Home Loan Lending Picked Up Last Month

Home loan lending made a modest gain last month, bucking the trend of consistent month-on-month falls over the year.

The Australian Bureau of Statistics monthly home loan approval figures revealed a seasonally adjusted 1.1 per cent jump in May from April – the first improvement in six months.

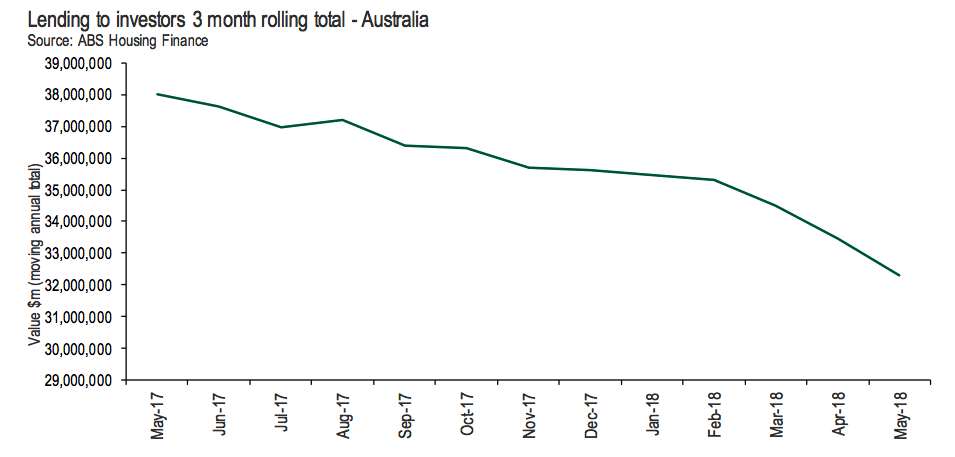

The value of housing finance rose 0.5 per cent to $31.9 billion. Unsurprisingly, investor lending fell again in May, its lowest share in the market since December 2011, Indeed economist Callam Pickering said.

The slump in investor lending was less marked than in April, falling 0.1 per cent to $10.7 billion.

Related: Queensland Leads Approvals Slump

First home buyers continue to buoy mortgage lending, entering the market at just the right time to offset falling investor numbers.

First home buyer lending remained unchanged from April to May at 17.6 per cent.

HIA principal economist Tim Reardon said that May’s housing finance data tells a more subdued story.

“Lending for the purchase of a new home has slowed throughout 2018.

“Less investor involvement in the market is one of the reasons why we are expecting a slowing in new home building over the next couple of years. The fall in investor activity will be more noticeable in the apartments sector.

Owner-occupier lending picked up to $14.9 billion this month from $14.7 billion.