Buyers ‘Spurred On’ by Market Bottom: Domain

Sydney’s property price falls slowed in the June quarter, while Melbourne’s median house and unit price increased, a move marking the first uptick in value since late 2017 for the Victorian capital.

The slowing rate of property price falls, strengthening clearance rates and growing buyer interest could be further indicators the larger two capital city markets could be nearing bottom.

Market sentiment has been spurred on by the Reserve Bank cutting interest rates to historic lows, APRA removing the 7 per cent interest rate buffer on mortgage lending, and negative gearing left unchanged.

Domain’s latest House Price Report for the June quarter says buyers could be encouraged by signs that in some capital cities the market appears to have bottomed out.

Industry analysts anticipate that residential property prices are projected to recover from 2020-2021, but economists largely agree that a return to boom-time conditions is unlikely.

Domain's report comes after the latest findings from economic forecaster BIS Oxford Economics, which anticipates Brisbane’s median house price could rise by 20 per cent over the three years to June 2022, and unit price growth to rise by 14 per cent for the period.

BIS also expects a total increase of 6 per cent for Sydney’s median house price, and Melbourne 7 per cent for the three years to June 2022.

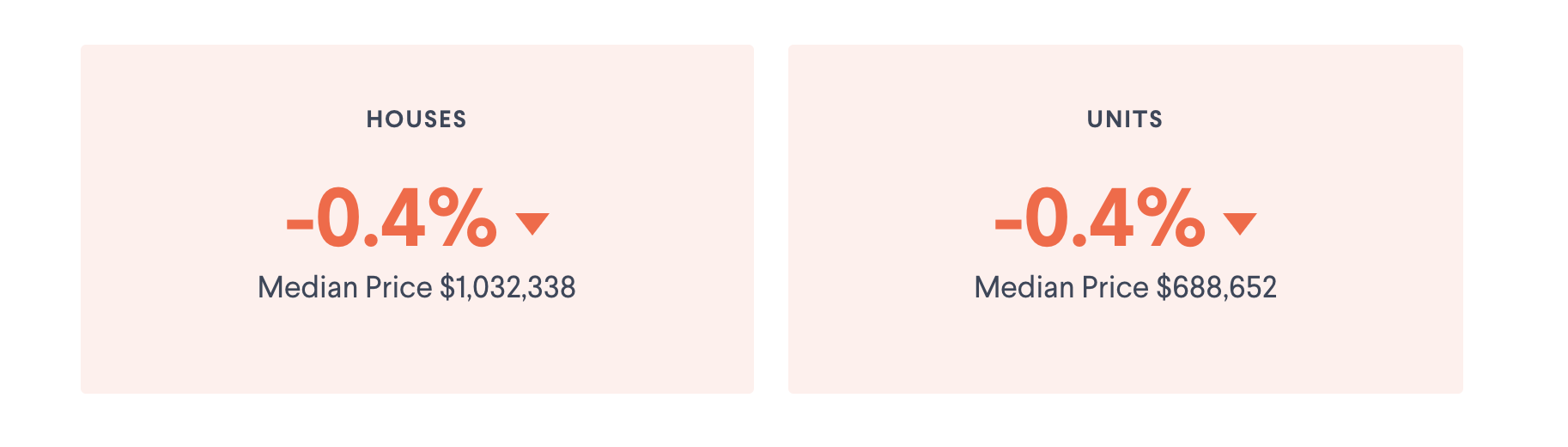

Sydney

Domain economist Trent Wiltshire says slowing price falls and a number of indicators suggest Sydney property prices could be close to bottoming out.

Sydney’s median house price still sits above the million dollar mark, 14 per cent below its mid-2017 peak, while unit prices are 11 per cent below the 2017 peak.

“Auction clearance rates over the past four weeks have averaged 68 per cent, a level which has historically aligned with modest annual price growth,” Wiltshere said.

Sydney house prices fell 0.4 per cent in the June quarter, and 9.1 per cent over the year.

While unit prices continued the downward trend for the period, now recording 7.1 per cent falls over the year.

“Property prices fell the most in Sydney's south and in the Canterbury-Bankstown region over the past year. Price falls were smallest on the north shore,” Wiltshere said.

House prices in Newcastle dropped by 5 per cent and 11 per cent in Wollongong over the past year.

