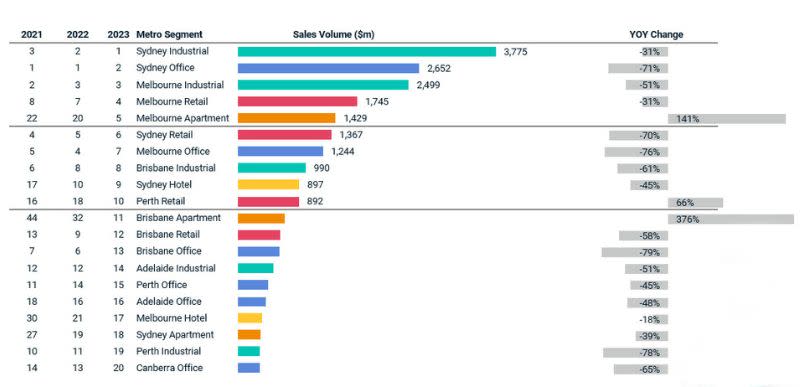

Investment in the Australian office market has slumped 71 per cent in the past 12 months, according to global financial giant MSCI.

Twelve months ago, office transactions represented about $22 billion for the first three quarters of the year, according to the investment data and analytics service.

However, in a sign of the downturn in the post-Covid office market, only about $6.4 billion in office assets have transacted in the first three quarters of this year.

“Sydney is the worst-performing major office market,” the MSCI head of real assets research in the Pacific, Ben Martin-Henry, said.

“But it tends to move quicker than any other market because it’s a financial hub.

“That doesn’t necessarily mean it will fall the furthest but it will fall fastest and that’s what we’ve seen so far.”

That said, the pace of decline in the capital value of Melbourne’s office market has picked up in the past couple of quarters, according to MSCI data. The Victorian capital’s market had recorded a loss of about 9 per cent during the downturn.

Australian property performance by sector

Martin-Henry said Melbourne had bigger over-arching issues than Sydney, particularly with the amount of stock coming to the market.

“We’re seeing a substantial slowdown retail and industrial as well,” he said. “But the office sector is feeling the most pain.”

The economist will make a keynote address at The Urban Developer’s Reposition, Repurpose, Reuse vSummit on November 23, which will explore the changes in the office sector in the wake of the pandemic.

Martin-Henry will speak on the shifting landscape of the office sector, consider the impact of location versus quality and uncover potential opportunities for astute investors.

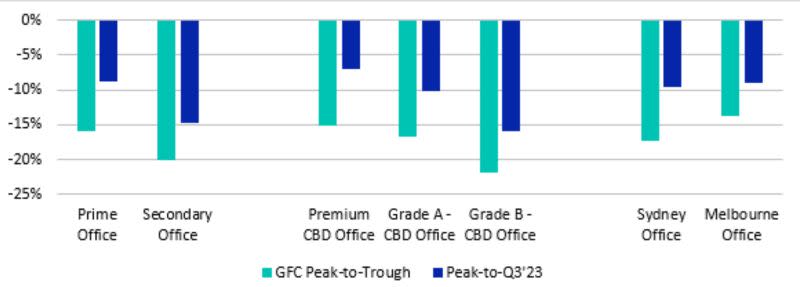

He said secondary office assets tended to perform worse during downturns because people were looking for a “flight-to-quality” on the transaction side but also on leasings.

Office performance by grade

“Because rents have fallen, or face rents are stagnating and incentives are increasing, you can get better deals out there in some of the prime stocks, on the A-grade stock,” he said, “so B-grade tends to perform significantly worse during economic pressure points.”

Martin-Henry said there were options for repurposing office stock but there needed to be a good investment case to make such a decision.

“I know there is a lot of discussion about solving a housing crisis by converting secondary grade office into residential but that is extraordinarily difficult and very expensive,” he said.

“That’s not to say that it can’t be done ... I’m sure individual offices can be repurposed.

“But I don’t think, as a whole, you can say we’re just going to convert secondary into residential and solve both problems.”

The Reposition, Repurpose, Reuse vSummit will take place virtually on Thursday, November 23. Click here to register and learn more.