Global industrial property giant Goodman Group has completed its two-storey warehouse facility in South Sydney, heralding a predicted flurry of multi-storey developments in the city’s tightly held logistics market.

The 16,085sq m industrial complex on a 1.69ha brownfield site at Alexandria is one of three multi-storey warehouses due to open within the next 12 months.

Multi-storey warehouses have long been popular within the densely populated areas of Asia. Real estate services provider CBRE now estimates there could be as many as six in and around Sydney in the next 24 months.

To be called Axis Alexandria, Goodman’s new facility is made up of nine units over two levels, ranging from 1000 to 7000 square metres.

Under the design, trucks will be able to access all units, including the top floor, via a ramp.

The property has 400kW of rooftop solar panels and is targeting a five-star Green Star Design and As-Built rating.

Goodman said fishing tackle producer Daiwa and global logistics company Nippon Express had agreed to contracts to move into the facility.

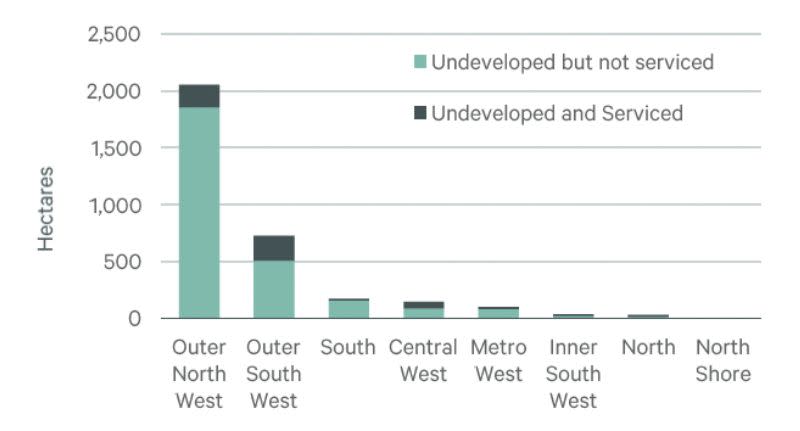

Sydney industrial land zones

▲ CBRE says only about 4 per cent of the total industrial-zoned land in Sydney’s inner precincts remained undeveloped and serviced. Source: CBRE Research

`

Goodman chief executive in Australia Jason Little said multi-storey industrial facilities were a sustainable solution to a lack of available space in key urban centres.

“With the strong market dynamics we have seen in South Sydney and limited supply of units greater than 5000sq m in the area since 2016, it was the ideal location to bring our extensive international experience to our home market,” Little said.

With 42 properties and about 950,000sq m, Goodman is one of the biggest landlords in South Sydney.

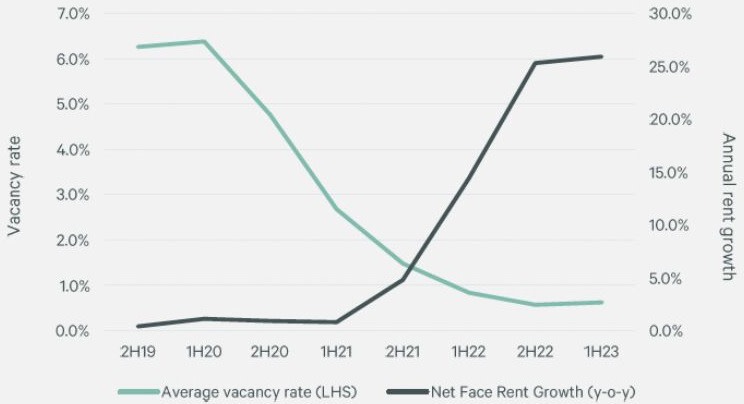

It first acquired the land at 1-3 Burrows Road, 5km from downtown Sydney, on a sale-and-leaseback basis in 2015. When construction began in 2022, Sydney’s industrial vacancy rate was down to 0.3 per cent and rents had surged 30 per cent in the previous 12 months.

Today, at just 0.2 per cent, Sydney’s industrial vacancy rate is among the lowest in the world.

In a report released in October on the rise of multi-storey warehousing, CBRE head of industrial and logistics research Sass J-Baleh said that just 4 per cent of the total industrial-zoned land in Sydney’s inner precincts remained undeveloped and serviced.

Lack of serviced industrial-zoned land, particularly in Sydney and Melbourne, is a criticism that’s been levelled at the Victorian and NSW governments for several years.

▲ Charter Hall’s multi-storey industrial facility, also in Alexandria. It is expected to complete in the third quarter of next year.

J-Baleh said the growth of Australia’s e-commerce sector, particularly during the pandemic, had exacerbated the lack of last-mile logistics space.

Online sales now account for 13 per cent of total retail.

“The e-commerce sector is still relatively immature in Australia when compared to advanced economies and therefore will be in a growth phase over the next 10 years,” J-Baleh said.

“The share of gross floorspace take-up in Australia from retail trade occupiers has also steadily grown in the past decade from, 13 per cent in 2012, to 20 per cent in 2022.”

CBRE forecasts a total of about 850,000sq m of multi-storey floorspace will be delivered between 2023 and 2027 across 20 projects in Sydney. Almost 30 per cent of that is either under construction or has development approval.

And about 15 per cent of new floorspace over that same four years is expected to come from multi-storey developments.

US private equity firm Cabot Properties’ 19,460sq m multi-storey development is supposed to complete in the second quarter of 2024, according to CBRE.

And in March this year, Charter Hall was given the green light to develop a 27,509sq m multi-storey facility, also in Alexandria. That is expected to complete in the third quarter of next year.

Industrial vacancy rates v rent growth

▲ Australia-wide, industrial vacancy rates are at less than 1 per cent, forcing annual rent growth to soar. Source: CBRE Research