A one-day deep dive on office, retail, healthcare, childcare and alternative sectors

UPCOMING | COMMERCIAL REAL ESTATE SUMMIT

Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeWith the completion of the third Barangaroo Tower in 2017, Sydneysiders said goodbye to the last blank canvas for an office site in the CBD.

CoreLogic construction data indicates that increasing demand for office space is partially being met with decentralisation efforts, with 65 office starts in the likes of Parramatta and Macquarie Park over the last 10 years.

However, major employers in finance and IT still demand space in the Sydney City CBD.

Decentralisation programs are being led largely by government. The economies of scale delivered to private business in the Sydney CBD is instead leading to the conversion of old office stock into prime space.

CoreLogic’s commercial real estate platform monitors over 600 office buildings in the Sydney CBD, as well as other major office precincts around the country.

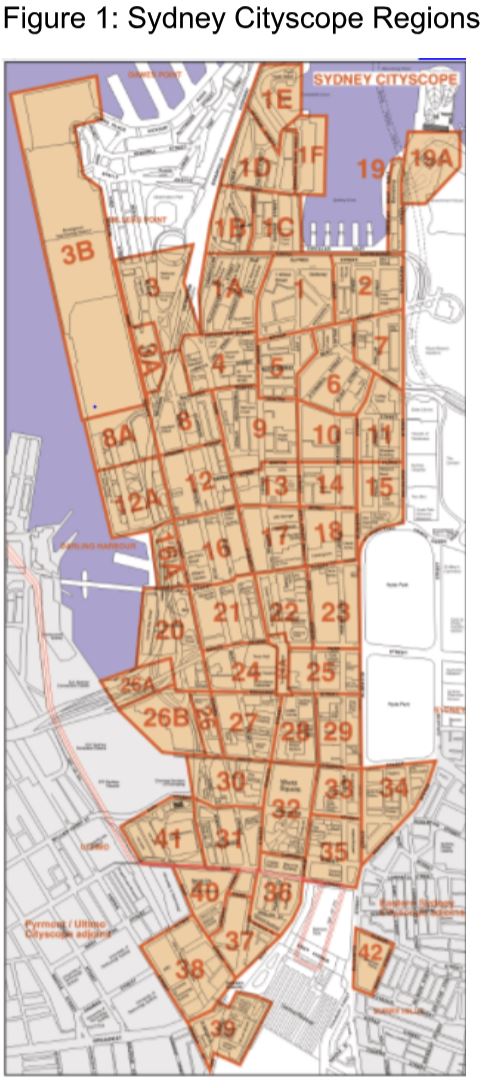

The Sydney CBD region monitored by CoreLogic is shown in Figure 1. It extends from Circular Quay to Regent Street in Ultimo, just before Broadway.

Related reading: Office Markets Outperform as Vacancies Hit Record Low

Major refurbishment across Sydney office buildings

Across the commercial buildings monitored in the Sydney CBD area, 490 commercial office buildings have been upgraded or redeveloped since being built. Several properties have also recorded development applications submitted for refurbishment.

