South-East Queensland Poised for Property Upturn

Contributed by Barn Wilson.

The Queensland economy is now well into recovery stage after an inevitable slump following the mining boom.

In the third quarter of 2017, state final demand rose a significant 2.7 per cent year-on-year, which was the first time in three years this measure returned a positive result – the culmination of five consecutive quarters of positive growth.

Access Economics have also forecast the Queensland state final demand will average 3.8 per cent annual growth over the next four years, easily outstripping the average annual growth of 0.2 per cent in state final demand over the last five years.

Infrastructure boom set to takeover apartment construction

According to JLL, Queensland employment surged 4.1 per cent year-on-year to August 2017, easily surpassing Victoria and New South Wales (3.7% and 2.3% respectively) and the national figure of 2.8 per cent.

This is in spite of a clear slowdown in the construction of apartments in Brisbane that has been well underway for the better part of 18 months.

Building approvals for units in the greater Brisbane area were down 59.9 per cent for the year to August 2017 as it became harder for both developers and investors to obtain finance.

Interestingly, the pressure from APRA for banks to limit investor finance has actually benefited the Brisbane apartment market. It has inadvertently forced developers to create more appealing and better quality products – which is contributing to a change in buyer profile to more owner-occupiers and less investors and reducing the amount of “cookie cutter” apartments in the market.

Over the coming quarters, it is anticipated approval numbers will remain subdued. However, any negative employment effects felt from a reduction in construction will be offset by the burgeoning pipeline of infrastructure programs currently underway or soon to commence in Queensland.

Major Infrastructure Projects

Cross River Rail

With the recent re-election of the Palaszczuk government, Brisbane’s $5.4 billion Cross River Rail will commence construction next year.

It will involve the construction of four new underground stations, significant upgrades to existing stations and Brisbane’s first southern CBD rail station at Albert Street.

Forecast to create 1,500 jobs annually, the Cross River Rail project is due for completion in 2024.

Related reading: Construction on the $5.4 billion Cross River Rail now Under Way

Queens Wharf Redevelopment

The redevelopment of the $3 billion Queen’s Wharf precinct is one of the largest developments ever undertaken in Queensland. It covers 27.3 hectares, roughly one fifth of the CBD area.

At peak construction, Queens Wharf is projected to created 2,000 jobs with 8,000 jobs ongoing upon completion in 2024.

Queens Wharf will house over 50 restaurants, bars and cafes upon completion, with an additional 1,000 hotel beds and 2,000 apartments in the residential precinct.

Once fully operational, Queen’s Wharf is expected to bring an additional 1.39 million visitors and an increased tourism spend of $1.69 billion annually.

Related reading: 7 Major Projects Add $12bn to Brisbane's Economy

Brisbane Showground regeneration

The redevelopment of the 22-hectare site is the largest brownfield development of its kind in Australia.

Due for completion in 2026, the $2.9 billion redevelopment of the Brisbane showgrounds will generate more than 2,000 jobs over the course of the development and add over $300 million annually to Queensland’s economy.

Related reading: Lendlease Announce Partnership to Develop Aged-Care in Brisbane

Brisbane International Airport second runway

This is the largest aviation project currently underway in Australia, and one of the largest currently being undertaken globally.

Due for completion in 2020, the $1.35 billion second runway will create 2,700 construction jobs over seven years.

By 2035, Brisbane airport will handle 50 million passengers a year.

Related reading: Brisbane Airport Launches New Retail Centre

Herston Quarter redevelopment

A world-class health and wellbeing precinct will become a new landmark in Brisbane’s northeast.

The $1.1 billion precinct is due for completion in 2027, creating 700 jobs in the construction phase.

Related reading: Herston Quarter Underway with $350m Specialist Centre

Brisbane Metro

Due to commence in 2019, the $944 million Brisbane Metro project will feature two new high-capacity, high frequency metro lines connecting Brisbane’s southern suburbs and inner northern suburbs with the CBD.

Due for completion in 2022, Brisbane metro will create 7,000 construction jobs.

Brisbane's Property Outlook

Cyclical lows for inner city residential developments

As the cranes come down and the lights go on, we’ve officially hit the settlement stage of the inner-Brisbane apartment market.

The number of apartments being approved is now at cyclical lows and has been edging that way for quite some time.

Urbis reported the third quarter of 2017 saw only 672 apartments reach development approval status – a significantly lower number than those in the peak of the cycle which reached over 5,000 apartments per quarter in 2014 and 2015.

We’re also seeing cyclical lows for the number of pre-sales achieved each quarter, with the last four quarters averaging 348 in sales volumes.

These figures are a result of the stage of the cycle the market is in, reflecting the natural slowdown in completed stock that will likely carry through until 2020. And while small pockets of Brisbane have seen an oversupply in the last 18 months, prices have not been materially affected.

