 33 per cent higher for the past decade.

As a result the report notes that over the long term, housing is now slightly more affordable in Adelaide than it was a decade ago.

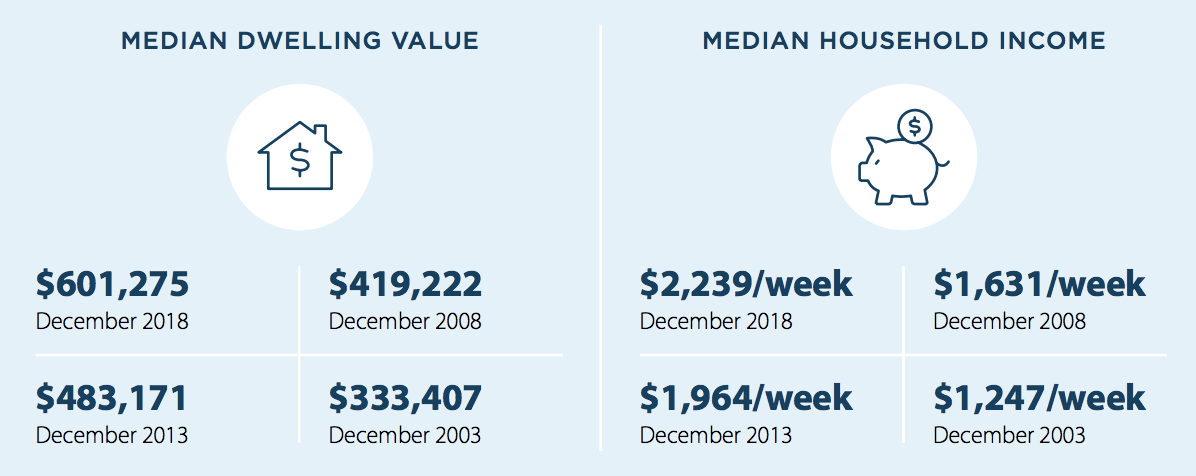

Canberra

Household incomes increased less than half the rate of dwelling values for the December quarter last year, this combined with rapidly rising rents has seen a deterioration in housing and rental affordability.

“Over the past decade, dwelling values have increased by 43.4 per cent compared to a 37.3 per cent increase in household incomes.”

Hobart

The report, based on property, demographic and economic data, found that over the past two years housing affordability had improved much faster than it had declined over the previous decade.

It also found Darwin is now the most affordable capital city for buyers, and Hobart is the nation's least affordable capital city for renters.

Darwin