Related: The Capital City Suburbs Tipped To Rise

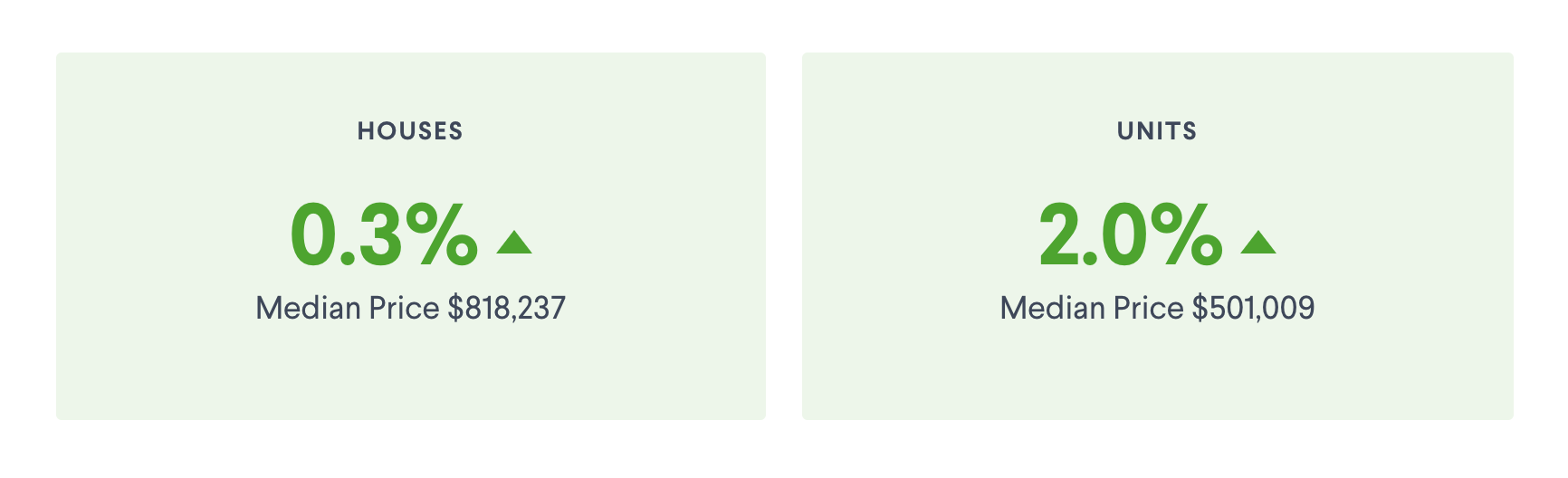

Melbourne

As auction clearance rates reach their highest point since November 2017 and more buyers attend open for inspections, buyer sentiment in Melboune’s property market has picked up.

“The biggest downturn in Melbourne property prices since the 1980s looks to be at an end,” the Domain report notes.

Melbourne's median house price recorded an increase of 0.3 per cent in the June quarter, marking the first rise since December 2017.

Wiltshere says Melbourne's most expensive areas recorded the biggest house price falls, as homes in Melbourne's inner-east and inner-south have fallen 16 per cent and 13 per cent respectively over the past year.

The report notes that house prices were unchanged in Melbourne’s west and north-west regions.

Ballarat and Bendigo recorded house price increases of 11 per cent and 5 per cent respectively over the past 12 months, and Geelong recorded a one per cent increase over the year.