Significant growth for house prices

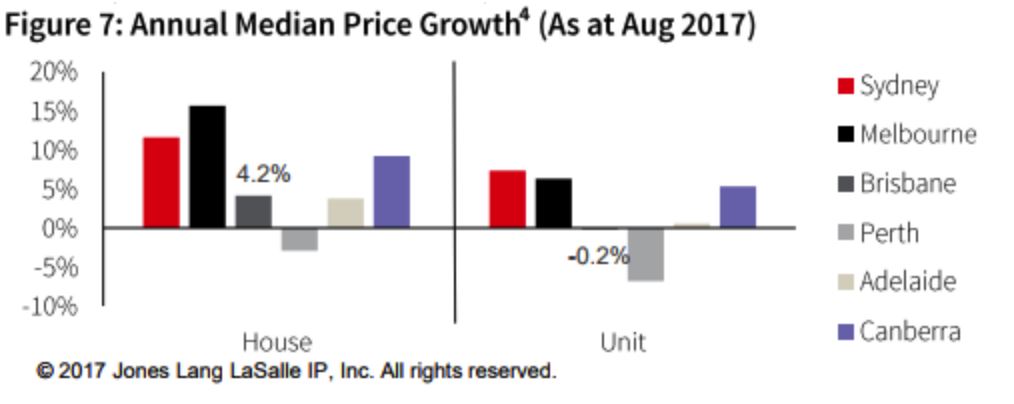

This chart from JLL’s third quarter Brisbane Apartment Market report shows Brisbane apartment prices were down only 0.2 per cent as at August 2017 year-on-year, while houses returned a robust 4.2 per cent positive growth story. Given this period spans the peak supply periods of the Brisbane apartment market (2016 and 2017) this is a reasonably solid result for apartments.

On a citywide level for apartment price growth, even the so called “hotspots” have remained relatively buoyant, despite the “oversupply” story.

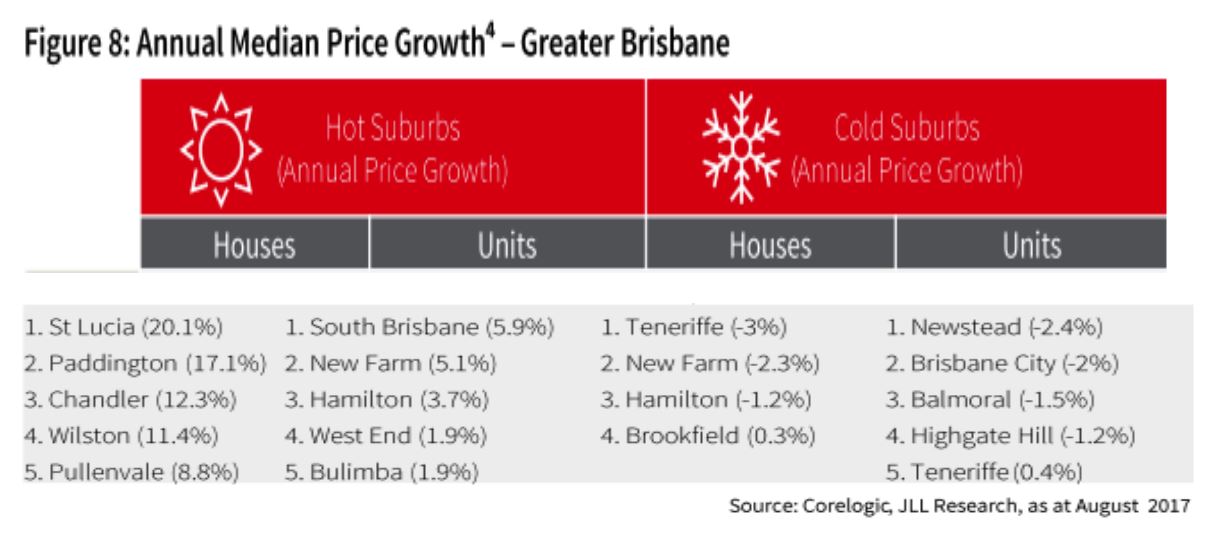

The table below shows the five strongest and weakest performing suburbs for median price growth for Brisbane houses and units for the 12 months to August 2017.

Supposed “problem suburbs” such as Newstead and Brisbane City have only seen a median price drop of 2 per cent each for the year and other challenging areas such as West End have achieved small positive returns in the 12 months to August 2017 (again, approximately 2%).

Brisbane housing values remain steady against soaring Sydney

The Brisbane housing market has not seen the same run up in prices as our east coast sister cities, Sydney and Melbourne. As a result, Brisbane should be insulated from any major price correction some economists are forecasting for these cities.

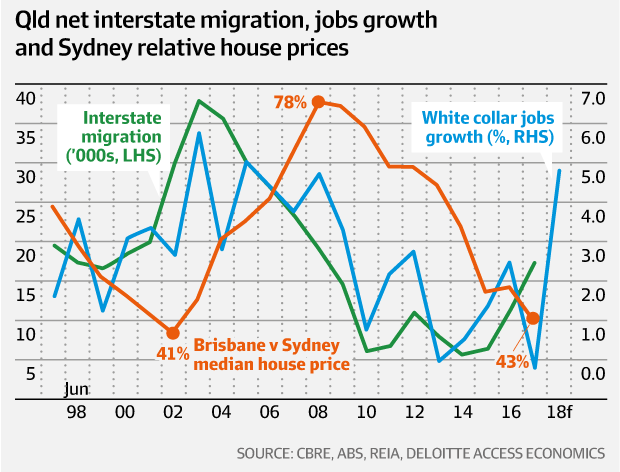

In fact, Brisbane’s housing is now valued at only 43 per cent of Sydney’s – which is at both historical and cyclical lows for the last two decades. The chart below shows the relationship between dwelling values in Brisbane as a percentage of Sydney’s and net interstate migration.

