Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

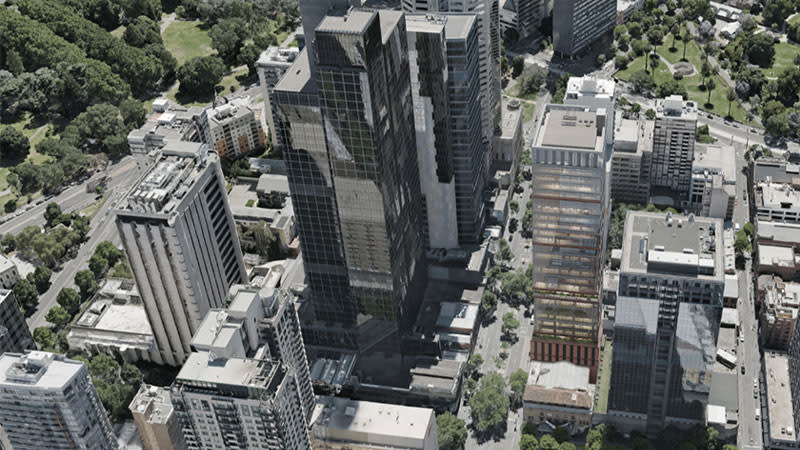

LaSalle Investment Management has lodged plans for a $200-million commercial tower to be built above Melbourne’s heritage-listed Comedy Theatre.

The global investment manager, an independent subsidiary of JLL, will partner with theatre owner the Marriner Group to unlock the site and build the new tower.

The proposal, which will be considered by the Future Melbourne Planning Committee before being forwarded to planning minister Lizzie Blandthorn, outlines a cantilevered 35-storey tower reaching 127m in the heart of the city’s east end theatre district.

Melbourne deputy lord mayor Nicholas Reece said the Comedy Theatre was one of the city’s most-loved venues and any prospective development would need to honour its heritage.

“Any application to redevelop the site must respect its heritage and hopefully enhance its operations as a theatre,” Reece said.

“As people would expect, council will consider the application very carefully.”

The tower would have a total gross floor area of 91,600sq m—comprising 18,000sq m of commercial NLA and will target a 5-Star Green Star Building rating.

The site, at 222-240 Exhibition Street, has been an entertainment venue since the 1840’s and the Comedy Theatre has operated there since 1928.

Its eastern boundary is separated by Punch Lane and adjoins LaSalle’s 29-level office tower at 222 Exhibition Street, which was completed in 1988 and renovated in 2010.

If realised, the tower will be in similar scale to 242 Exhibition Street—a 47-storey commercial building opposite the site which was completed in 1994 and currently occupied by the Telstra Commercial Centre.

Under plans, designed by Architectus, LaSalle intends to demolish the existing carpark building at 222 Exhibition Street and an existing fly tower at the rear of the theatre to create a 5900sq m development site. Heritage overlays apply to 240 Exhibition Street and the Comedy Theatre’s fly tower.

While the fly tower is intended to be removed, plans include the retention of the historic facade of the theatre, on Lonsdale Street.

The planned tower will be built above a two-level basement and will have a six-level podium which will include two 150sq m rehearsal spaces on level three and five respectively which will connect to the upper gallery of the theatre building.

The podium will also include mezzanine spaces on level six and eight as well as a 700sq m restaurant and rooftop terrace on level seven.

From there the tower will cantilever over the theatre from level nine, providing 660sq m floorplates, before jutting out again at level 16 through to level 21 offering larger 780sq m floorplates and 844sq m floorplates from levels 22 to 32.

As part of the development, LaSalle plans to upgrade the theatre with contemporary stage facilities, an expanded stage and back of house area, along with a new fly tower that will allow the theatre to compete for and accommodate larger shows.

A new direct access to Lonsdale Street will also be created to enable performers and staff requiring accessibility facilities to access and work in the venue for the first time.

“This commercial proposal seeks to provide much-needed enhancements to the Comedy Theatre, including associated conservation works,” the developer said in its design statement.

“It will also inject new activity and amenity into a prominent corner of Melbourne’s CBD through carefully considered building program crafted around a theatre-led narrative.”

The development application backs the recovery of the Melbourne office market, which is continuing to return to normal following the easing of pandemic restrictions.

Melbourne CBD’s office market is showing positive signs of recovery with demand for office space growing as the city continues to emerge from two years of rolling lockdowns.

Office rents lifted in Melbourne for the first time in more than two years, rising by 6 per cent in the March quarter, as demand for larger, better quality space spurred on stronger leasing activity.

Despite strong demand, higher supply saw the Melbourne CBD office vacancy rate rise from 10.4 per cent in mid-2021 to 11.9 per cent at the turn of the year.

The majority of stock entering the Melbourne CBD market this year will be refurbished—Wesley Place in Lonsdale Street is the only new development and is fully precommitted.

Commercial properties have also started to change hands in greater frequency with Singaporean real estate giant CapitaLand recently acquiring one of the city’s major commercial offerings, a 22-storey office building at 120 Spencer Street, for more than $320 million.

In April, Charter Hall, backed by sovereign wealth fund GIC, struck a $2.1 billion deal to acquire the two-tower Southern Cross complex on Bourke Street on a yield of about 4.5 per cent.

Another tower at 330 Collins Street has recently been sold to Singaporean fund manager HThree City and partner City Developments for $236 million.