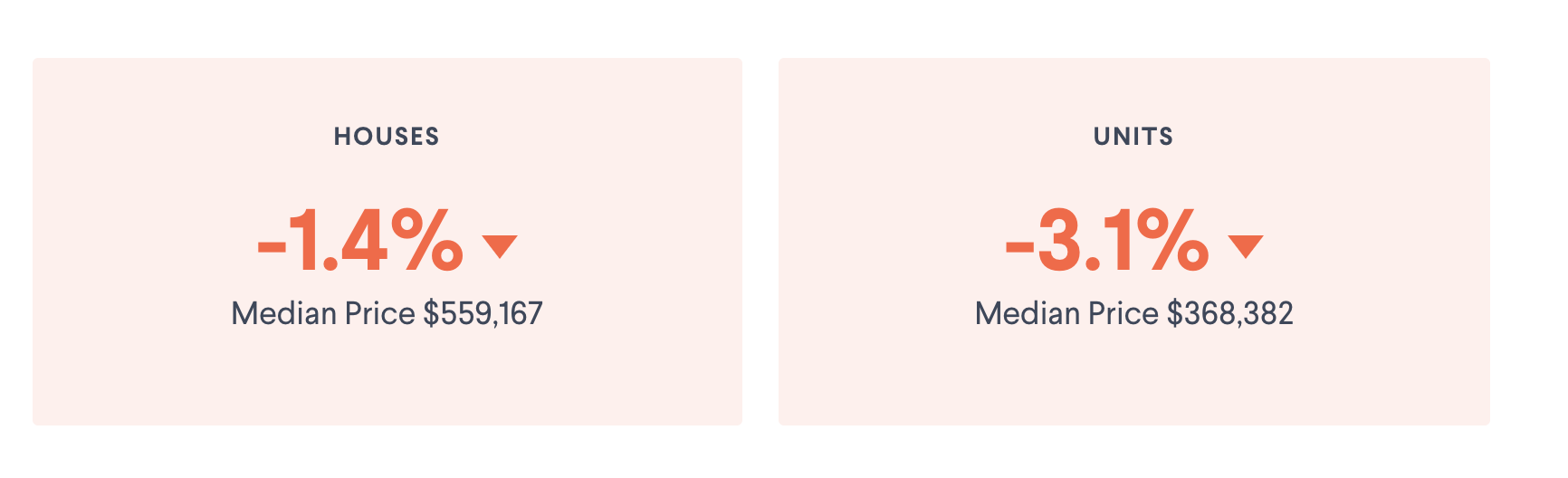

Brisbane

Brisbane’s median house price dropped by 1.4 per cent in the June quarter, which now sits at $559,167.

Fewer apartments are expected to hit the market late this year and next, as a result Domain’s report expects this will put less downward pressure on prices.

“Strong population growth has meant the correction in unit prices was not as severe as some had predicted,” Wiltshere notes.

Brisbne’s median unit price is now 11 per cent below the 2016 peak, seeing unit values back at 2013 prices.

Domain says Brisbane house prices have now fallen 2 per cent since the mid-2018 peak.

Last week, BIS Oxford Economics forecast that Brisbane’s median house price could rise by 20 per cent over the three years to June 2022, while it anticipates growth in the unit sector to take longer to return, with a 14 per cent rise in the unit median for the period.

Domain says house prices in Brisbane's west and in the Moreton Bay region were the strongest areas for house prices, holding up over the past year.

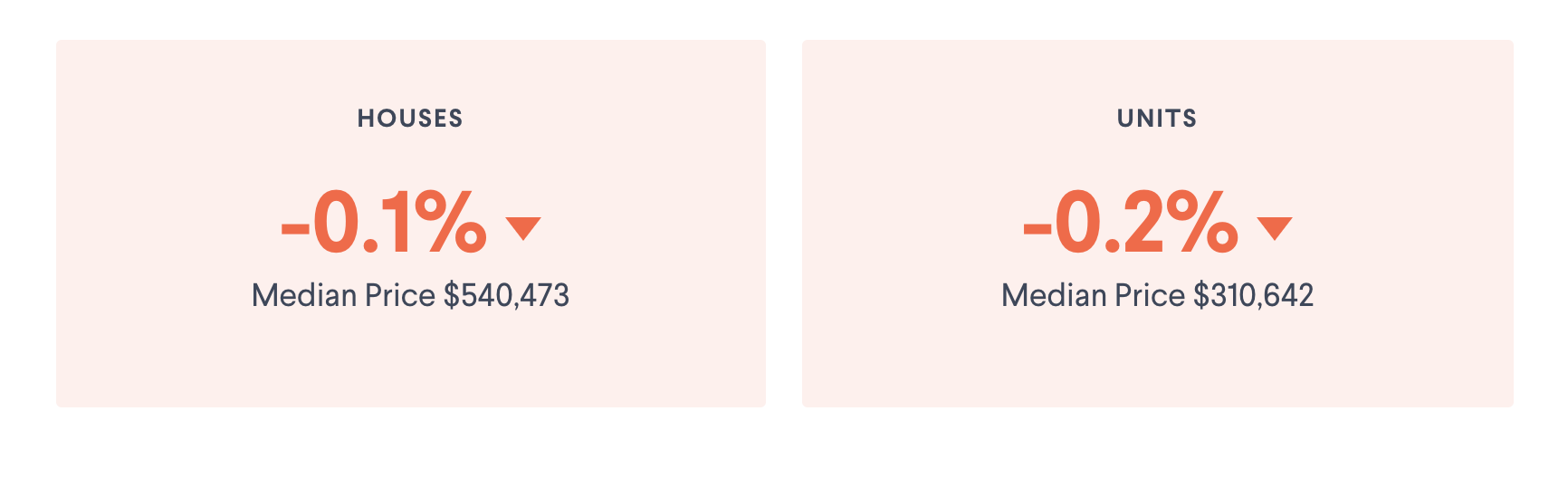

Adelaide

June 2019 quarter on quarter change: Domain

Adelaide's market has slowed. The report shows house prices dropped a slight 0.1 per cent for the June quarter, marking only its second drop since 2014.

