Is Australia’s Residential Market Experiencing a Credit Crunch?

The credit crunch and property sector doom and gloom are the ongoing themes of the media's coverage of Australia's residential market slowdown, but Corelogic analyst Cameron Kusher says that the use of the term "crunch" may be a "little overzealous".

While owner occupier credit growth has slowed marginally over the past few months, Kusher says the annual growth rate is actually slightly higher than a year ago.

"While investor demand could be characterised as experiencing a crunch at the moment, owner occupier demand, for now, remains quite solid," Kusher said.

In line with current market research, Corelogic anticipates dwelling values in Sydney and Melbourne will continue to decline over the coming months ultimately placing pressure on headline growth rates.

“Given this, the overall value of housing finance commitments is anticipated to fall and the expansion in housing credit will likely continue to slow,” Kusher said.

Related: Infrastructure, Migration and the ‘Mini-credit’ Crunch: Deloitte

Flow of new lending

The value of outstanding housing credit to Australian lenders was recorded at $1.762 trillion as of May 2018, a historic high. This represents growth is certainly slowing, Corelogic says, but it is still expanding.

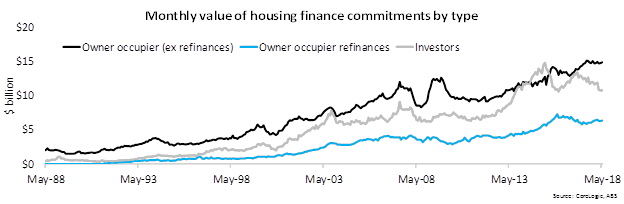

“While total housing credit is important to consider when looking at any ‘credit crunch’ scenario, so too is the flow of new lending,” Kusher said.

Considering the flow of new lending thanks to housing finance commitment figures published by the Australian Bureau of Statistics, there was $31.9 billion worth of housing finance commitments in May 2018, the highest monthly value in three months.

“The $31.9 billion was -5.5 per cent lower than its historic high monthly value of $33.7 billion in August 2017,” Kusher said.

Considering the current flow in credit data, CoreLogic says investors may be caught in a credit crunch but owner occupiers are not within its grips.

“Owner occupiers account for 66.5 per cent so a crunch in investor demand has less of an impact on overall credit demand than a crunch in owner occupier demand does,” Kusher said.

When analysing the current flows in credit data it is fair to say that there has been a credit crunch for investors but a credit crunch is not really evident for owner occupiers.

--CoreLogic

Australia’s largest capital cities Sydney and Melbourne, where price values have cooled, have seen investor demand drop off.

“While investor demand could be characterised as experiencing a crunch at the moment, owner occupier demand, for now, remains quite solid,” Kusher said.

“What is unknown is whether it is market conditions that have led to the fall in in investor demand or is it the fall in investor demand that has led to the decline in values, in reality it is probably a combination of both.”