Interested in a Corporate TUD+ Membership?Speak to our team today for a special end-of-year discountSpeak to our team for an end-of-year discount

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

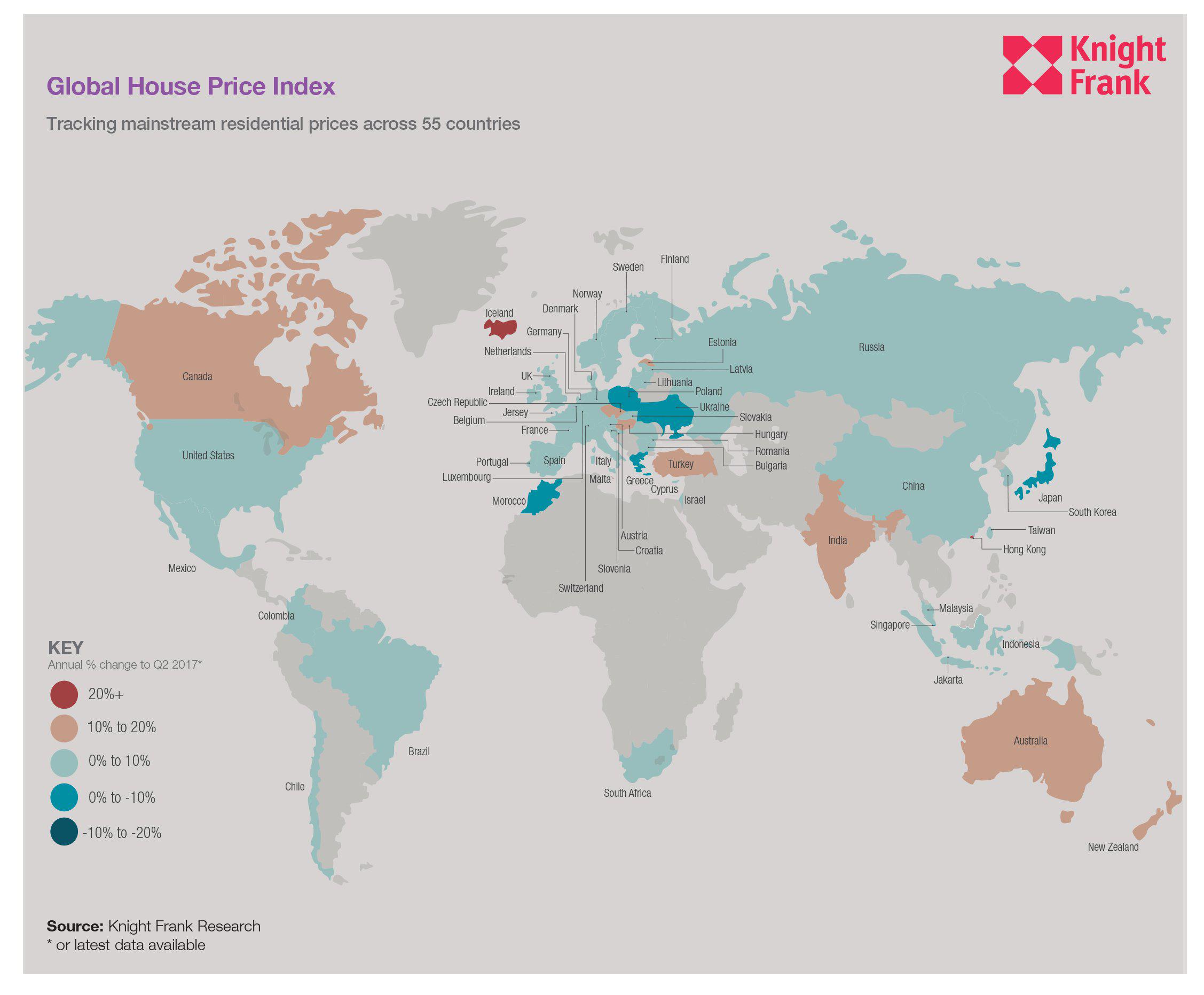

SubscribeAustralia has moved up nine places to the 11th spot in the latest Knight Frank Global House Price Index, propelled by a 10.2% growth in house prices in the second quarter 2017.

Across the 55 countries tracked, house prices increased by a global average of 5.6% in the year to June 2017.

Knight Frank Head of Australian Residential Research Michelle Ciesielski said there has been a moderate resurgence in the Sydney residential market over the past year.

“This time around, capital growth is not likely to be as strong as experienced over the past four years with a continued tightened lending environment," she said.

“Analysing the annual sales turnover trend as a potential leading indicator for projected capital growth for houses and apartments, a standout is the moderate strengthening of the Greater Perth and Greater Darwin residential markets."

Knight Frank's report revealed Australia came in 11th position, up from 20th position as of Q1 2017 at 7.7% growth, and up from 16th position with 6.8% growth as of Q2 2016.

New Zealand slipped from third position in the rankings to 10th as annual price growth moderated to 10.4%.

