JLL Retail Survey: National Retailers Say Competition Is Hotting Up

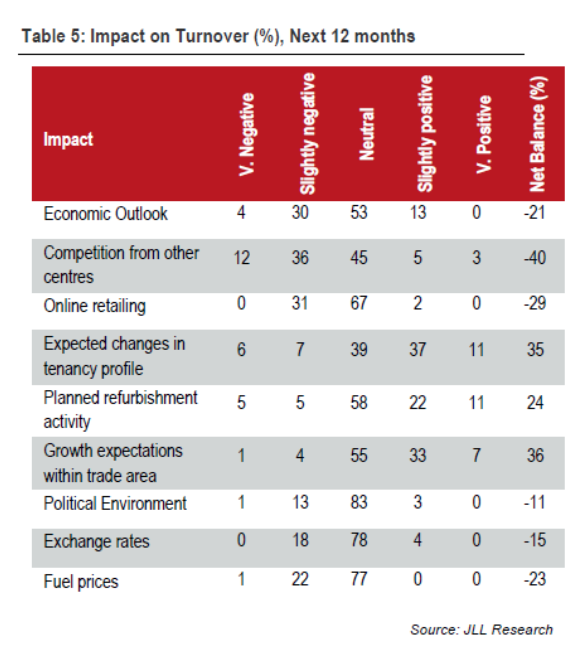

A national JLL Retail Survey showed that competition, online retailing and fuel prices were the three key concerns among shopping centre managers that continue to impact on their sentiment.

Fuel prices re-emerged as a major area of concern due to the wild fluctuations in price over recent months.

JLL’s 16th Retail Centre Managers’ Survey was undertaken in February across 109 JLL-managed retail shopping centres nationally. The majority of centres were neighbourhood centres and sub-regional centres.

The main concerns highlighted by Centre Managers as impacting their future turnover performance were ‘competition from other centres’ (with a net balance of -40), ‘online retailing’ (-29) and fuel prices (-23). The ‘economic outlook’ followed closely behind at -21.

The most positive factors continue to be ‘changes to tenancy profile’, ‘growth expectations within the trade area’ and ‘planned refurbishment activity’.

JLL Head of Property & Asset Management Richard Fennell said the key strategy for many centre managers is to provide a strong food retailing mix.

"While overall tenant enquiry remains subdued, enquiry from fresh food and food catering tenants is buoyant. Not only is this where enquiry is relatively strong, a quality food offering, including cafes, gives customers a reason to linger longer in centres," he said.

JLL retail figures revealed positive signs of vacancy improving for both sub-regional and neighbourhood centres. Neighbourhood centre vacancies improved from 3.7% in June 2016 to 2.6% in December, well below the long-term average of 4.6% Sub-regional vacancies improved from 3.5% to 3.0% but remains above the long-term average of 2.2%.

“With strong competition from new centres impacting some centres across the JLL portfolio, the reduced vacancy rate reported across neighbourhood and sub-regional centres was a positive outcome," Mr Fennel said.

The report identified speciality fashion as being a challenging sector, particularly in larger sub-regional centres where apparel has traditionally been a significant category.

In part, the decline of the sector was been offset by a stronger focus on non-retail services such as medical centres, financial services and travel agencies.

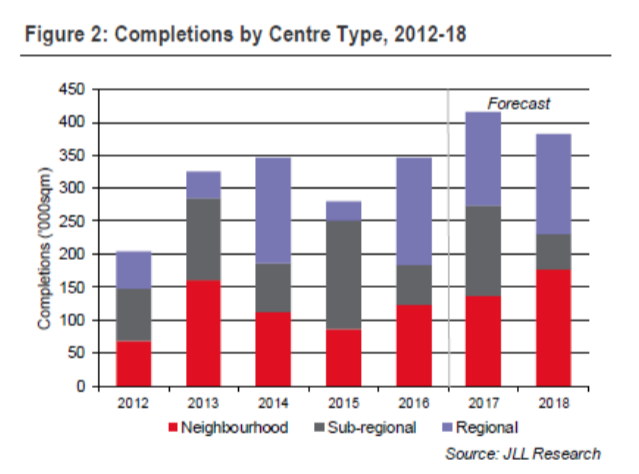

JLL Director of Strategic Consulting David Snoswell said the level of new supply for neighbourhood, sub-regional and regional shopping centres across Australia’s major capital cities is expected to peak in 2017.

"Completions in 2017 in the major capital city markets are forecast at 416,000 square metres and this is expected to heighten competition in the retail sector.

"The battle for market share in the supermarket sector has been a key driver of new supply, particularly in the neighbourhood and sub-regional sectors, while growth in regional centres has in part been driven by expansion of global ‘fast fashion’ retailers such as H&M and Uniqlo.”