Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Brisbane’s median house price has crossed the $1-million threshold for the first time as Perth races towards the same milestone with Adelaide not far behind.

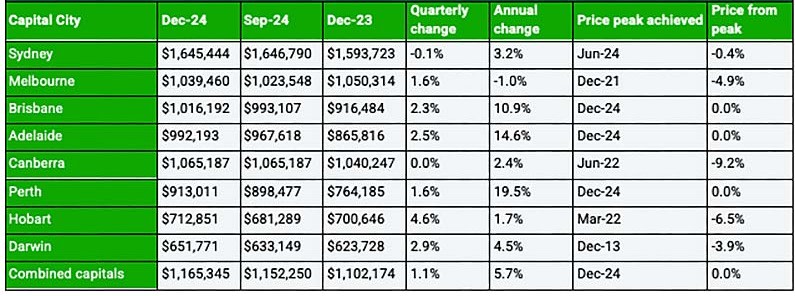

According to Domain’s House Price Report for the December quarter of 2024, Brisbane joined Sydney, Melbourne and Canberra in the million-dollar club, with the gap between Brisbane and Melbourne house prices now at its lowest point since 2009.

Domain chief of research and economics Nicola Powell said housing market momentum had decreased across all capital cities, slowing to its lowest level since September, 2023.

“The market is finally catching up to the financial pressure many buyers have been facing,” Powell said.

Powell said the market slowing was probably not great for the outlook in terms of the development feasibility.

“We know developers are under cost pressure and the feasibility of projects isn’t really stacking up, which is one of the pain points about delivering supply that is much needed across Australia to help aid affordability,” Powell told The Urban Developer.

“We’ve seen such stretched affordability and what we’ve got currently unravelling is borrowing capacity is still being clipped, and it is steering demand to more affordable property, more affordable suburbs and therefore property types.”

Perth led capital city gains with a 19.5 per cent increase in house prices, followed by Adelaide at 14.6 per cent and Brisbane at 10.9 per cent.

Sydney experienced a slight decline—house prices fell by $1300 over the quarter.

According to the report, 2024 was a year of two halves for Sydney, with house prices rising 3.7 per cent in the first half but falling 0.4 per cent in the second.

Melbourne recorded its first house price increase in 12 months. It was also the first time in about four years that Melbourne recorded stronger positive quarterly growth than Sydney, the report said.

Supply levels show significant change, with the report revealing that December, 2024 ended with the highest number of properties available for sale in three years across combined capitals, suggesting increased market activity during the autumn season.

Current median house prices in capital cities show Sydney at $1,645,444, Melbourne at $1,039,460 and Brisbane at $1,016,192.

Adelaide’s median sits at $992,193, while Perth has reached $913,011. According to the report, Perth could reach the $1 million milestone by the end of 2025, requiring a 9.5 per cent (about $87,000) increase, with forecast growth of 8-10 per cent making this possible.

Current median house price and changes

The combined capitals median house price is $1,165,345, according to the report.

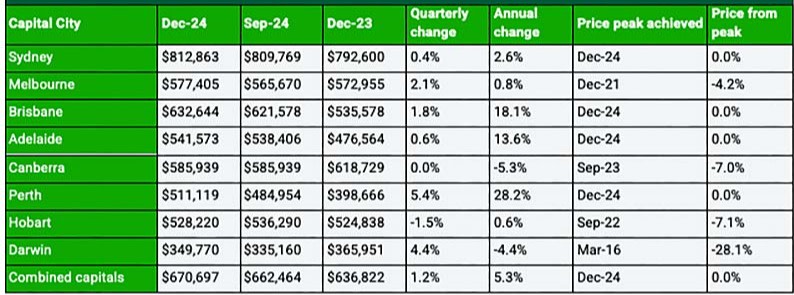

In the unit market, Perth experienced significant growth with a 28.2 per cent annual increase, while Brisbane recorded an 18.1 per cent rise.

Sydney’s unit prices reached a new peak at $812,863, with Melbourne units at $577,405. Hobart was the only capital to record a unit price decline during the quarter.

Market conditions suggest a shift towards buyers in 2025, with longer selling periods and increased negotiation opportunities.

“At the moment, many potential buyers are holding off, hoping for a cash rate cut to improve their borrowing power,” Powell said.

The market transformation has been building since September 2024, when properties began staying on market longer across most capitals.

Current median unit price and changes

According to the Domain House Price Report fpor September of 2024, the trend varied significantly by location, with Perth homes selling in just 11 days while Hobart properties remained listed for 51 days.

“As demand decreases and more homes come on to the market, we’re seeing a shift in dynamics that can’t be ignored,” Powell said.

“This has led to softer clearance rates, longer time on the market, and more opportunities to negotiate on price. Overall, the market seems to be moving towards a buyers’ market, which could offer better conditions for those looking to purchase property this year.”

Despite the slowdown, the sustained price growth marks the longest period of quarterly increases since 2012-2015, with house prices growing for eight consecutive quarters and unit prices achieving seven quarters of continuous increases.

According to CoreLogic’s latest Quarterly Rental Review, national rental growth has also slowed, with a 4.8 per cent increase in 2024 compared with 8.1 per cent in 2023.

Vacancy rates also rose from 1.4 per cent to 1.9 per cent over 2024, while regional areas continued to outperform capital cities with 6.2 per cent annual growth compared with 4.3 per cent in capitals.