While Adelaide’s unit prices fell slightly, down 0.2 per cent, in the June quarter.

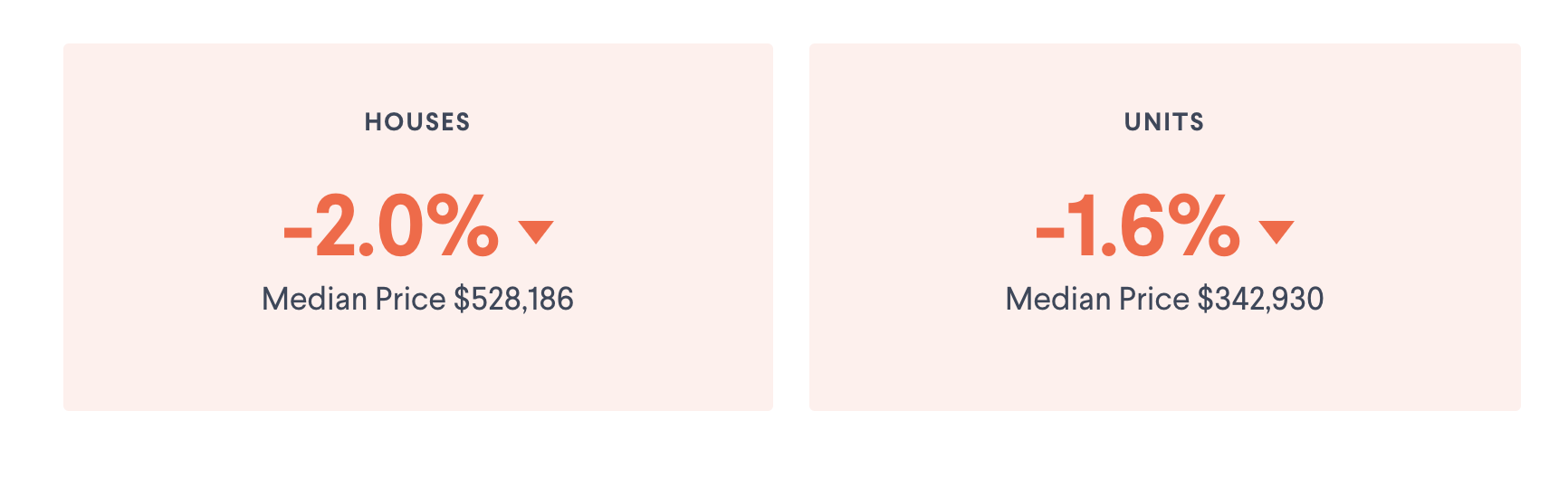

Perth

Despite the continued falls in values, the report notes “Perth’s price falls could be close to ending”.

“Population growth is picking up, there’s more buyer interest, the mining outlook is now much stronger and there is growing demand for workers,” Wiltshere said.

House prices fell 2 per cent in the June quarter, now 14 per cent below the 2014 peak.

Perth’s unit prices are now 19 per cent below their 2014 peak.

