Office Sector Posts Strongest Result for Six Years

Australia’s beleaguered office sector has recorded its best quarter for six years, new data reveals.

According to JLL Research’s report on national office markets for the third quarter of this year, positive net absorption of 91,900sq m was recorded across the period, the strongest quarterly net absorption result since the same quarter in 2018.

The national CBD office market vacancy rate tightened by 0.3 of a percentage point to 15.1 per cent at the end of September, the report said.

It said the strong result was partly due to a sharp reduction in sublease availability. For the year to date, CBD office market sublease availability has declined by 84,000 square metres.

JLL head of research, Australasia, Andrew Ballantyne said that Australia’s economy had slowed in 2024 “and a slowing economy is normally associated with increased sublease availability”.

“However, a reduction in sublease points towards higher utilisation and organisations requiring additional office space to accommodate workforce requirements,” he said.

The report said the quality story remained a strong theme across the Australian office sector.

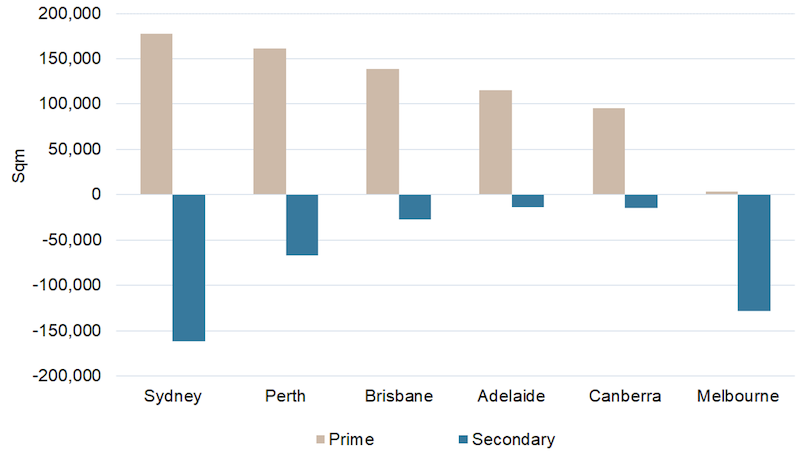

Prime grade net absorption was 83,300sq m in the quarter, while secondary was 8600 square metres. For 2024 so far, prime net absorption across CBD office markets has totalled 159,600 square metres.

JLL head of office leasing, Australia, Tim O’Connor said that for most organisations, people and technology were the two main fixed costs.

CBD office markets net absorption by grade

“Real estate is a lower order cost but a well-designed workplace can play an important role in the attraction and retention of knowledge workers,” O’Connor said.

“The quality story is not simply a prime-versus-secondary discussion. The secondary grade market is not homogenous and those well-located assets with a diverse range of amenities are receiving strong tenant enquiry.”

The Sydney CBD recorded net absorption of 53,600sq m in the quarter and 69,200sq m over the 12 months to September, 2024. The Sydney CBD recorded a sharp reduction in sublease availability to 92,500sq m—the lowest level since 2020’s second quarter.

“The opening of the Sydney Metro City and South-West has connected the CBD and North Shore to Sydney’s North-West growth corridor,” O’Connor said.

“We’ve had positive discussions with several organisations about how this world-class piece of infrastructure will shape the travel patterns of their workforce.”

Meanwhile, the Melbourne CBD recorded negative net absorption of 8500sq m during the quarter but JLL is positive about that city’s market.

“We believe that Melbourne will follow a similar recovery trajectory to Sydney,” O’Connor said.

“Occupier demand for well-located prime grade assets is stronger, sublease availability is trending lower, while Victoria has positive population growth—a key explanatory variable for office sector demand.”