Online sales lifted by 2.5 per cent during the past 12 months to represent 9.1 per cent of the retail market, as the growing trend towards online purchases accelerated due to limiting public outings and international travel restrictions keeping consumers at home.

The outlook for retailers plays into a broader theme of a cyclical rotation in the equity market, as businesses that typically do best during an economic expansion fare better than the defensive corners of the market, such as consumer staples.

Around 8.2 per cent of household goods retailing in 2020 was due to increased spending as a share of income, which now may be at risk going forward as households reassess their spending behaviour.

“Unfortunately for many retailers in 2021, the economic recovery and re-opening of industries will more likely be a headwind than a boon,” Rumbens said.

“A return to ‘normal’ poses a bigger risk to some retailers [due to] more opportunities for non-retail spending, and an increasing shift back towards travel and hospitality over the year.

“This includes household goods retailing, where the durability and one-off nature of the purchase increases the risk of a sharper pull back in spending.”

Supermarket sales growth is likely to remain elevated long after coronavirus lockdowns, with food retailers, particularly Woolworths and Coles experiencing stronger-than-expected profit growth.

“It will take time for certain parts of spending to reboot, including hospitality and travel as border disruptions remain a common feature,” Rumbens said.

“If these issues are wholly resolved by vaccines, the shift in spending behaviour could be more pronounced and result in a bigger handbrake for retail spending.”

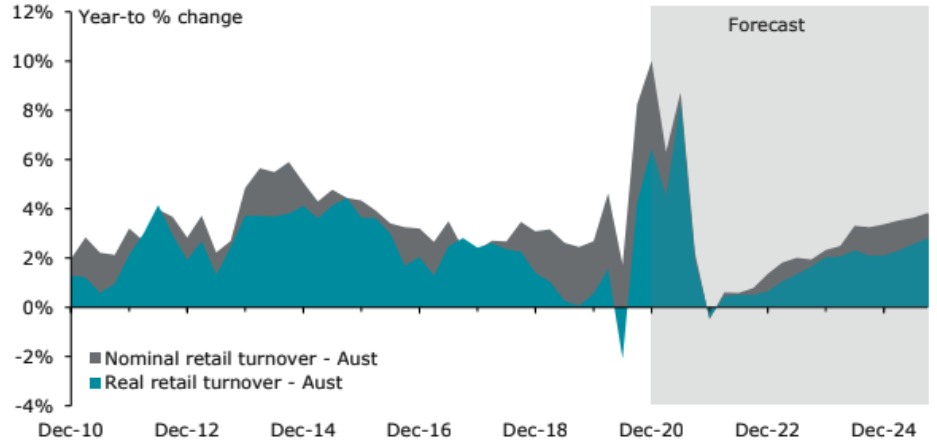

Rumbens said the surging housing market will provide further support to spending across the year, but the spending segment a pull-back towards the later stages of the year.

According to CBRE, new retail developments are forecast to drop dramatically over the next five years, with new supply expected to fall from 2022 with asset valuations bottoming out this year.