Business Confidence Weighs on Office Take Up

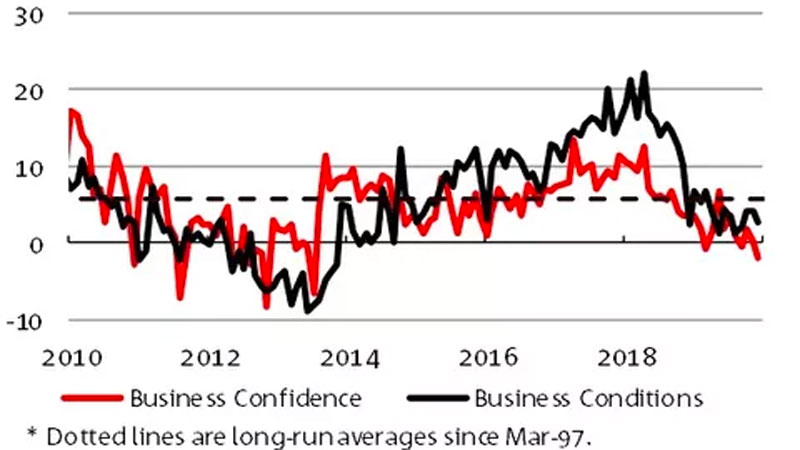

Business confidence deteriorated during 2019, translating into softer net absorption—the overall take-up of office space—in commercial markets.

The national CBD office market vacancy rate fell to 8.3 per cent over 2019, according to the latest quarterly results from JLL Research.

The figures also showed positive net absorption of 15,200sq m over the fourth quarter and 50,000sq m over 2019—the weakest result since 2014.

Brisbane recorded 28,900sq m of net absorption last quarter and 44,900sq m over 2019–well above the 20-year average of 27,100 square metres.

The headline vacancy rate compressed by 1.5 percentage points to 11.7 per cent in 2019.

Melbourne recorded 11,700sq m of net absorption over the quarter and 21,500sq m in 2019.

The quarterly vacancy rate tightened to 3.4 per cent, the lowest level since 1988, while rents continue to move higher with prime gross effective rents increasing by 6.5 per cent over 2019.

Sydney was the only CBD office market to record negative net absorption in 2019 of -63,200sq m and vacancy increased to 5.0 per cent.

However Sydney metropolitan office markets had a very strong 2019 with 113,800sq m of net absorption across nine monitored Sydney metropolitan office markets including Parramatta (46,900sq m), Sydney Fringe (41,800sq m) and North Sydney (22,500sq m).

NAB Group chief economist Alan Oster said there were falls in both profitability and trading, while the employment index was unchanged.

“After showing initial signs over recent months, it now appears that business conditions have stabilised following their sizeable decline since mid-2018,” he said.

“The decline in conditions has been fairly broad-based across the states and is evident across industries,” he said.

JLL Australia head of research Andrew Ballantyne said business confidence deteriorated throughout 2019 and this translated into softer net absorption across a number of markets but Brisbane came out unscathed.

“In another sign of confidence in the Brisbane CBD office leasing market, the resource sector is in expansion mode. Over the quarter, BHP and the New Hope Group expanded their occupational footprint in the Brisbane CBD,” Ballantyne said.

“The next phase of the Brisbane CBD office market recovery should be a moderation in leasing incentives. Prime gross effective rents increased by 3.2 per cent over 2019 and we expect effective rental growth to be stronger in 2020 and 2021.”

JLL Australia head of leasing Tim O’Connor said Melbourne had a lot of new developments in the pipeline.

“There will, however, be concerns about backfill space availability in the Western Core and pressures in the secondary grade market as vacancy is cascaded down to lower quality assets,” he said.

The Sydney CBD office market was impacted by a confluence of factors last year.

“The decentralisation of NSW government departments, consolidation of Telstra and softer business confidence leading to an increase in sublease availability all contributed to the negative net absorption result for 2019,” O’Connor said.

O’Connor added the Reserve Bank of Australia highlighted that the economy reached a gentle turning point in the latter part of 2019.

"Infrastructure spending and a recovery in residential house prices are positives for the domestic economy. However, geopolitical risk factors will remain on the radar of organisations and have the potential to influence long-term decision-making in 2020,” he said.