Property Prices Will Fall 8% in 2018: Morgan Stanley

Investment bank Morgan Stanley says that the outlook for residential property is continuing to slide with prices expected to fall by about 8 per cent and lending by over one-third during 2018.

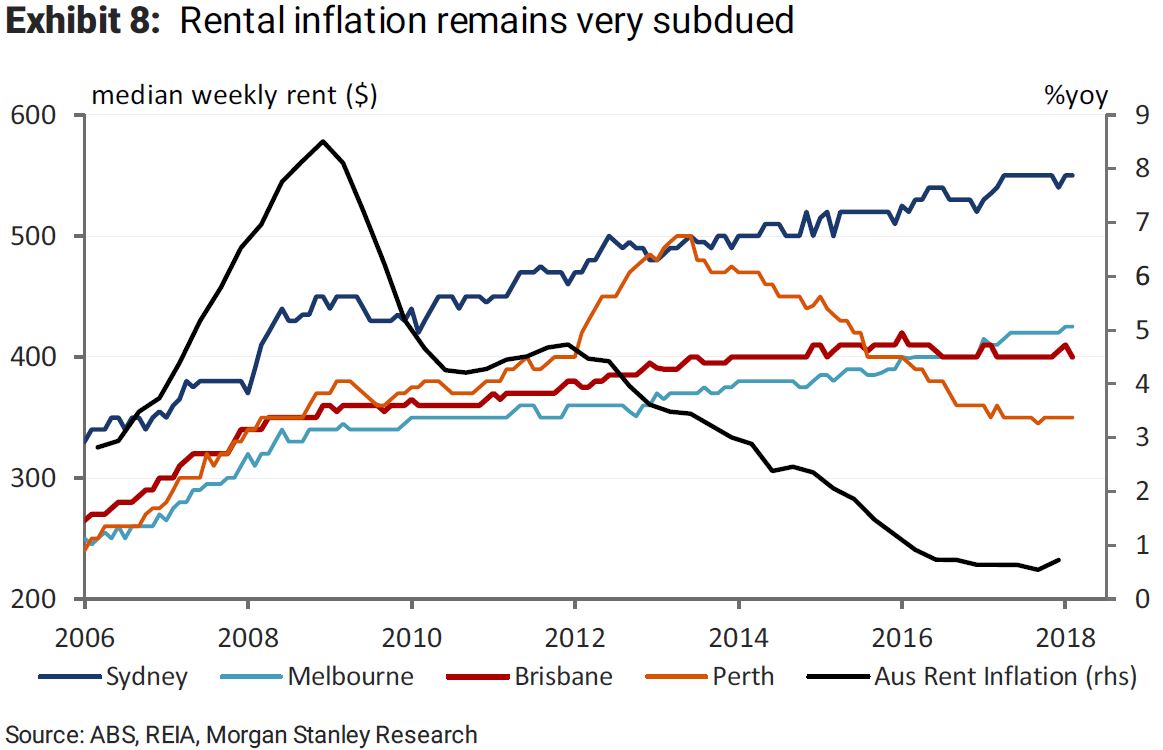

The bank says that housing loan growth will fall from about 6 per cent to around 4 per cent in 2018 given the combination of more onerous capital rules, tighter lending standards, higher mortgage rates and credit rationing.

“The risk is skewed to the downside given an increasing focus on responsible lending.”

In particular, the share of interest-only and investor lending continues to decline, as macro prudential measures bite and declining prices reduce “fear of missing out” driven demand.

Related reading: APRA Scraps Investor Loan Growth Cap

The increases in net migration – 250,000 for the year to September, 2017 – has reduced the effect of apartment oversupply although Morgan Stanley still forecast a surplus of 30,000 dwellings in the market. The effects of migration domestically and from overseas has been especially important in supporting Melbourne in reducing the fall in housing prices.

Morgan Stanley’s report states: "With national prices down 1.5 per cent from the peak late last year, it is clear the housing market has turned.

Related reading: Developers Favour Townhouses in Slowing Property Market

"But in contrast with others in the market who view the worst as behind us, we expect prices to fall further throughout 2018, as credit availability is tightened further and a stretched consumer reassesses the outlook.

“Approvals have held up better than we expected the past few months, but we question the transmission to starts and completions given tighter developer credit, sales demand and project economics.”

Given the tightening credit conditions for developers and volatility in the market, Morgan Stanley warns that some projects could be in jeopardy.

"While the backlog of approvals not yet completed remains high, we expect some projects to be shelved given tighter credit conditions.”