Brisbane Office Vacancy Set to Moderate in ‘Positive’ Market

Vacancy rates in Brisbane’s office markets are expected to ease later this year, with the city’s prime office vacancy rate anticipated to fall to 8.9 per cent by the end of 2018.

Brisbane’s prime office vacancy rate was more than 12 per cent at the start the year.

Queensland’s improving economic conditions is boosting business confidence, jobs growth and tenant activity according to the latest CBRE’s latest office market report, which forecasts the overall CBD vacancy to reduce to less than 14 per cent over the next 18 months – from 16.2 per cent at the start of 2018.

CBRE director James Comino says this momentum, bolstered by white collar employment growth, is driving continued recovery in Brisbane’s office leasing space.

“Organic growth has been particularly evident in the IT, finance and construction industries, with growth also emerging in the areas of public administration, tourism, education, healthcare and social services,” he said.

Deloitte Access Economics projects 11.35 per cent growth across the next five years, in line with strong interstate migration and rising demand for longer lease terms, surpassing the previous five-year growth rate of 2.35 per cent.

Comino says the state government has made around 25,000sq m in lease commitments over the past 12 months, further highlighting confidence in Brisbane’s local market.

Supporting the recovering market conditions is Brisbane’s sturdy infrastructure pipeline which includes the $3 billion Queen’s Wharf Project, Howard Smith Wharves, the new Brisbane Airport Redevelopment, the $5.4 billion Cross River Rail, the Brisbane Quarter and the Brisbane Live project.

“This pipeline will contribute significantly to increasing Brisbane’s employment base and has already resulted in immediate project requirements in the CBD,” Comino said.

Related reading: Impact Investment Seeks Co-Investors in World’s Largest Timber Office Building

Brisbane’s fringe office leasing market to return to positive in second half of 2018

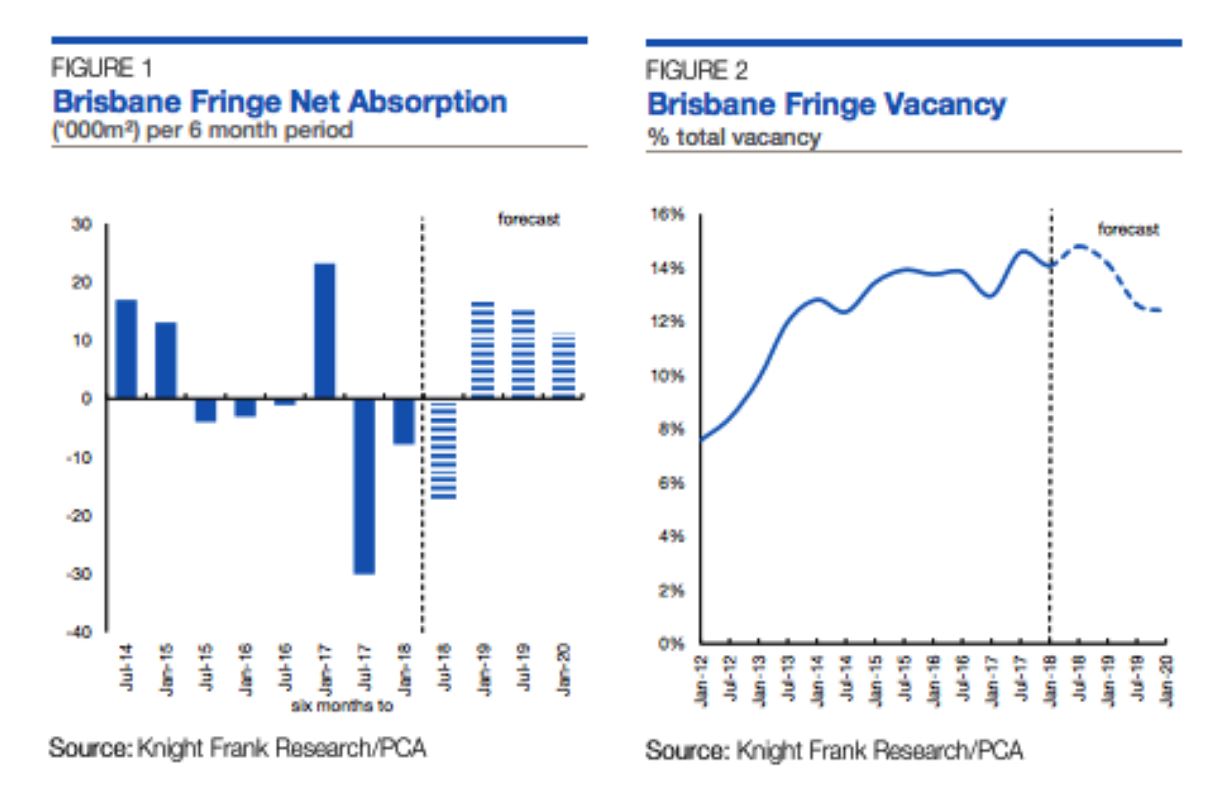

Vacancy rates in Brisbane’s fringe office markets will rise slightly before they ease later in the year, according to Knight Frank’s latest Brisbane fringe office market overview.

Total vacancy is expected to rise slightly from 14.1 per cent to 14.8 per cent to peak in mid 2018, before beginning to ease towards the year’s end.

The report found that supply in 2019 would be dominated by refurbished accommodation.

Knight Frank Queensland senior director of research Jennelle Wilson said that unlike the CBD, where there was a marked diversion between the vacancy rate for prime and secondary stock, the gap between fringe rates was relatively close.

“Recent deterioration in the prime market has taken the vacancy to 13.4%. In part this was due to two fringe buildings, previously with significant sub-lease space and partially occupied, transferring to direct vacancy at lease end, with a resultant gap in occupation.

“The secondary market vacancy has been assisted by the withdrawal of obsolete stock.”

Knight Frank senior director of office leasing Andrew Carlton said total vacancy in the fringe was expected to show a sustained recovery from late 2018, along with an improvement in effective rents.

“Tenant requirements that are considering the fringe have lifted, with IT, media and engineering tenants all active,” he said.

While net absorption in the Brisbane fringe market was negative for 2017 and is expected to remain that way for the first half of 2018, from the second half of the year it was expected to return to positive.

Carlton said this would happen as the fringe regained some of its competitive rental advantage over the CBD market.