NSW Number One In Tax Increases

New data released by the Australian Bureau of Statistics revealed the NSW Government has continued to lean on the property industry to prop up its spending adding further pressure to house prices.

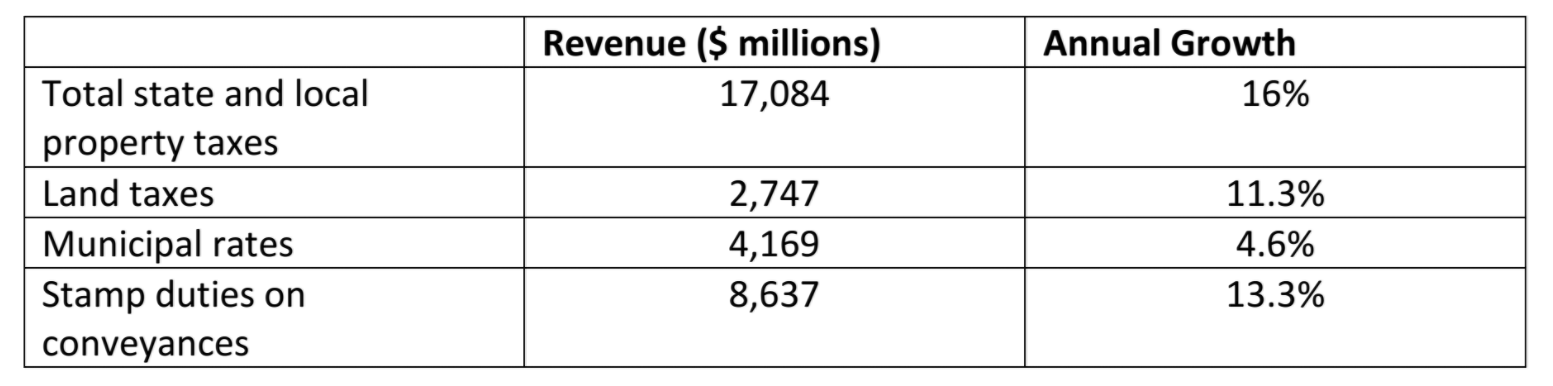

The new data showed that taxes on property increased by 16 per cent, or $2.4 billion in NSW in 2015/16, leading Australia in terms of property tax hikes. Over the last five years, revenue from Property Taxes in NSW have increased by 64.9 per cent, or $6.7 Billion.

The NSW tax grab has bolstered last year’s national property tax revenue where property taxes hit a record $49.5 billion across Australia.

“This a podium finish NSW does not want," NSW Executive Director Jane Fitzgerald said.

"With housing affordability the number one issue for this premier and her leadership team, it is concerning that they continue to squeeze the industry dry and are swimming in property tax revenue."

Source: Property Council“Higher taxes on property means higher house prices and more strain on first home buyers - this government is simply throwing fuel on the fire," Ms Fitzgerald said.

“With the average house price in NSW at around $900,000 and in parts of Sydney at well over $1 million, we need to be reducing taxes on the property industry, not leading the nation in terms of tax hikes.

“Over the past five years, revenue for property-based stamp duty in NSW has doubled, from around four billion dollars to over eight billion dollars.

“When will enough be enough -- and we look at tax reform in this state to reduce the burden on the industry and look at sustainable, long term revenue streams rather than property taxes that rise and fall with the market," she said.

“The upcoming state budget must be brave and bold and contain tax reform that releases the financial pressure on the people of NSW.”