Housing Finance Hits 5-Year Low

The number of loans being issued to owner-occupiers has plunged to the lowest levels in five years, according to the latest housing finance figures from the Australian Bureau of Statistics.

The slide is due in large part to traditional banks moving abruptly away from the property market due to stringent APRA regulations and the fallout from the Royal Commission.

Loans for building and new home purchases fell 3.8 per cent over September to $29.1 billion, 13.5 per cent lower than this time last year.

First homebuyer activity also retreated following acute improvements in 2017, down by 2.0 per cent over the quarter and down by 3.7 per cent compared with a year ago.

Loans to owner-occupiers are at their lowest in value since July 2015 at $19.37 billion.

Investors are also feeling the strain with lending dipping 5.0 per cent over the quarter and is 18.2 per cent below the level recorded a year ago.

Related: Major Lender Pulls Out of SMSF Lending

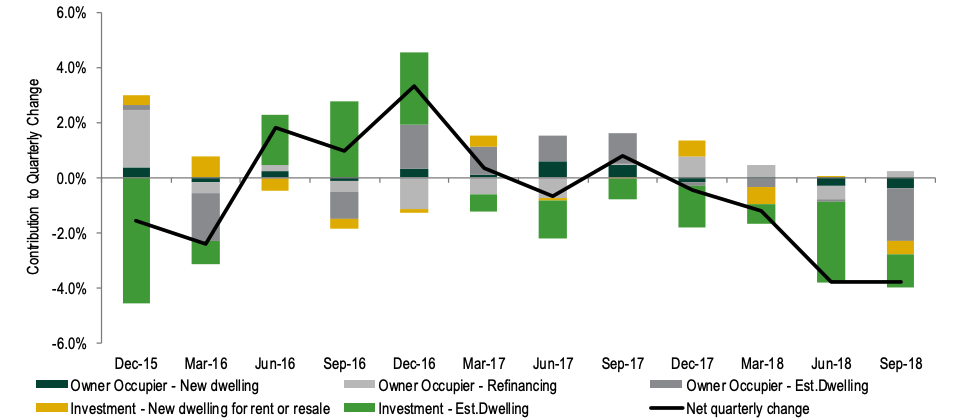

Housing Finance by Purpose - Contribution to Quarterly Change in Value of Loans

The downturn in home lending activity over the month has taken the number of loans to owner-occupiers to its lowest level since 2013, according to HIA acting principal economist Geordan Murray.

“The comparison to 2013 is important — this was the point in time when the recovery in the housing market begun.”

“We are seeing lending activity for both new and established homes softening.”

“The housing cycle has most definitely progressed into a contractionary phase and the shift in sentiment would typically see a drop in demand for new loans.”

Higher mortgage rates have already driven a decline in demand for investors over the past year, with the major banks resisting any adjustment to mortgage rates for owner-occupiers.

Recent Corelogic data revealed increasing rates which had previously impacted the investor market segment was now affecting owner-occupiers.

“In context of the more restrictive lending environment that homebuyers now face, it is clear that the soft lending numbers are as much to do with would-be home buyers having greater difficulty accessing finance as it is about sentiment.”

“At this juncture it will be important for the regulators to monitor the impact of their earlier interventions to ensure that policy settings remain appropriate in the new phase of the cycle.”