Consumer Sentiment Back to Pre-Covid Levels

Consumer sentiment is now back around pre-Covid levels as lockdown restrictions begin ease across the country.

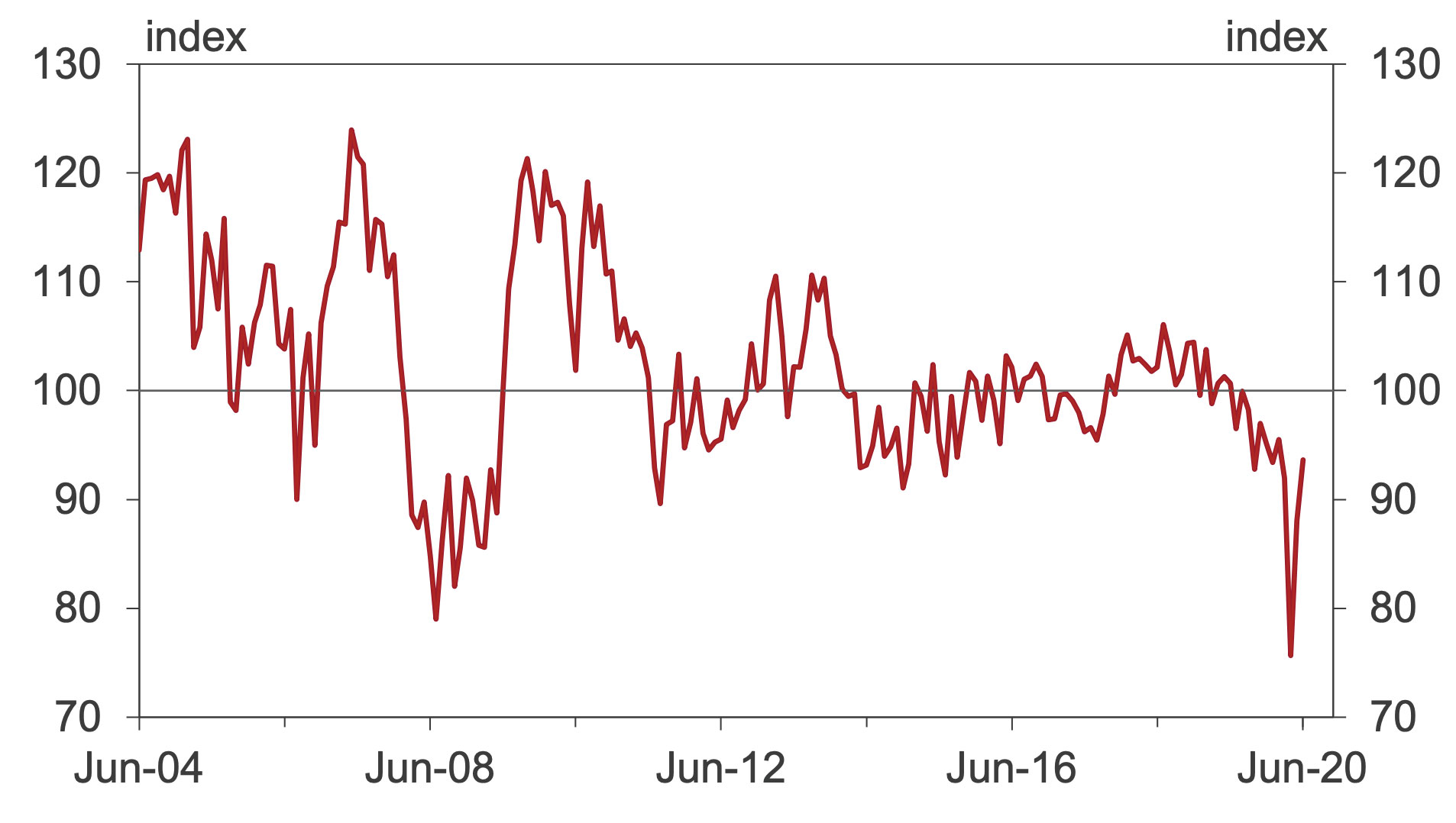

Westpac reported an increase of 6 per cent in its consumer sentiment index reaching 94 points in June, lifting from 88 points in May.

The index, now just 2 per cent below the average recorded in the months leading up to the crisis—between September and February, is weighted to represent a score below 100 speaks to more pessimists than optimists among respondents.

Consumer sentiment over recent months had been weighed down by expectations on employment, spending on household items and long- and short-term economic conditions brought forward by the pandemic.

The recent state of pessimism extended across all the major states although somewhat more entrenched in Victoria at an index score of 75.3 compared to NSW with a score of 84.2.

Westpac Melbourne Institute Index of Consumer Sentiment

^Source: Westpac Economics, Melbourne Institute

“While the monthly gains are impressive, the Index is still relatively weak by historical standards,” Westpac chief economist Bill Evans said.

While a positive result, recouping all of the 20 per cent collapse when the pandemic took hold in March, sentiment is still down 7 per cent compared to a year ago.

Evans said there would be continued intense pressure on family finances and concern about the near-term outlook for the economy.

Sentiment around housing showed a modest improvement across June, with assessments around “time to buy” consolidating on previous gains and price expectations showing a lift, albeit to still very weak levels.

The “time to buy a dwelling” index dipped 0.5 per cent but held on to most of May’s strong rebound following the collapse in this index in April.

Westpac said at 107.6, the index continues to hold in positive territory but is still well below 2019’s average level of—a pattern evident across all of the major states.

“To date, house prices have held up surprisingly well, albeit on extremely low turnover,” Evans said.

“Resilient reads on ‘time to buy a dwelling’ are encouraging but the survey continues to point to a sharp deterioration in the outlook for prices compared to a few months ago.”

Consumer expectations for house prices posted a solid gain lifting 10.5 per cent but at 80.6 on the index, it remains in pessimistic territory 43 per cent below the optimistic readings immediately prior to the Covid-19 lockdown.

Corelogic figures show Australia's home prices fell in May, down 0.4 per cent, but the pace of decline was less than expected.