Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeDevelopers are closely watching the early progress of Coposit, an innovative new app just released enabling buyers to secure a property with just a $10,000 deposit for the first time in Australia.

Already dubbed a “game-changer” and “the AfterPay of property”, Coposit says it is a lifeline to homebuyers and predicts it will revolutionise property buying.

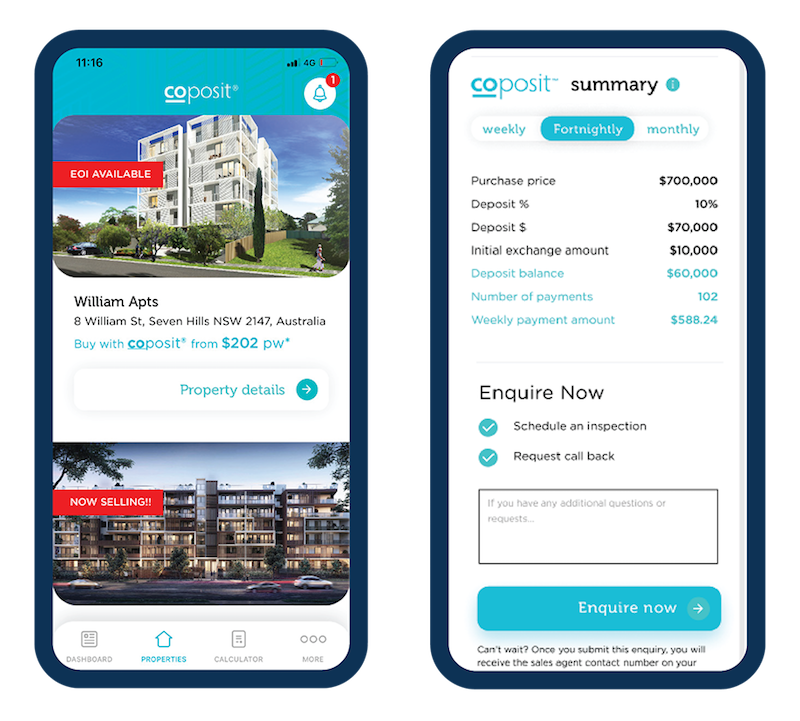

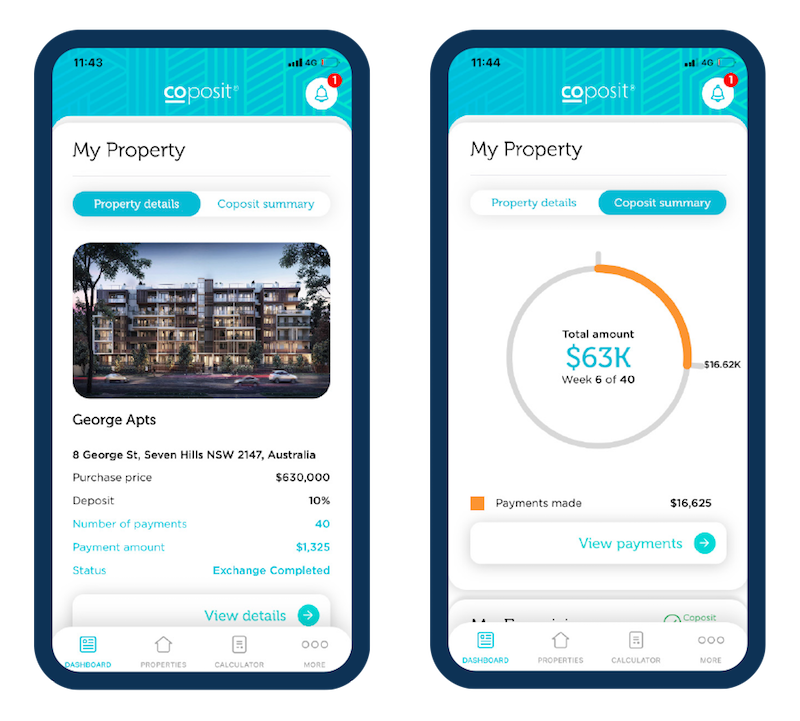

It enables buyers to purchase a property with as little as $10,000 in savings and pay the remainder of the deposit over weekly payments, called “coposits” with no interest or fees.

Presenting a wholistic offering, Coposit allows buyers to browse listings, submit property enquiries, pay, and manage deposits and even exchange contracts digitally from anywhere in the world.

“Coposit has been years in the making—we could see how increasingly difficult it is becoming to get into the property market,” Copost chief executive Chris Ferris said.

Ferris has some 10 years’ experience in the property sector and was most recently director of Sydney-based development company Civic Properties for eight years.

This helped Ferris formulate the Coposit app with the primary goal of helping purchasers supported by a comprehensive understanding of the symbiotic needs of developers, financiers, and real estate agents.

He said Coposit was a game-changer for property developers, particularly for developers of off-the-plan stock.

It delivers a whole new market of potential buyers and streamlines the sales process with a suite of customised back-end tools that simplify sales, manage inventory, and maintain buyer engagement.

“We know the pain points for residential developers and identified the untapped opportunity in the wait time for buyers while new homes and apartments are being constructed. This period of time lends itself ideally to buyers paying off their deposit,” Ferris said.

“Coposit unlocks a whole new sales channel and has proven to deliver an additional 23 per cent of buyers who are otherwise unable to buy.

“It does the heavy-lifting and makes the sales process fast and easy. Developers and agents can access all relevant sales data and analytics in real-time within seconds.”

He said that the app also helped to qualify buyers and minimise settlement default risk, “delivering on the dream wish list of any developer”.

Consumer response to Coposit is testimony to the pent-up demand in the market, he said.

Coposit was trialled at Civic Properties’ The Hills Village in Seven Hills in Sydney’s west. When complete in 2022, it will be the first planned community in Seven Hills, with more than 400 apartments across four separate buildings.

An impressive 67 of 97 apartments were sold using the Coposit app in just under five months since being trialled at The George Apartments in The Hills Village.

Importantly, 77 per cent of buyers elected to make weekly coposits while 23 per cent of buyers would not have been able to purchase without the innovative app.

With an initial focus in New South Wales, Coposit plans a national roll-out starting with Victoria, Queensland and the ACT.

Coposit has a range of in-built features including a dashboard providing clients with a summary of key information about their property and payment history as well as regular project updates via app notifications.

It also helps buyers develop a payment history with the regular weekly “coposits” or payments helping to demonstrate financial discipline and loan serviceability to financial institutions when it comes time to settle the property purchase.

The Urban Developer is proud to partner with Coposit to deliver this article to you. In doing so, we can continue to publish our daily news, information, insights and opinion to you, our valued readers.