Reducing the Impact of FIRB Regulations on Developers

The Foreign Investment Review Board annual report, released last week, highlighted the significant impact the foreign acquisitions and takeovers regulations can have on developers of residential real estate.

The FIRB report referenced the introduction of application fees in December 2015 as a significant factor in decreasing residential real estate approvals last financial year.

Unlike other types of real estate (where the application fees are limited or capped in some way), the fees payable by non-business foreign purchasers of residential real estate are not subject to a cap.

They currently start at $5,500 for properties purchased for up to $1 million, then go to $11,100 for properties purchased for over $1 million up to $1,999,999 and then increase by about $11,100 every $1 million in purchase price thereafter.

The fees are approximately 1.1 per cent of the purchase price.

Conditional contracts

In the case of any acquisition of real estate by a foreign buyer, the contract for sale must be subject to the buyer obtaining FIRB approval or first having obtained an appropriate exemption certificate from FIRB.

This conditionality raises uncertainty for the vendor/developer as to whether the sale will proceed.

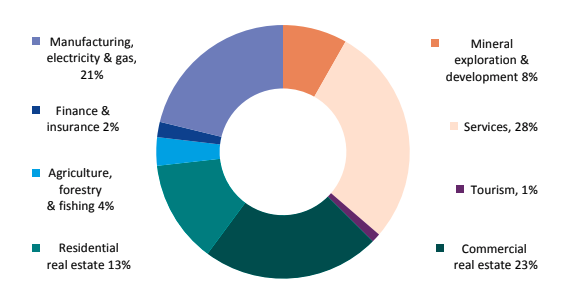

FIRB approvals by sector

Developer incentives may overcome the problem

Due to the current slowing market, some developers are offering incentives to buyers of new residential property to try to move unsold or non-settled stock.

In relation to the FIRB fees, developers are able to obtain an exemption certificate from FIRB (currently at a cost of $25,700) in respect of individual developments.

In accordance with the conditions of the certificate, the developer is required to pay the FIRB fee applicable to the sale of individual lots to foreign purchasers.

These payments are made as part of the obligations imposed by FIRB on developers holding such certificates to report to FIRB on sales made every six months.

If a developer proceeds on the basis of such exemption certificate, individual buyers do not need to pay the FIRB fees and can enter into unconditional contracts to purchase the apartment (provided the aggregate purchase price of apartments acquired in the development by the purchaser do not exceed $3 million).

The ability of purchasers to enter into unconditional contracts should be seen as a positive by both the developer and its financiers.

The FIRB fees could be included in the feasibility for the project as an additional development cost. As a percentage of total costs, this may not be a large impediment to achieving the desired return and would make the development more attractive to foreign purchasers.

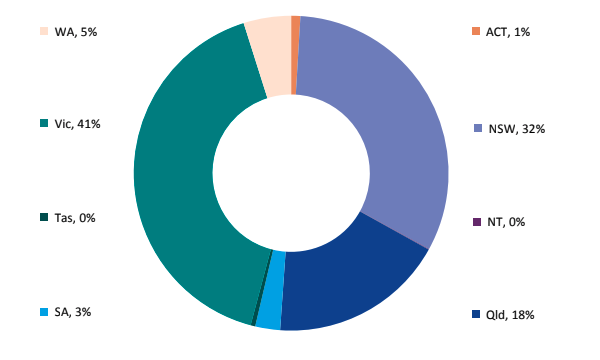

Proportion of FIRB residential real estate approvals

Completed projects

It appears that exemption certificates can be sought for completed developments as well as future ones.

The definition of new dwelling includes premises that have been built on residential land which have not previously been sold and have not previously been occupied.

In addition, developers can apply for Near-New Exemption Certificates, which relate to new dwellings previously contracted to be sold but for which settlement fell through.

These provisions indicate that exemption certificates are available for existing stock in completed developments, although this would need to be confirmed with the Foreign Investment Review Board.

Conditions for obtaining exemption certificates

Unfortunately, there are a number of conditions which must be satisfied in order for a developer to be able to obtain the exemption certificate, some of which will preclude certain developers and projects from being able to obtain the certificate. These include:

The development must be for at least 50 dwellings (which cannot be townhouses);

Development approval has been obtained;

No more than 50% of the lots may be sold to foreign purchasers.

In addition, in assessing an application, FIRB will need to see detailed information about the project including:

Marketing plans and budget;

The schedule for construction, including stages. FIRB may only grant certificates for stages individually, which may adversely impact the project (where certificates for subsequent stages are not granted);

Architectural plans and concepts; and

Information in respect of the units to be built.

The compliance history of the developer vis-a-vis FIRB will also be taken into account.

Bottom line

With application fees being identified as a reason why residential sales to foreign buyers have dropped, developers considering how to overcome this may wish to consider obtaining and complying with the FIRB exemption certificates referred to above.

If the certificates are not available for completed projects, the use of such exemption certificates for future developments should nonetheless be seen as beneficial as they provide developers with a means of minimising buyer hesitancy arising from FIRB application fees going forward.