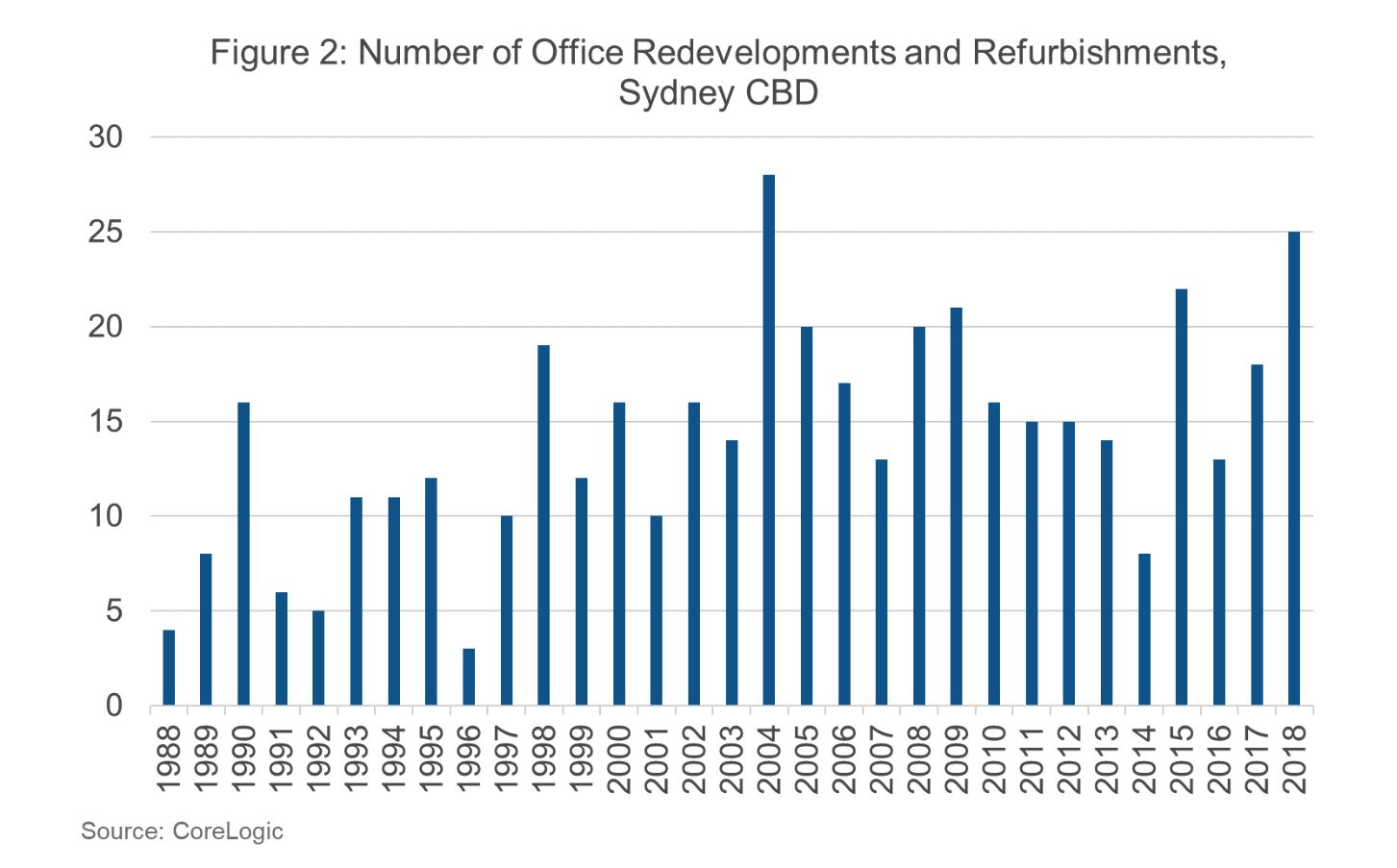

Refurbishments across office buildings range from the complete internal demolition and reconfiguration of buildings (sometimes including a change in the primary use), through to internal and/or external upgrades to structures, facilities and services. The number of offices that have had refurbishments over the years are presented in Figure 2.

The average annual growth in the number of completed redevelopments and refurbishments has been 22.9 per cent in the last 30 years, suggesting a steady increase in the improvement of existing Sydney office buildings in the CBD.

2018 marks another strong year of redevelopment and refurbishment. In the Sydney Cityscope region, 25 buildings were marked as having been updated in the year to date. With seven months left in the year, it is likely that 2018 will be the highest year on record for the number of office buildings receiving refurbishment.

