Off-the-Plan Market Outlook 'Optimistic': Investorist

The fallout from the banking royal commission, cooling Chinese investment and tightening lending standards has created an uncertain property market over the last 18 months.

And Australia's off-the-plan market has been hard hit, with developers offering cash rebates, part payments of stamp duty and massive commissions as incentives to offset sliding investor demand and falling prices.

Off-the-plan sales platform Investorist has taken a "pulse check" of industry sentiment in the off-the-plan market in Australia and found it still has potential despite facing many recent challenges.

The market fully expected there would be a rebound shortly after the stamp duty changes took effect, but in reality this was minor," Investorist chief executive Jon Ellis said.

"Declining investor demand has marked a real paradigm shift after the boom times of the past few years."

Of the $7.5 trillion Australian residential real estate market, $70 billion was valued as off-the-plan in the last financial year.

Related: Chinese Investment Fell 60% Last Year

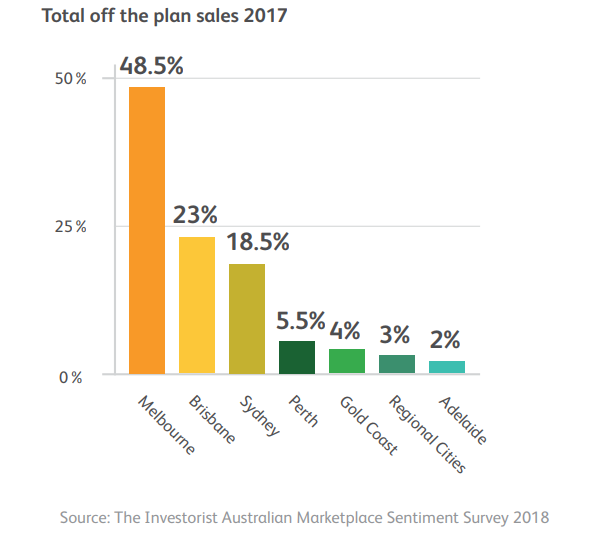

The off-the-plan market in Australia is dominated by Sydney, Melbourne and Brisbane, which account for 90 per cent of all off-the-plan sales across the country as well as 90 per cent of all apartment approvals.

On top of already very stringent lending criteria from banks, the recent banking royal commission findings are likely to tighten lending even further.

The survey revealed that 68 per cent of buyers were affected by the dwindling availability of loans.

A decrease in Chinese investment, Australia’s largest foreign investor, has also added to the harsh environment for off-the-plan developers.

China’s recent recent foreign investment disincentives combined with their strict capital controls has seen a 40 per cent decrease in Chinese investment in Australia since the second half of 2017.

Many Chinese investors have persevered due to the many benefits of the Australian market.

The survey also revealed the "sweet spot" for pricing off-the-plan apartments, with nearly 50 per cent of developers saying it was between $400,000 and $750,000.

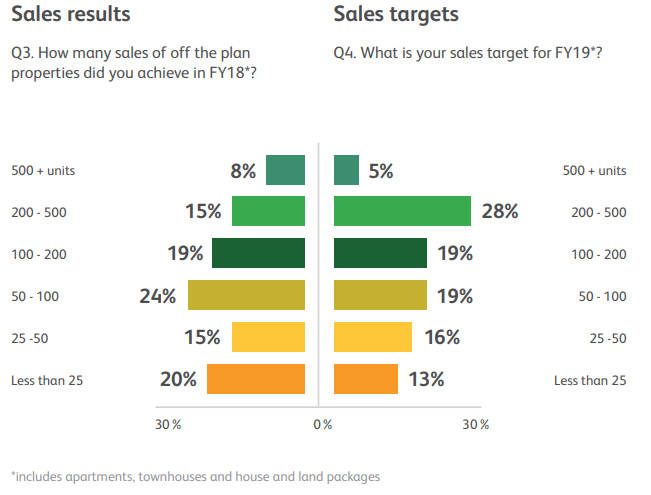

Despite the tough times, 70 per cent of developers surveyed by Investorist have remained optimistic, believing that they will sell more this financial year than the last.

"In a buoyant property market, there will always be the emergence of more opportunistic and inexperienced operators," Ellis said.

"When the going gets tougher as we’ve seen over the last year, the former drop out of the industry. The longer term, more experienced players survive and frequently thrive."