RBA Keeps Interest Rates on Hold as Year Winds Down

The Reserve Bank of Australia has ended the year on hold, keeping interest rates at 4.35 per cent.

In a statement after the meeting at which it decided to stay the course for the ninth month in a row, the RBA said that although inflation had fallen “substantially” since the peak in 2022, the message was clear—we’re not out of the woods in sustainably returning inflation to target.

Measures of underlying inflation were about 3.5 per cent, the RBA said, and “some way” from the 2.5 per cent midpoint of the inflation target, with recent forecasts suggesting it would not return “sustainably” to this midpoint until 2026.

Labour conditions remain tight, with unemployment at 4.1 per cent in October, up from 3.5 per cent in late 2022, and while wage pressures have eased, labour productivity growth “remains weak”.

REA Group senior economist Eleanor Creagh said that the economy was experiencing a period of weak growth.

“However, the RBA is likely to keep rates on hold through the first quarter of 2025, unless there is an external shock or significant shifts in unemployment or underlying inflation, as it aims to sustainably return inflation to target,” she said.

“Although headline inflation is within the 2 to 3 per cent target, underlying price pressures, stickier components of inflation, and a resilient labour market have prevented an interest rate cut this year.”

Creagh predicted rate cuts from May under current conditions, and highlighted that home price growth had also persisted despite the higher interest rate environment.

“The increase in properties hitting the market this year has been met with strong demand but increased stock for sale has been a contributor to slowing price growth, along with affordability constraints and the sustained higher interest rate environment.”

While home prices are expected to lift in the months ahead, its pace will be softer given the strong growth in prices in recent years.

“While home price growth is currently slowing, it is expected to gain momentum once interest rates begin to fall, though the timing of rate cuts remains uncertain,” Creagh said.

“If conditions warranting rate cuts emerge in May, 2025, improving affordability and buyer confidence are expected to drive renewed demand and price growth through the second half of the year.”

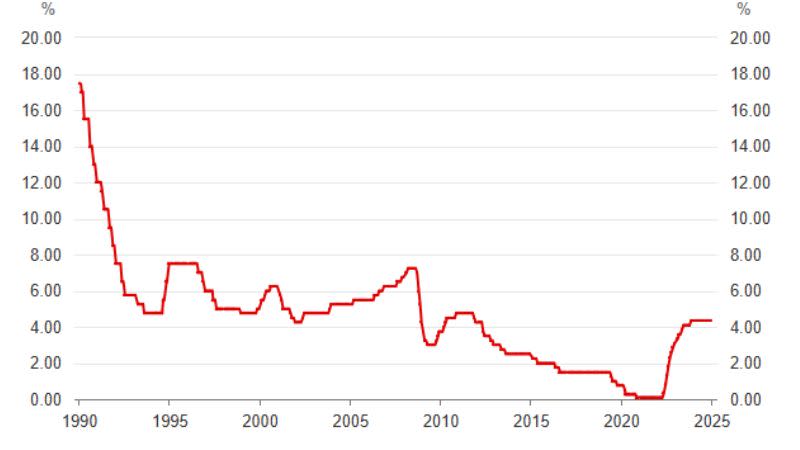

Cash rate target since 1990

Tight labour market conditions, juxtaposed with a combination of low productivity growth, weak economic conditions and high inflation demonstrates the ‘narrow path’ the RBA is traversing, keeping rates high while avoiding a recession or blow out in the unemployment rate, according to CoreLogic Asia Pacific research director Tim Lawless.

“So far, the RBA has held to this path; the economy has staved off a recession, albeit largely due to population growth and government spending,” he said.

“Similarly, households are battling through a seven-quarter ‘per capita’ recession that has been compounded by a period of negative real income growth and a depletion of savings, yet we haven’t seen mortgage arrears rise beyond 2 per cent.

“The timing of a rate cut remains a guessing game, but lower rates look likely within the first half of next year. The RBA has three meetings in the first half of next year, with monetary policy decisions handed down on Feb 18, April 1 and May 20.

“Whatever the timing, once interest rates do start to reduce, it might be enough to stave off further declines in home values, or even support some subtle growth across the more affordable markets.

“However, the rate-cutting cycle is likely to be a cautious and gradual one, suggesting we aren’t likely to see a return to the frothy growth conditions of recent cycles any time soon.”

Domain chief of research and economics Nicola Powell said today’s news “will undoubtedly be disappointing for homeowners, as well as prospective buyers who are holding off for a cut to the cash rate”.

“The RBA will be relying on economic data released early 2025 to help shape the next rate decision in February.

“While inflation is falling, this does not mean the RBA will reduce rates immediately. It is more likely that cuts will begin from May onwards.”

Powell said that the longer interest rates stayed at the current level, the greater the risk of a rise in distressed listings.

“Our data shows that currently, distressed listings remain low across Australia, indicating that Australians have adjusted as best they can without any rate cuts this year by reining in discretionary spending in other areas,” she said.

“However, if that cash rate stays as is, distressed sales could lift in some areas if financial strain becomes too much for homeowners.”

Finder head of consumer research Graham Cooke said many homeowners could not wait for a rate cut.

“Thousands of stressed homeowners can’t manage much longer with soaring mortgage costs smashing household budgets,” Cooke said.

“While we expect the RBA to start cutting the cash rate next year, many will struggle through the festive season with less money to spend than in previous years.”

Australians with an average home loan size of $641,416 are now paying $3958 a month on repayments on average—$1453 more a month and $17,436 more a year than they were before the RBA started lifting the cash rate in May, 2022, according to Finder.