Queensland Will Fare Better from Migration Downturn

Brisbane housing values may not decline significantly in 2020, although figures show buying and selling activity in the market has fallen sharply.

When it comes to population growth and Queensland’s property market, the state has been leading the nation for net interstate migration, with a strong upward trajectory.

Speaking on the Covid-19 impact on the housing market, Corelogic’s Tim Lawless said Queensland has overtaken Victoria, which had previously held the mantle for the number of net interstate arrivals.

“Of course Queensland has some exposure to overseas migration, but nowhere near as much as say New South Wales or Victoria,” Lawless said, speaking at The Urban Developer’s virtual residential summit on Tuesday.

“I think Queensland is in a very good position in that it won’t be as impacted by a downturn in overseas migration numbers, which in turn of course probably won’t impact the rental markets quite as severely as Sydney or Melbourne.”

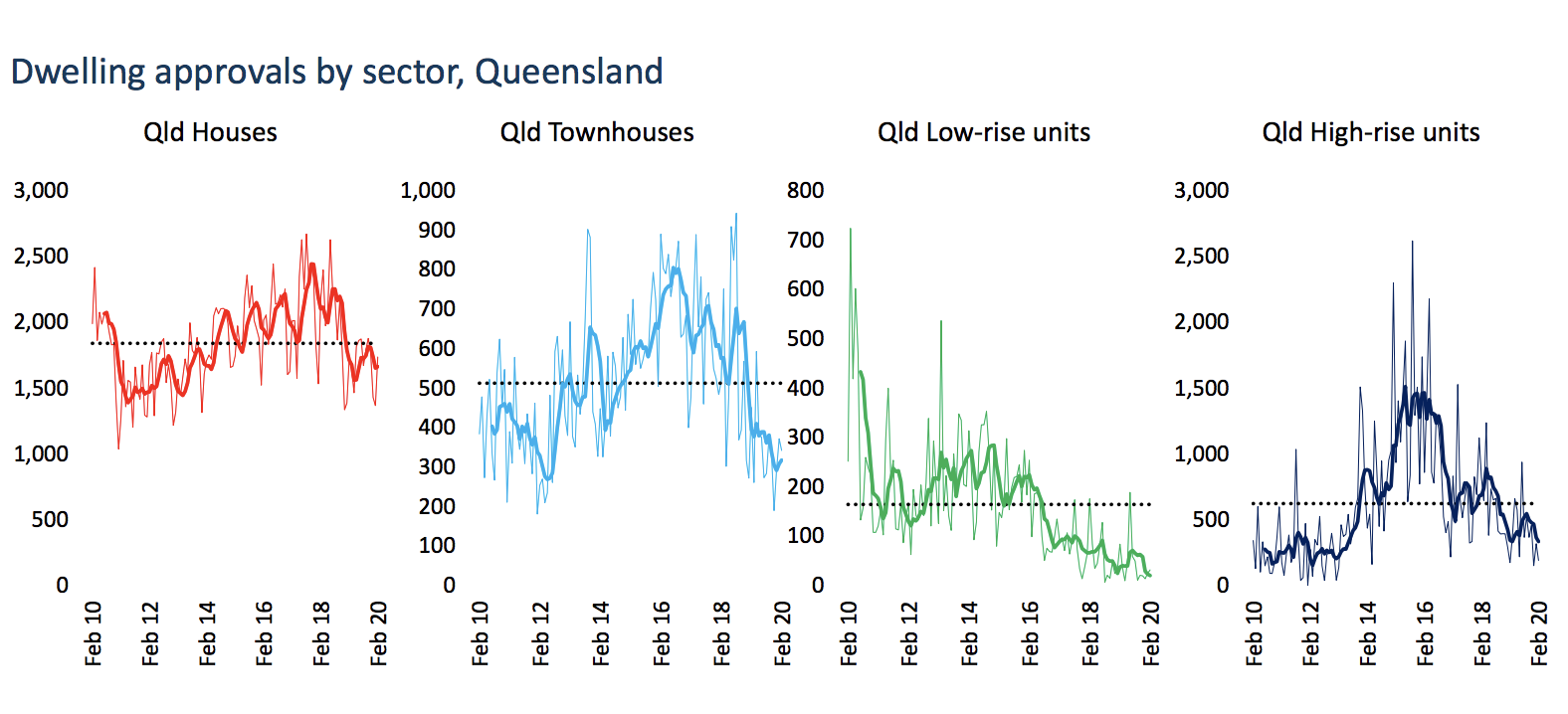

Queensland dwelling approvals by sector

While Brisbane’s housing market was into its upswing for residential property from mid-2019, Lawless said the depth and duration of this “market pause” depends on how well the coronavirus is contained, and how long the shutdown period lasts.

