Office Sector Lifts Despite ‘Dire Predictions’

The CBD office sector appears to have confounded the naysayers, lifting across the June quarter despite fears a Covid upsurge would stifle demand.

According to the Property Council of Australia’s latest Office Market Report, tenant demand lifted 0.5 per cent on average across the nation’s CBDs.

Despite this, new office buildings coming on to the market pushed aggregate vacancy rates up in capital city and non-capital CBDs.

Property Council chief executive Ken Morrison said the figures were heartening.

“In a healthy sign for our CBDs, the office market continues to defy previous dire predictions, with demand still in positive territory after nearly three years of the pandemic,” he said.

“Demand for office space was strongest in Brisbane at more than three times historic average, with Sydney, Perth and Adelaide also above average, while demand grew by 0.1 per cent in Melbourne and dropped in Canberra by 0.1 per cent.

“While the Australian office vacancy increased by 0.8 per cent to 12.9 per cent over the six months to July 2022, it’s new office space that is driving this outcome, not businesses wanting less office space.”

The supply of office space across Australia’s capital cities had been above the historical average in four of the past five reporting periods, the report showed.

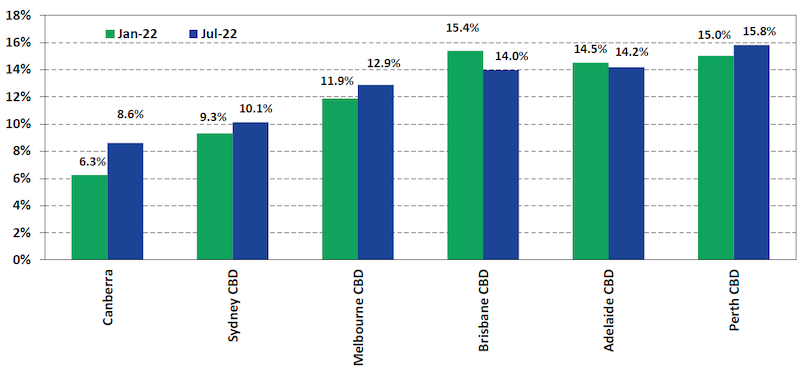

CBD vacancy change: six months to July 2022

“All capital city CBD markets experienced new supply increases, a combined 1.6 per cent, but supply is forecast to taper off in coming years,” Morrison said.

He said although many predicted a crash in demand for office space and a spiking vacancy rate, that had not happened.

“This has been underpinned by strong employment and the recognition that an office in the city is fundamental to the success of many businesses,” Morrison said.

The council’s July edition of the Office Market Report, which is released twice a year, showed overall CBD vacancy had increased from 11.3 per cent to 12 per cent, while non-CBD areas had risen from 13.9 per cent to 15.2 per cent.

Brisbane and Adelaide recorded vacancy decreases, from 15.4 per cent to 14 per cent and 14.5 per cent to 14.2 per cent respectively, the only two CBDs in which supply didn’t outstrip demand.

The vacancy rate rose in the other capital cities—from 6.3 per cent to 8.6 per cent in Canberra, 9.3 per cent to 10.1 per cent in Sydney, 11.9 per cent to 12.9 per cent in Melbourne and 15 per cent to 15.8 per cent in Perth.

Sublease vacancy increased slightly in the Australian CBD and non-CBD markets, with Melbourne responsible for more than half of all CBD sublease vacancy.

Future supply in the CBD markets is expected to be below the historical average until July 2025, while in the non-CBD markets supply is expected to be above the historical average until July 2023 before reducing in the following years.