Sydney’s ageing building office stock

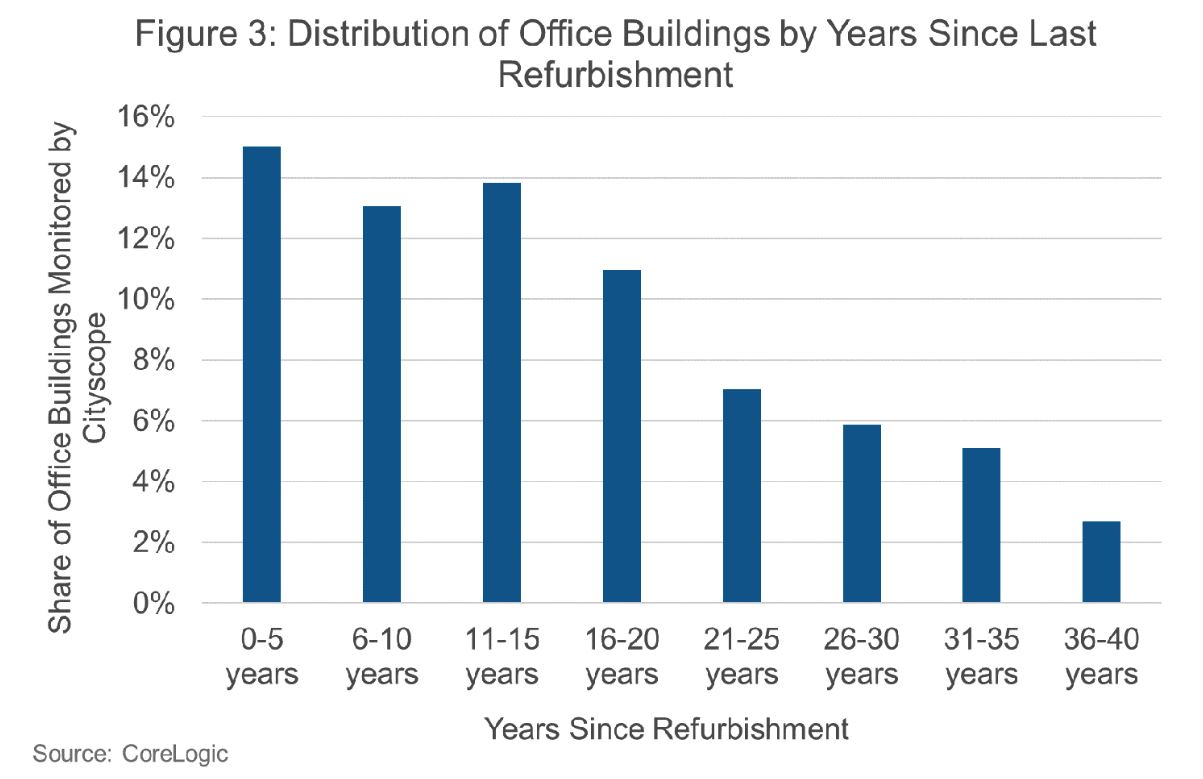

While refurbishment is becoming increasingly popular, data to the end of May suggests that 21 per cent of office buildings in the Sydney Cityscope region had not had refurbishments in over 20 years, and 45 per cent of properties had not seen refurbishment in over 10 years. The distribution of Cityscope office buildings by their last refurbishment is shown in Figure 3.

Related reading: Sydney Housing Market Has Slowed: Here’s How the Construction Pipeline Has Responded

Urban renewal and commercial development has been recently focused on water-front commercial spaces. These include the AMP building project, the re-development of Darling Harbour, Barangaroo and the recently completed EY building.

Of the stock that has not seen refurbishment in over 20 years (138 office buildings), most of the sites were located on George Street, and few of those were north of 200 George Street. Kent Street and Sussex Street had similarly aged stock, with 15 and 13 sites respectively that had not seen re-development in over 20 years.

There were 92 buildings which have not seen refurbishment in over 10-15 years, or 13.8 per cent of stock, as indicated in Figure 3. These were largely located on Pitt Street (16 buildings), George Street (11 buildings) and Clarence Street (9 buildings).

Related reading: Crown Group's $250m Clarence Street Residential Tower

Developers may be deterred from these sites by limited harbour views (especially following the Barangaroo Tower completions), high capital values, or logistical complications of re-developing buildings on the main street of the city, particularly among ongoing works on the Sydney Metro and Light Rail.

Rising refurbishments in the city, and increased demand for prime office space, suggests the office construction landscape will shift towards overcoming such challenges.

Contributed by Eliza Owens.

Eliza Owen is a commercial property research analyst at CoreLogic.

The Urban Developer will occasionally publish opinion pieces written by outside contributors representing a wide range of viewpoints.