Higher Mortgage Rates Will Prolong Weak Property Market: Corelogic

The spring selling season will be different this year. With three of the four major banks announcing an increase in variable mortgage rates and Sydney and Melbourne now well-embedded in a downturn, the property market has keenly felt the decline in sentiment.

Higher mortgage rates have already driven a decline in demand for investors over the past year, with the major banks resisting any adjustment to mortgage rates for owner-occupiers.

Corelogic research analyst Cameron Kusher says the big difference in Thursday’s announcement is that higher interest rates will affect owner-occupiers.

“Most of the previous mortgage rate changes announced by the major banks have only affected investors and those with interest only mortgages,” Kusher said.

Kusher says it is likely higher mortgage rates will impact housing market sentiment.

“[It] may end up further exacerbating the declines which are already occurring in Sydney, Melbourne, Perth and Darwin and the slowing of value growth being experienced elsewhere.

“Overall this move seems likely to lead to a continuation of the currently weak housing market conditions over the coming months and may weaken the market further.”

Recent Corelogic data reveals tighter lending conditions, higher mortgage rates for investors and reduced affordability has already led to falls of 5.6 per cent from the peak in Sydney and 3.5 per cent in Melbourne.

“This has occurred so far without higher interest rates for owner occupiers paying off principal and interest however, that is about to change,” Kusher said.

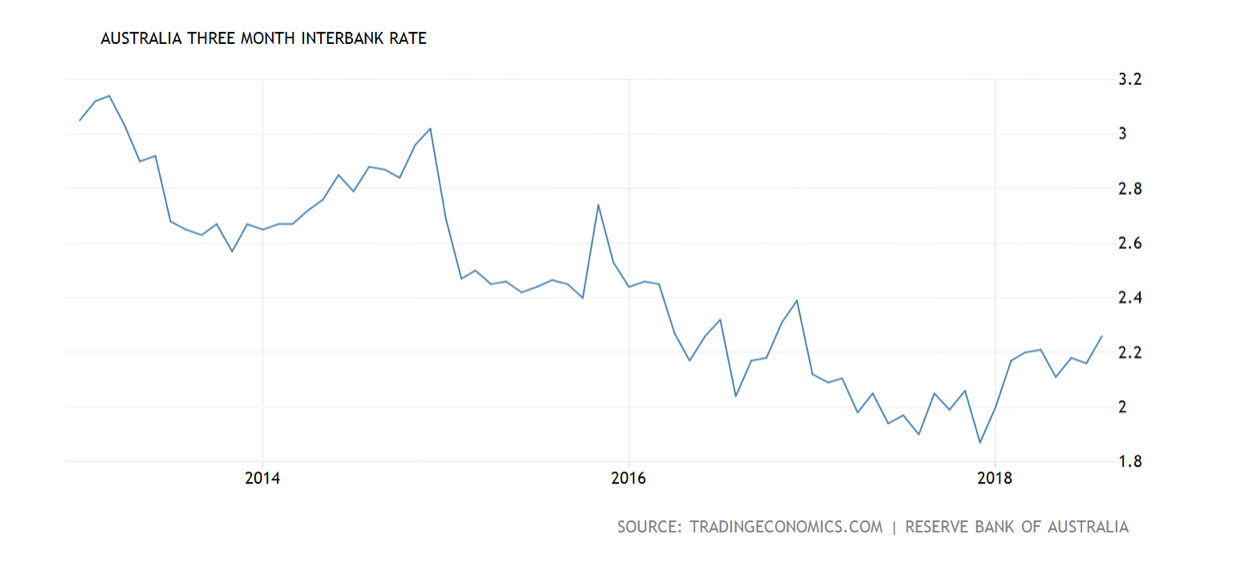

Kusher says lenders have “had their hand forced” by higher funding costs.

