Five Trends Re-Shaping Hospitality Post-Pandemic

Covid-19 is bringing permanent change to the hospitality sector, and in order to survive and thrive, there are a number of ways landlords and developers must change the nature of food and beverage planning.

The future of food and beverage in a post-Covid world is not doing the same thing over again and, as Einstein said, expecting a difficult result.

Continuing to plan, design, and lease stores in the food and beverage sector in the same way as we did pre-Covid will not achieve a positive outcome.

Help is at hand. Australia’s leading F&B consultancy firm, Brain & Poulter, has identified five “mega trends” which offer a guide to how to think differently about the food and beverage sector, and come out a winner.

1. Quantum

Peak industry body, The Restaurant and Catering Association of Australia predicts a contraction in the quantum of food and beverage outlets in Australia, by up to 20 per cent as a result of Covid-19.

Brain & Poulter’s Suzee Brain predicts a “re-balancing” of numbers, with contraction in the CBD, replaced by growth in the suburbs due to working from home adjustments.

“If the majority of office workers were to spend just one day a week working from home as part of the “new normal”, that would result in a 20 per cent contraction in demand for coffees and lunches in the CBD.

“But the need for coffee and a poke bowl lunch doesn’t go away, it’s just shifted location—closer to the worker’s home,” Brain said.

Pre-Covid, many food and beverage lease plans were carved up either by the architect—in terms of how many boxes they could create in a space—or by leasing, based on how many hot prospects they had on their books.

Going forward, sticking to this approach could quickly end up either “over-fooding” or “under-fooding”a location.

The alternative is to do it differently: post-Covid, developers should invest in sound market research by food and beverage experts to identify demand and customer profiles.

Creating a customer-centric food and beverage lease plan, developers will find their project leases faster and retains tenants for the term of their lease.

2. Capacity

Before Covid, seating ratios for food and beverage outlets were based on allowing a space of 1.1 to 1.4sq m between customers.

As the pandemic came under control, the majority of states have limited capacity to one customer per 4sq m of space, radically decreasing seating capacities and therefore earning potential, with productivity measured in sales per square metre.

As a nation, our personal space ratio has expanded in the last six months, long enough now for it to have formed a habit, so much so that in the post-pandemic world, crammed internal spaces will strike fear in customers and limit engagement.

Again, in this scenario, continuing doing it the same—forecasting sales and rent productivity on pre-Covid benchmarks will create unrealistic feasibilities and lower return on income.

Doing it differently means increasing external seating areas, adding mezzanine seating, controlling the length of booking times to increase table turnover: these are just some of the ideas smart developers and operators will implement to drive up sales productivity.

3: Revenue streams

With internal dining capacity curtailed and significant growth in the “dining-at-home” sector, landlords need to find tenants who can prove their business model does not rely solely on dining-in.

Brain & Poulter’s co-director Kate Poulter encourages landlords to check operators have at least seven different income streams modelled in their business plan before executing a lease.

“Doing it the same would mean doing deals with tenants that had a successful track record pre-Covid; doing deals with ‘favourite’ tenants or doing portfolio-wide deals—all of which could result in poorer rents as operators fail to maintain or grow sales.

“Doing it differently would mean amending lease application forms to deeply investigate how prospective tenants plan to drive alternative sales such as drive-through; delivery; in-home events; live streaming; merchandise; collaborations and social media,” Poulter said.

Landlords who use a food and beverage expert skilled in reviewing the application to ensure the concept and plan match the capacity and the design will be more likely to execute leases that meet the financial expectations of both landlord and tenant.

4: Design

The “build it and they will come” adage will not work in the context of the new “Covid-normal”.

For landlords, common area design needs to change to incorporate contactless ordering and collection; more external and al fresco space; touchless entry and exit and selection of more hygienic materials and finishes.

Food and beverage tenant design needs to change to allow for contactless collection; direct takeaway access; customer safety and one-way customer flows.

Doing it the same in would mean letting your design be dominated by customer experience, which Poulter believes will leave you with a gaping hole in the strategy and design to capture customers who don’t want to dine-in but want convenience.

“Doing it differently means thinking about how to design a precinct to facilitate as many customers for takeaway as for dine-in to ensure maximum engagement and frequency of use, by differing customer segments,” Poulter said.

5: Technology

During lockdown, the fastest-growing online activity undertaken by Australians was using food delivery services.

For many landlords hooked on “bricks-and-mortar” retail, encouraging delivery seems the antithesis of building food and beverage precincts.

Brain & Poulter’s Suzee Brain concedes that this is the type of mentality Albert Einstein was talking about when he coined his definition of insanity.

“To thrive after Covid, a food and beverage precinct needs to be omnichannel.

“The landlord must control the umbrella technology to facilitate a fully digital order, payment and collection system, otherwise F&B tenants will move off-site into dark kitchens where they can generate the same sales using a hybrid of dine-in and delivery and not have to pay as much rent,” Brain said.

To tackle this necessary adjustment, Brain & Poulter has developed versatile white-label app solutions designed explicitly for food and beverage precincts that are also applicable to the entire retail offering.

In this scenario, there are again two options: doing it the same would mean spending marketing dollars to get people to come into the centre while denying the move to on-line shopping and home food delivery .

The alternative is doing it differently by investing in precinct-level ordering, payment, collection and delivery technology; designing specifically to provide space for contactless ordering and collection and using technology to collect valuable customer insights and data.

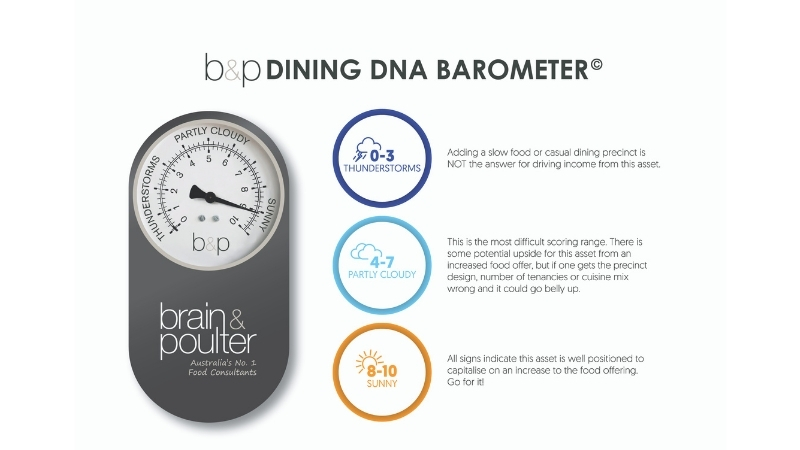

Brain & Poulter’s exclusive food and beverage barometer

To assist with finding out if the pressure on your food and beverage development is rising or falling as a result of Covid impacts, Brain & Poulter has developed a food and beverage barometer to measure the winds of change and determine how they apply to your asset.

Contact us here for a free 30-minute review of your development to see what reading our barometer reveals about your project.

The Urban Developer is proud to partner with Brain & Poulter to deliver this article to you. In doing so, we can continue to publish our free daily news, information, insights and opinion to you, our valued readers.