Sydney House Prices Are ‘50% Overvalued’: The Economist

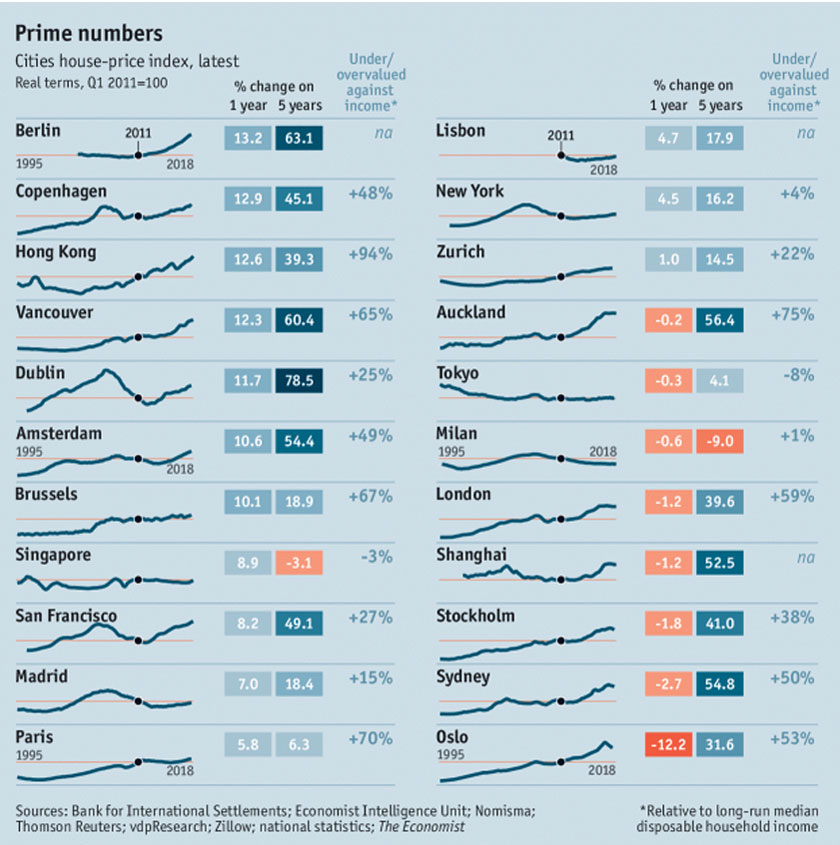

The Economist has launched its new cities house-price index, measuring house-price inflation and introducing valuation measures to determine which cities are most overvalued.

And in some more bad news for Sydney's residential property market, the publication says that Sydney is at least 50 per cent overvalued.

Of 22 of the world’s most desirable metropolitan areas surveyed the average price of a home rose by 34 per cent over the past five years.

In seven cities it rose by more than half.

Homes in Berlin now cost 82 per cent more than they did at the end of 2007. Those in Hong Kong are worth a whopping 147 per cent more while house prices in Sydney have grown 64 per cent.

National house prices in Australia, Canada and New Zealand have been more than 20 per cent above fair value compared with income and 30 per cent above fair value compared with rents for the past three years.

They have now hit 40 per cent above fair value for both metrics.

Related: House Price Decline Largest in Six Years

Global Cities House-Price Index

Cities with overpriced housing include Sydney, Vancouver, Amsterdam, Copenhagen, and London.

Cities that are at fair value or undervalued include Tokyo, Milan, Singapore and New York.

However, the index indicates that property prices may be near a turning point with the average rate of house-price inflation across the 22 cities measured slowing from 6.2 per cent annually 12 months ago to 4.7 per cent now.

“The three reasons why cities have experienced a property boom — and why it may now be ending — are demand, supply and the cost of money,” the report noted.

London as a prime example lost 100,000 people to the rest of Britain in the 12 months to June 2017 due to scarce housing and ballooning prices with rents averaging about half of a typical pay-cheque.

Increasing prices have been supported by planning restrictions, land banking and a failure of governments to expand supply in many cities.

Loose credit policies since the financial crisis have also made mortgages extremely cheap.

“This has super-charged prices,” Knight Frank's global head of residential research Liam Bailey said.

Adding to the downtick are cities becoming less welcoming to foreign capital, too. In Vancouver, new policies have made it harder for foreigners to buy property.

Here in Australia increased property-transaction taxes for non-residents have affected the markets negatively while New Zealand has considering banning foreigners from buying property.

Cities that have started to see a downturn now include Auckland, London, Sydney and Toronto, with house prices falling, albeit slowly.