Figures show the pipeline of new supply coming into Queensland’s market was tracking lower in late 2019, with the supply pipeline well below average.

“Implying the potential for an undersupply down the track…although demand from overseas migrants is set to drop,” Lawless said.

“As new unit supply is absorbed and values rise, the proportion of off-the-plan settlement valuations lower than the contract price is moderating, but still high.”

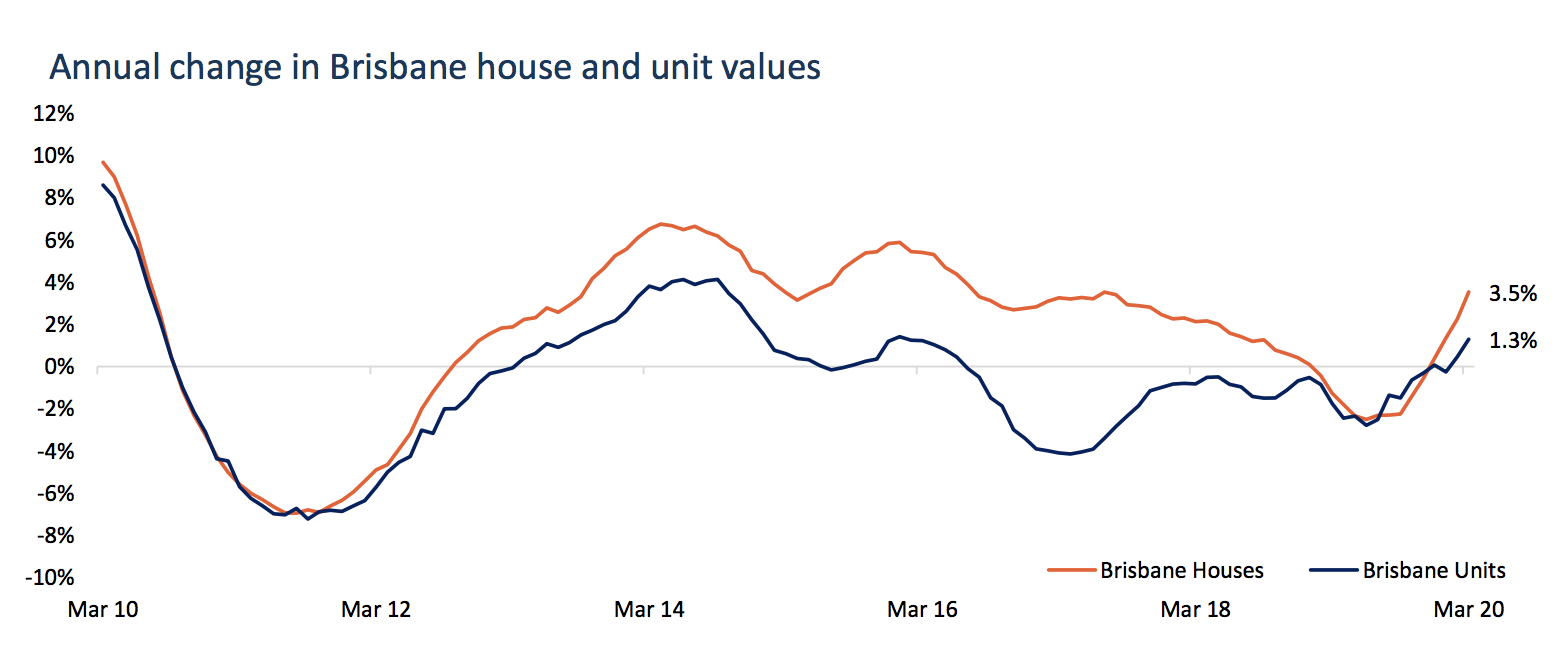

Brisbane unit values remain 11.1 per cent below 2010 peak

“New housing supply under construction has fallen with pending detached supply back around the decade average and unit supply dropping below the decade average,” Lawless said.

Brisbane unit values are 11.1 per cent below the peak of 2010, and Brisbane house values to date continue to track solidly.

While the next few months present an unprecedented shock to the economy, Lawless said it otherwise has strong fundamentals.

“The institutional response is about 'building a bridge' to the recovery phase, with stimulus totalling about 16.5 per cent of GDP.

“Previous economic shocks have seen housing values relatively insulated, while volumes are more susceptible to volatility.”