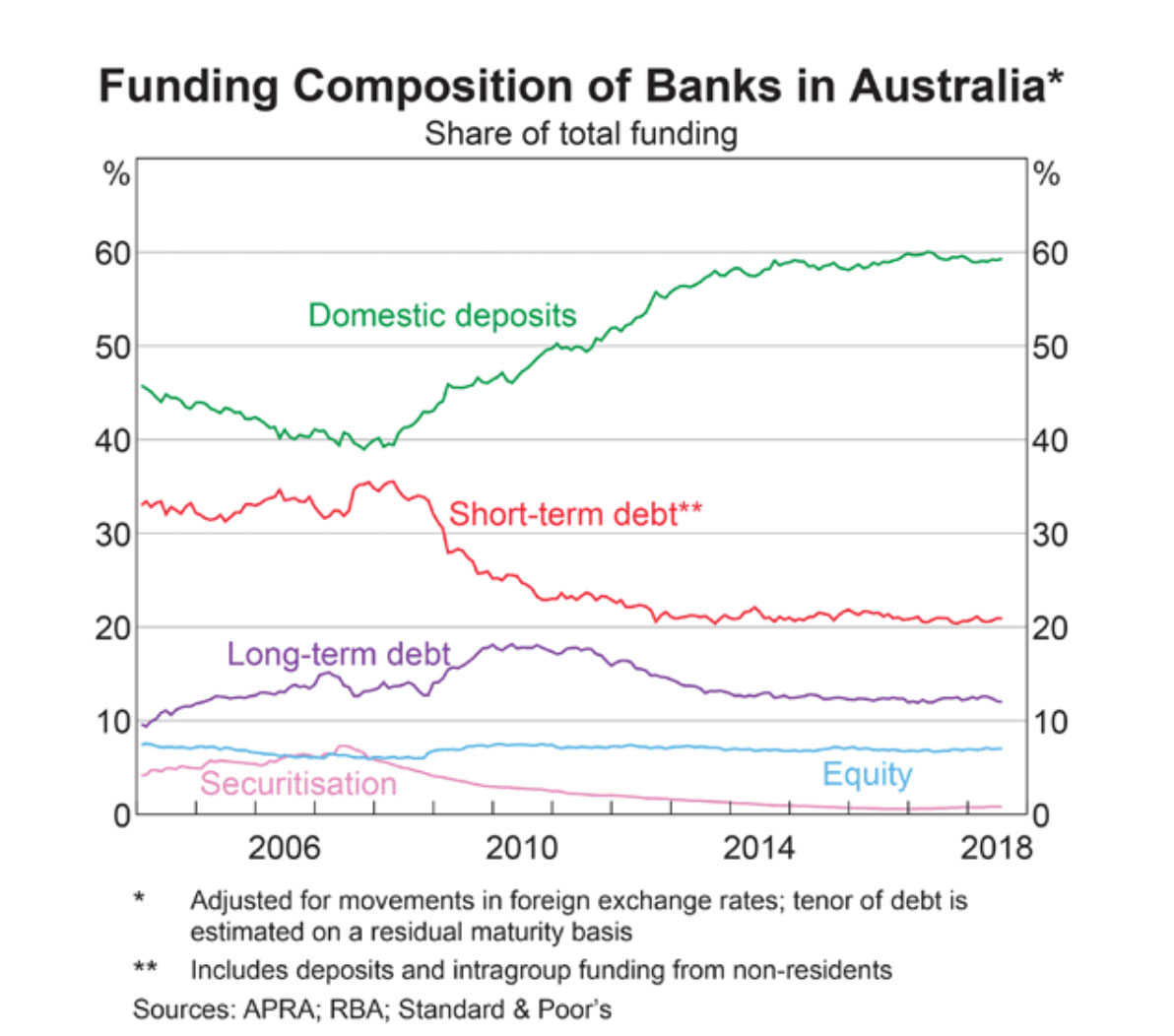

“Short-term funding is not an insignificant part of the funding profile (slightly more than 20%), although the share of funding from short-term debt has fallen over recent years as domestic deposits have increased.”

Kusher says there are other ways that the banks can handle higher short-term funding costs other than lifting mortgage rates.

“But that would likely mean cutting dividends which lenders seem reluctant to want to do or reducing deposit interest rates which would likely see a further reduction in the primary funding source: domestic deposits.”

“From the lenders perspective, they realise that the housing downturn is becoming entrenched (particularly in Perth and Darwin, but more recently in Sydney and Melbourne) and they are doing what they can to maintain profitability in the face of lower mortgage volume,” Kusher said.