House Prices in Australian Cities Less Positive in 2018: SQM

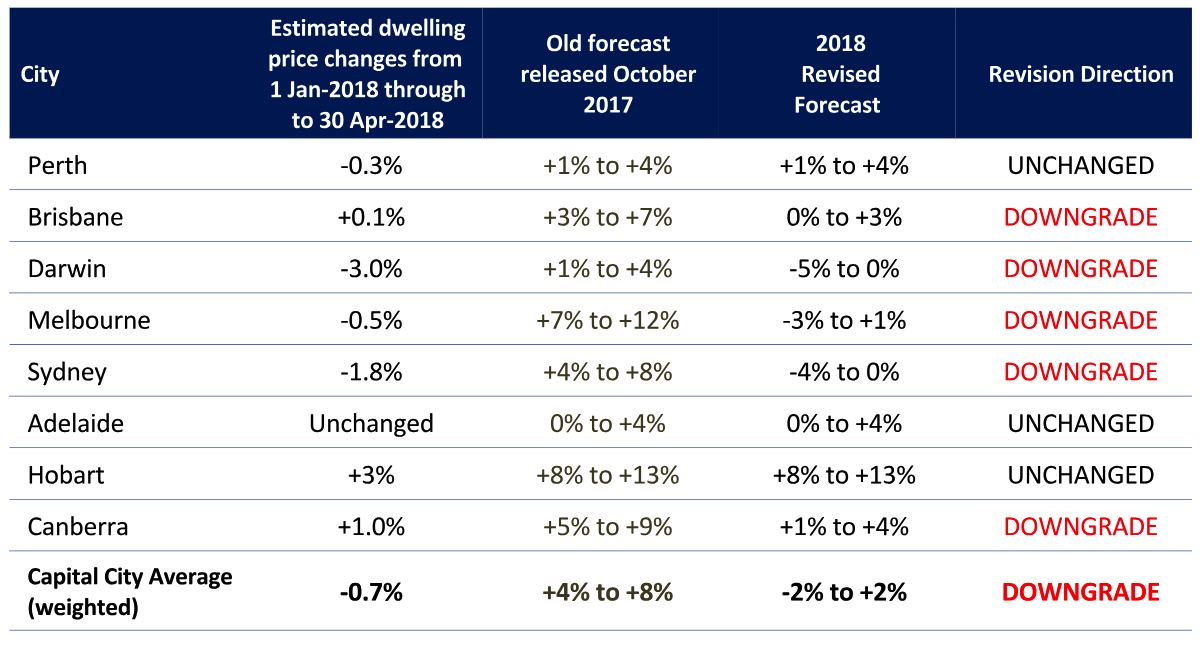

Property research group SQM has revised its forecasts for Sydney house prices, predicting that they will fall by as much as 4 per cent in 2018, adjusted from its original forecast of 4 to 8 per cent growth.

Recent auction results suggested that market activity in Australian cities deteriorated during April with clearance rates circling the mid 50 per cent range indicating weaker conditions and price falls.

“Asking prices for April fell 1.15% for houses and 0.6% for units – this suggests a degree of capitulation by property sellers which will likely mean a negative pricing result for the June Quarter,” SQM’s Louis Christopher said.

The group downgraded its House Price forecasts made in its Housing Boom and Bust report last October.

“Given the loosening of investment property credit growth restriction, there may be a response from Sydney investors. However, given other housing credit restrictions it is unlikely that the response will be significant.”

Related reading: Property Prices Will Fall 8% in 2018: Morgan Stanley

SQM also revised its Melbourne forecasts from its earlier prediction of 7 to 12 per cent growth.

Melbourne’s total property listings were low, but SQM said there was a recent house price trend upwards to the point where listings were six per cent higher than a year ago.

However, asking house prices slowed in pace to an annualised rate of five to seven per cent after rising at year on year levels of up to 22 per cent.

Related reading: Capital City Housing Prices Clock First Annual Fall in Five Years

“SQM Research expect vendors to adjust to the market further in coming months as days on market for listed properties is increasing,” Christopher said.

“It should be noted that on a nominal aggregate income to dwelling prices measure, the Melbourne market is approximately 49 per cent overvalued. SQM Research expects this overvaluation to wind down somewhat over an extended period of time.”

Related reading: Rental Affordability Still Poor for Low Earners

Brisbane, in comparison to Australia’s other key cities, experienced a downgraded base case House Price Forecast to between zero per cent to 3 per cent for 2018. The research group previously tipped a rise of 3 to 7 per cent in Brisbane.

“The evidence now suggests that action to reduce borrowings risks is now affecting the national housing market as a whole,” Christopher said.

“This action, predominantly targeted at property investors, has triggered a decline in demand for residential property.

“Given the downgrades mentioned above, our base case forecast is for the housing market to record flat dwelling price changes in 2018 with our forecast downgraded to -2 per cent to +2 per cent.”

Despite the findings, SQM made it clear that a property house price doomsday was not imminent in Australia.

“It is stressed that SQM Research does not expect a general housing price crash to occur this year. The conditions required to create such a downturn are not in the housing market at present.

“The national economy is overall, healthy. Unemployment is relatively low and stable. Population growth is very strong. Oversupply of new real estate is only occurring in pockets.”