Reduction in supply levels should help protect housing values

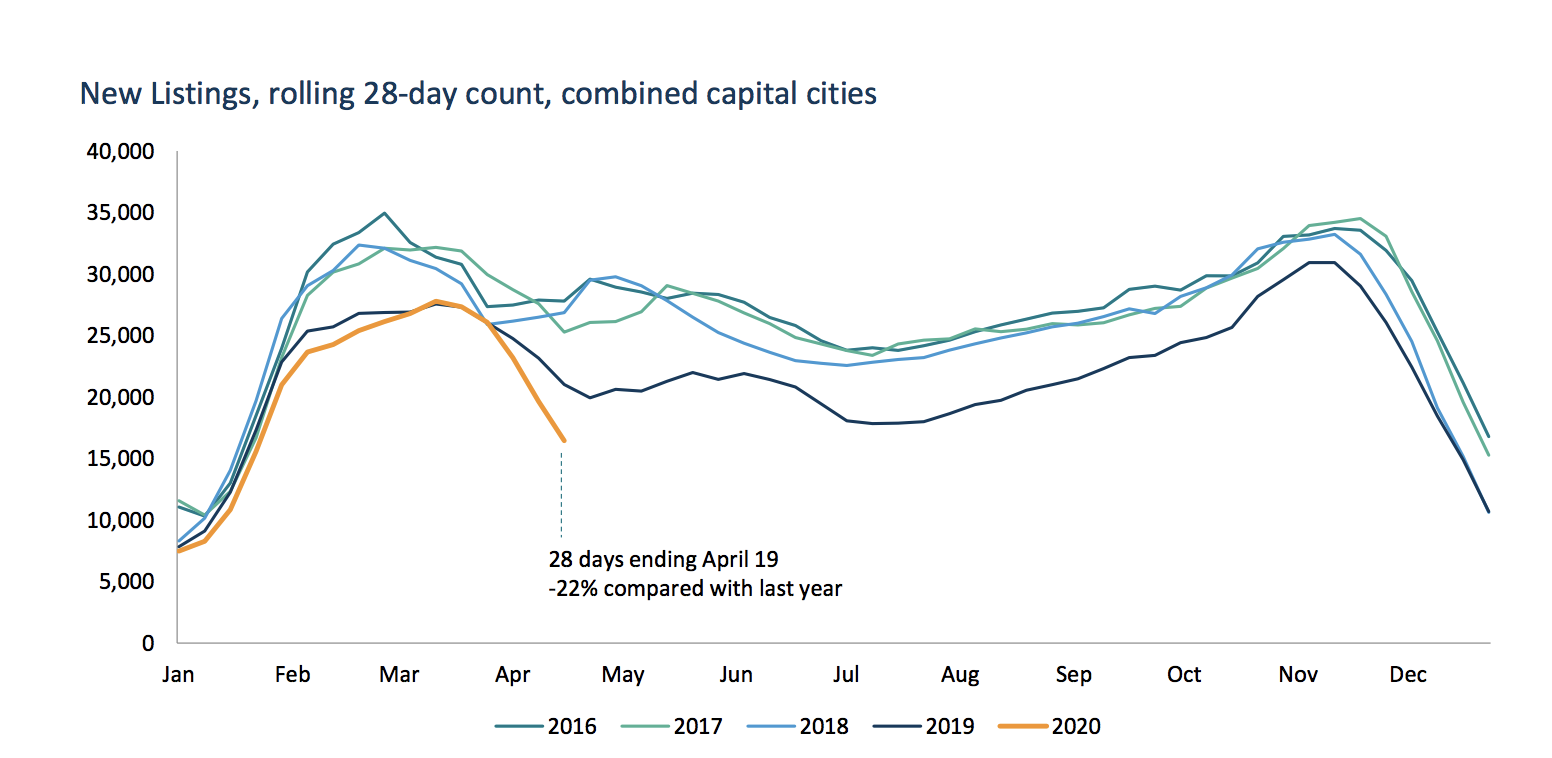

New listing numbers, based on agent activity, is likely to settle around half of what it normally would be for this time of year, with new listings expected to further fall substantially.

“In some ways that’s a positive,” Lawless said.

New listings likely to fall in coming months

“As we see buyer numbers retreating to the sidelines, seeing a reduction in supply levels should be another factor that helps protect housing values.

“But for the industry, for real estate agents particularly, and for any industries peripheral to a transaction like building and pest inspectors, and removalists, conveyancers, and finance, obviously less transaction activity is going to heavily impact those sectors.”

New listing numbers are down about 25 per cent in Brisbane, compared to last year.

Lawless noted that the ANZ-Roy Morgan weekly reading on consumer sentiment dropped dramatically over the past four weeks, but showed a bounce back over the most recent two weeks.

“Low consumer confidence and social distancing measures have impacted transaction activity, with Australians likely to temporarily put high commitment decisions on hold.”