Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

The Reserve Bank of Australia has decided to maintain its cash rate target at 3.6 per cent, marking a pause in what would have been the 11th straight month of rate increases.

Explaining the pause, the RBA said that it wanted “to provide additional time to assess the impact of the increase in interest rates to date and the economic outlook”.

A range of information, including the monthly CPI indicator, suggested that inflation had peaked in Australia, RBA governor Philip Lowe said.

“The board’s priority is to return inflation to target. High inflation makes life difficult for people and damages the functioning of the economy.”

CoreLogic research director Tim Lawless said this did not mean that interest rates would remain paused, and a key factor in future interest rate decisions would be how rapidly inflation fell toward the target range.

“While a pause doesn’t necessarily mean interest rates hikes are ‘done’, it is likely the tightening cycle is close to topping out,” he said.

“Despite the highest interest rates since 2012, we have seen a lift in housing values over the past month; a timely reminder that interest rates are but one of the many key factors influencing housing trends.”

Knight Frank’s chief economist Ben Burston said that for property investors, the macro context now looked more reassuring.

“[There is] a likelihood that rates will remain stable over the next few months as the RBA assesses the impact of the rate increases to date, and potentially be cut in 2024-25 if the economy slows as expected,” he said.

“The moderation in peak rate expectations is already feeding through to reduced pressure on funding costs, as evidenced by two, three and five-year bond yields dropping by 50-70 basis points since late February.”

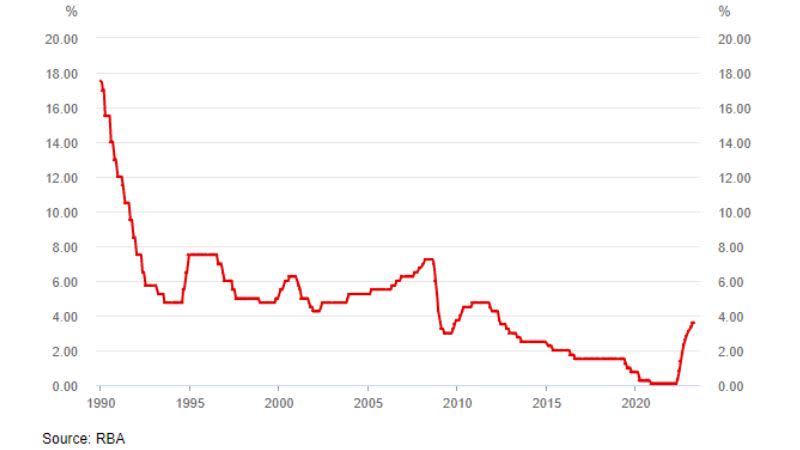

Three decades of rises and falls

Rothelowman managing principal and former Becton Property Group head of sales Nigel Hobart said that although the implications of interest rate rises and pauses were complex, some outcomes could be seen clearly in the aftermath.

“When the RBA makes a decision, whether it is to pause or hike, it creates clarity for people. It’s the ambiguity that causes people to hesitate,” Hobart said.

“The sales rate per week tends to be slower leading up to a decision.

“But no matter what that decision is, there are more sales in the week after, because buyers knew they had certainty in how much they could afford and how much margins we’re going up and how much difference would that make to repayments.”

With interest remaining steady but still much higher than the market has experienced in recent years, much activity in the sector will be “iceberg” activity, with those at early stages of projects looking at and preparing sites.

“You’re likely to see more site transactions in this kind of period, and therefore a lot more activity in the creation of product ready to go to market in the next cycle,” Hobart said.

The RBA also acknowledged that rents are increasing “at the fastest rate in some years, with vacancy rates low in many parts of the country”, and this would also be attractive to potential developers, especially in the build-to-rent market, Hobart said.

“They will be achieving rents far superior to rents two or three years ago.

“This becomes attractive to a lender, the risk profile for a lender is far less, lenders will be more interested in funding an asset like that.”

Opportunity can arise as interest rate increases shift attitudes towards owning a home.

As interest rates and house prices remain high, many will find owning a home more difficult or may not want the responsibility that comes with it. Build-to-rent properties can provide an alternative option.

“The winners in build-to-rent are going to be those who see it as a lifestyle choice for those who actively don’t want to own a home.

“The quality is seen to be really good and competitive, you’re going to have people that want to rent for life, it is now becoming aspirational.

“Aspirational tenants are what seasoned players are looking at and seeing it as a brand and lifestyle experience, and one that people will pay well for.”