Brisbane CBD Leasing Market Strongest in 10 Years

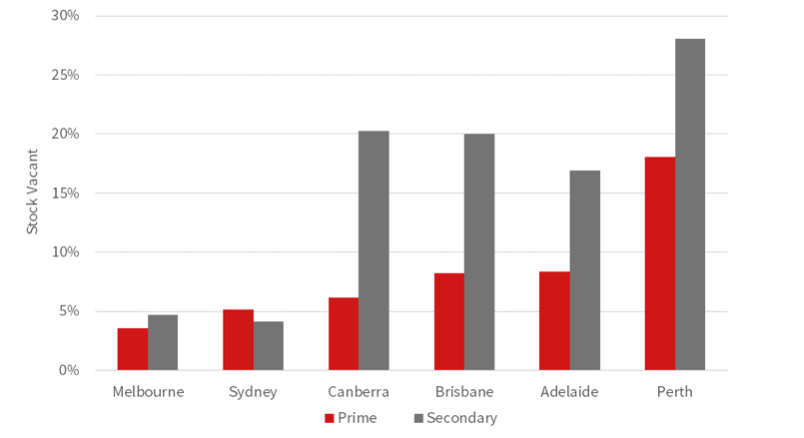

Brisbane CBD's leasing market continues to tighten with prime grade office vacancy at its lowest level since 2012.

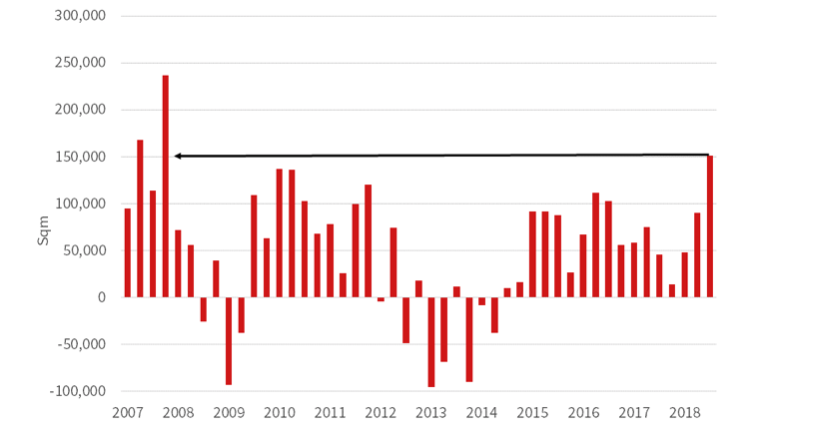

Research released by JLL has recorded a positive net absorption of 151,200sq m nationwide over the last quarter and 258,600sq m over the 12 months to September 2018.

Brisbane CBD recorded 15,400sq m of net absorption in the third quarter and vacancy tightened to 13.9 per cent.

Over the past year, net absorption in Brisbane totalled 39,600sq m, 29 per cent above the 40-year average of 30,600 square metres.

“Brisbane, Perth and Adelaide will be the office markets to watch closely in 2019,” JLL head of office leasing Tim O’Connor said.

“Leasing enquiry and activity is positive, prime grade vacancy has tightened in Brisbane and Adelaide and we expect owners will start winding back incentives to a level more associated with current vacancy rates.”

Related: Top 20 Most Expensive Office Markets

Australian CBD Office Markets Net Absorption

Adelaide has benefited from growth in the defence, resources and professional services sectors recording positive net absorption of 14,700sq m over the quarter and 23,200sq m over the 12 months to September 2018.

Melbourne has continued to be the standout performer nationwide, recording 79,900sq m of net absorption over the quarter and 187,800sq m over the 12 months to September 2018.

“The Melbourne CBD office leasing market juggernaut continues to roll on,” O’Connor said.

“Melbourne is one of the world’s strongest performing cities and we continue to see a diverse range of industry sectors expanding their occupational footprint in the Melbourne CBD.”

Related: National Office Vacancy Rates Tighten Due to Demand in Sydney, Melbourne

Australian CBD Office Markets, Vacancy Rate by Grade

Melbourne's CBD development pipeline over the next two years is anticipated to be the cities largest year for completions since 1991.

JLL projects vacancy as of 2020 will sit around 6 per cent, well below equilibrium of 7 per cent to 9 per cent for the Melbourne CBD.

Sydney CBD recorded 8,800sq m of net absorption over the 12 months to September 2018 and vacancy was 4.7 per cent, exerting upward pressure on Sydney CBD rents.

“Two more WeWork facilities opened last quarter and we are speaking with a number of potential new co-working operators,” O’Connor said.

Sydney currently faces challenges for new entrants with a lack of contiguous space within the CBD.