Iceland and Hong Kong led the rankings with an accelerated annual rate of price growth over the last three months -- in Iceland’s case from 17.8% to 23.2% and for Hong Kong, from 14.4% to 21.1%.

China’s average price growth dipped marginally to 9.6% in the 12 months to June. Undeterred by policymakers’ efforts to rein in speculative demand and control price inflation, developers are reportedly raising their sales targets for 2017.

“Despite still lingering in negative territory, both are reporting an improvement in sales turnover, with house sales in Greater Darwin recording 6% growth in the number of annual sales in the year ending June 2017," Ciesielski said.

"In saying this, there is still some time before we see capital growth in these markets.

“Other markets to watch, showing recent sustained appreciation in annual turnover were houses in Greater Adelaide and Canberra, and apartments in Sydney and Canberra."

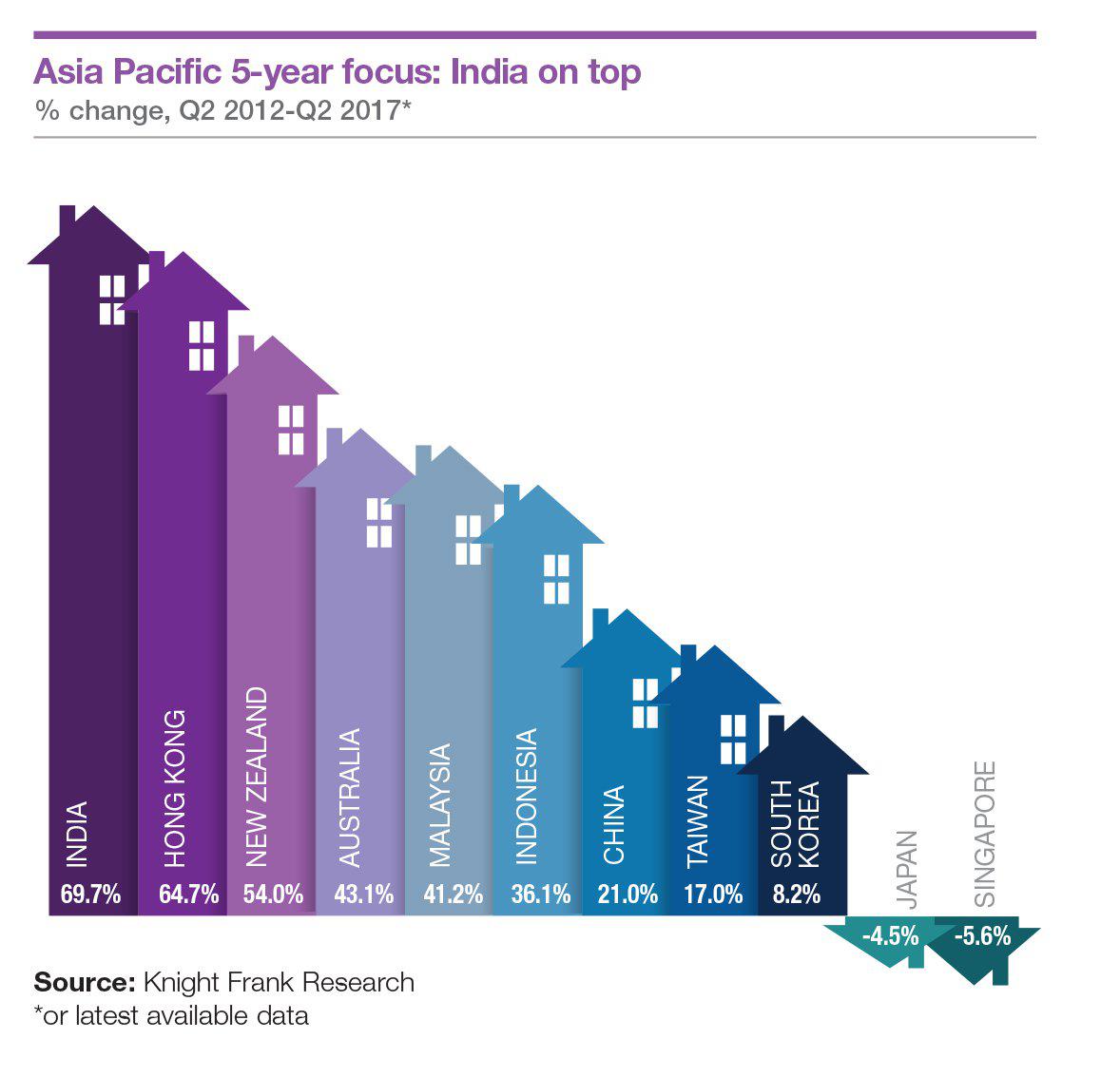

Knight Frank Head of Asia-Pacific Research Nicholas Holt said the five-year price growth figures show a huge divergence in performance across the Asia-Pacific region.

He said the growth numbers in India (69.7%) stood in sharp contrast to Singapore (-5.6%) which saw the stringent cooling measures applied over the period dampen market activity.

“The Australasian markets have seen some of the strongest growth over this period, with the cities of Sydney, Melbourne and Auckland especially outperforming the wider market," Holt said.