Further Falls for Residential Property, Experts Warn

The outlook for Australia’s residential property market has plunged to a new low, according to two new reports, with house prices in Sydney and Melbourne set to fall even further.

Investment bank Morgan Stanley suggests a new price floor is still somewhere over the horizon for the country's dwelling prices.

National and Sydney dwelling prices have dropped 2.3 per cent and 4.8 per cent from their peak, respectively.

Morgan Stanley economists warn that prices could slump close to 10 per cent, while noting that further falls would bring a monetary or prudential policy adjustment into the debate.

Related: Property Prices Will Fall 8% in 2018: Morgan Stanley

The NAB residential property survey shares a similar dour outlook, predicting further falls for the housing market.

NAB economists expects a larger decline in 2018 and a moderate fall in 2019, led by Sydney and Melbourne as well as a sharper decline in unit prices in Brisbane.

“We also expect house prices to flatten in aggregate in 2020 - implying a peak to trough fall of 6.5 per cent and 2.5 per cent in Sydney and Melbourne respectively,” the NAB report stated.

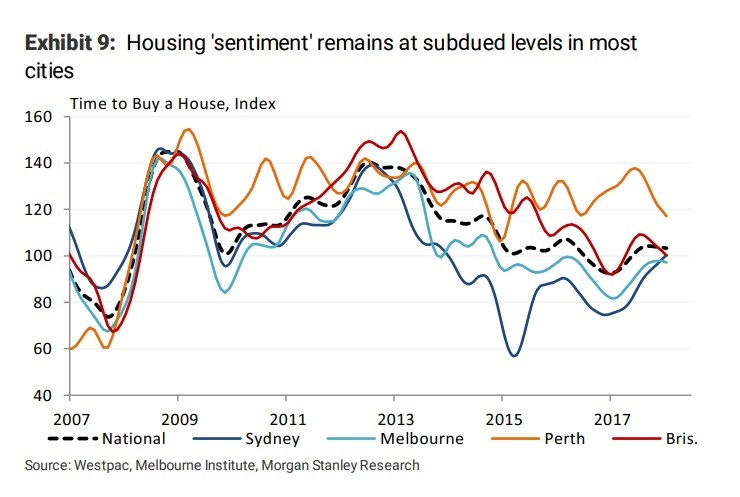

NAB’s Residential Property Index, a measure of sentiment among 300 property professionals, is now below average for the first time in two years, with weaker sentiment reported in all states.

“Any further tightening in lending standards as well as additional changes to government or prudential policy to address affordability or financial stability concerns are likely to have an impact on these forecasts,” the report said.

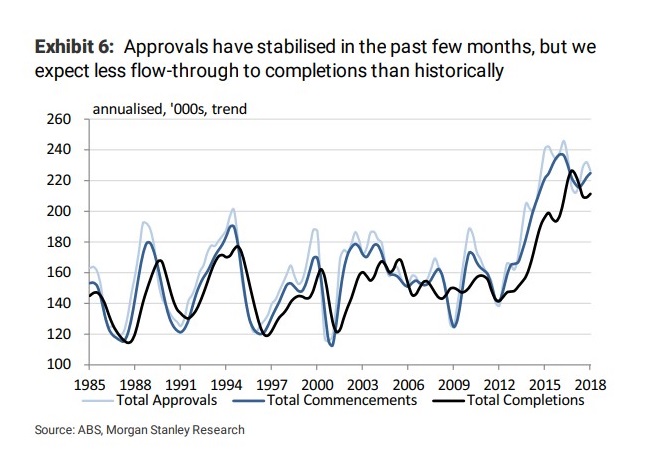

Morgan Stanley research reveals approvals have remained resilient over the year, but expects construction activity to continue declining particularly in the apartment sector.

"This would reflect some projects being shelved, given tighter credit conditions."