Office Vacancy Turns Negative

All CBD office markets recorded negative net absorption and increased vacancy during the tail end of the first wave of Covid-19 in Australia.

The figures showed a negative net absorption of -147,600sq m in the second quarter of 2020, according to JLL's national office vacancy statistics.

The CBD office vacancy rate also increased by 1.8 percentage points from 8.4 per cent to 10.2 per cent.

JLL national head of leasing Tim O’Connor said in an environment of uncertain revenue projections, organisations have pivoted towards addressing their cost base.

“We have seen a number of organisations downsize their space requirements and sublease availability has started to increase,” O’Connor said.

Although many office tenants were looking to downsize, landlords were looking to the next incarnation of office space including co-working, technological advances and social distancing measures.

Australian office vacancy

| City | Net Absorption | Vacancy |

|---|---|---|

| Sydney | -66,600sq m | 7.5% |

| Melbourne | -42,300sq m | 7.7% |

| Brisbane | -15,700sq m | 12.8% |

| Perth | -10,500sq m | 20.1% |

| Canberra | -8,200sq m | 8.2% |

| Adelaide | -4,400sq m | 14.7% |

| National | -146,600sq m | 10.2% |

^Source: JLL National Office Vacancy Statistics 2Q20

The JLL head of leasing said the trajectory of Australia’s economic recovery would determine the employment outlook and demand for office space.

“The work from home experience has shown it has a viable place in a modern flexible workplace strategy,” O’Connor said.

“However, the office re-entry has shown the importance of office space for collaboration, ideas generation and employee socialisation.

“While a number of organisations will downsize and offer sublease space to the market, we expect to see increased leasing enquiry from organisations in the public sector, digital economy and healthcare sectors.”

Related: Global Companies to Downsize Office Footprint

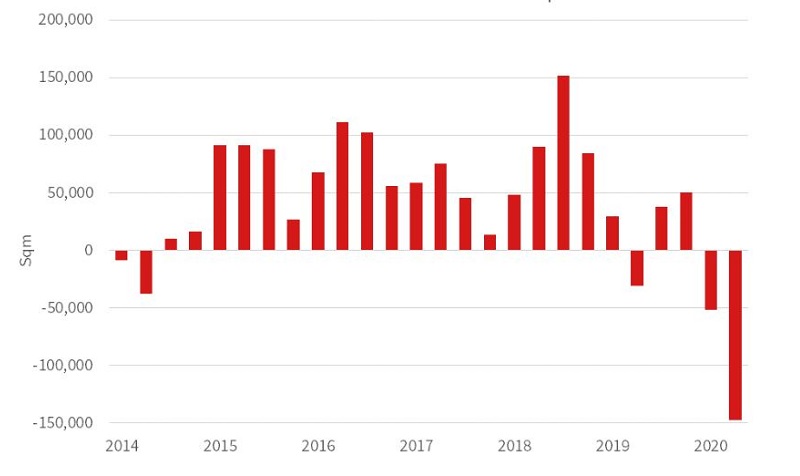

Australian CBD office market net absorption

^Source: JLL National Office Vacancy Statistics 2Q20

JLL national head of research Andrew Ballantyne said the past 12 weeks were unprecedented for the Australian office sector.

“Headcount reductions have been concentrated in the hospitality, retail, arts and recreation and construction sectors, but traditional office using industry sectors have not been immune,” Ballantyne said.

“Policy measures have provided downside protection to the economy and the re-opening of the economy has occurred well ahead of expectations.

“However, many organisations will struggle to find a pathway back to pre-crisis revenue levels and this will have an impact on office sector demand.

“We are closely watching the announcement of new infrastructure projects both domestically and overseas. The mining sector will be a direct beneficiary of new infrastructure projects and we may see an increase in project space over the latter part of 2020 and into 2021.”