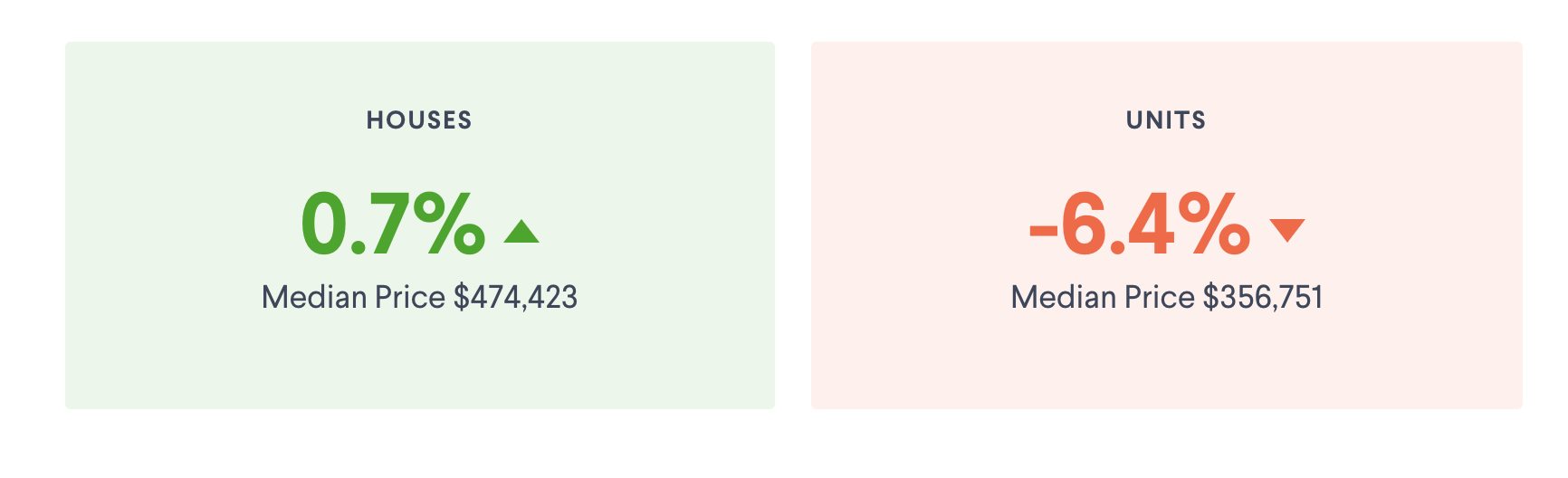

Hobart

Hobart’s median house price has recorded a 3.4 per cent rise over the year, the slowest rate of growth in a three year period, which Domain notes could signal the end of the capital city’s hot property price run.

Hobart’s property boom has pushed its median house price up by 35 per cent over the past three years.

The June quarter saw houses increase by 0.7 per cent, and units record falls of 6.4 per cent.

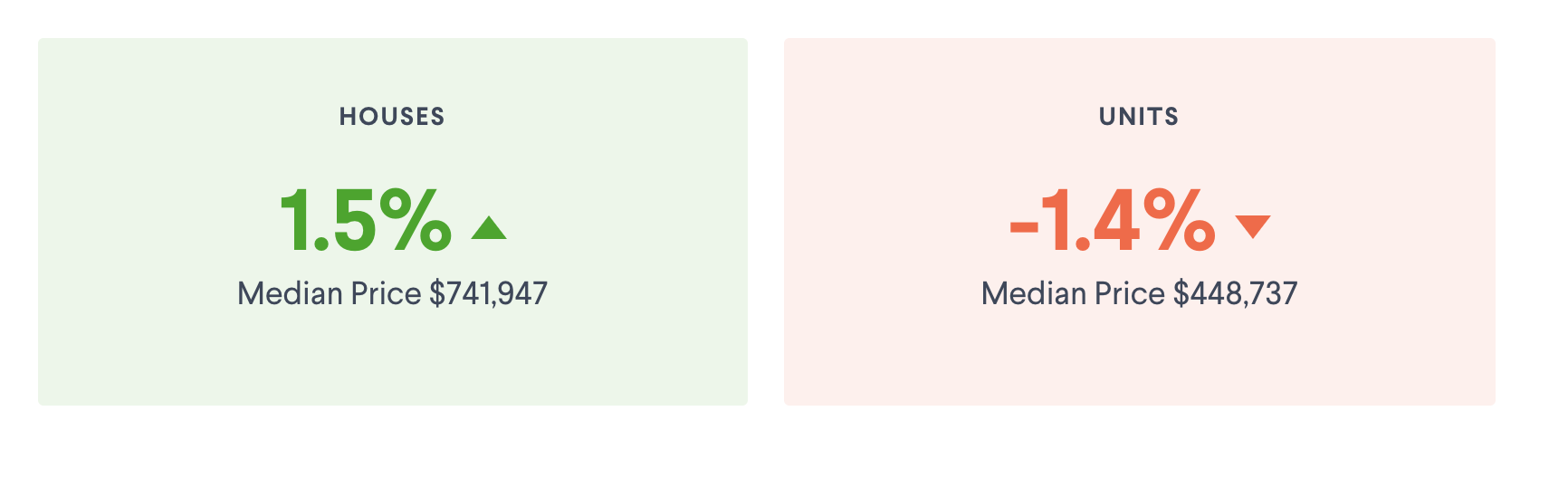

Canberra

Canberra's median house price increased 1.5 per cent in the June quarter, remaining unchanged over the year with a median house price of $741,947.

While its median unit price increased by 1.9 per cent over the year, new apartment building is expected to restrain unit prices from rising too much.