So what does this chart tell us?

Over the last two decades, Queensland’s net interstate migration peaked at just under 40,000 people (2002). This coincided with Brisbane’s housing being at its lowest value in relation to Sydney’s (43%).

In 2017, the ratio was at the same level as it was in 2002, as a result of Sydney’s recent bull market run up in prices.

Queensland’s net interstate migration has been steadily increasing since 2014 and history suggests that the dwelling price difference to Sydney (and Melbourne) should lead to a surge in interstate migration in the coming years and a subsequent surge in dwelling values in Brisbane.

Indeed, according to the Macquarie Bank equity strategy team we can expect "another great wave of interstate migration into Queensland."

Based on past patterns, approximately 130,000 people could be expected to make the migration north into Queensland over the next three years.

The average number of migrants over a three-year period is greater than the peak year in the above chart.

Migration on this scale would more than likely soak up any additional supply in the Brisbane apartment market, and could also drive up real estate prices.

Over the medium-term, the Brisbane property market is looking steady due to:

Lower apartment supply and surging interstate migration.

Political stability and a burgeoning pipeline of major infrastructure project.

JLL’s outlook for the Brisbane property market for the 12 months out from December 2017 can be seen below. While there is still some supply to work through the system, the outlook for unit prices in the next 12 months is steady, and they expect price appreciation in the housing market.

Gold Coast to see improving state employment and net migration

The Gold Coast property market boasts similar features to Brisbane – and is likely to see the same benefits as a result.

Wide price differential compared with Sydney and Melbourne

Improving state employment picture

Increasingly stable state government

Expected increase in net state migration.

Where the Gold Coast market differs is on the supply side of the equation – particularly since the global financial crisis.

Lenders exposed to the Gold Coast apartment market experienced losses at this time, and as a result lending on large developments all but dried up in the ensuing years.

Under normal circumstances, a chronic lack of supply would lead to a sharp upturn in prices – but in the case of the Gold Coast, there was an equal lack of confidence from buyers, particularly from interstate investors.

So, for the Gold Coast, prices are only really now getting back to pre-GFC levels for off-the-plan apartments in desirable beachside locations.

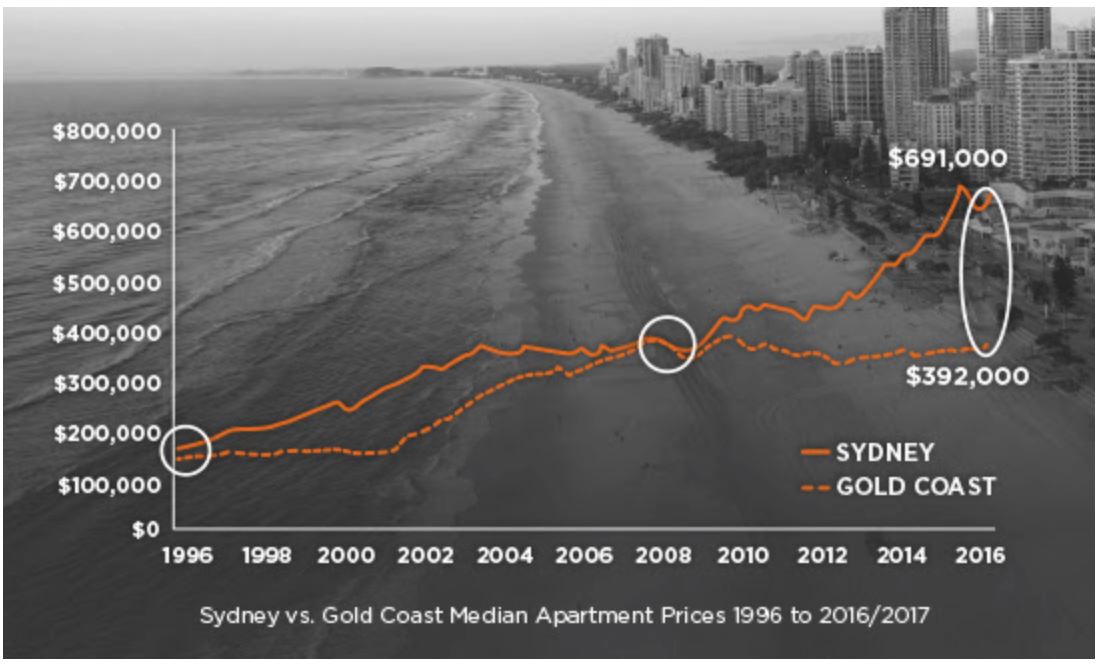

What can we see from this chart?

The median apartment price for Gold Coast has practically flat-lined since around 2008.

Historically, the median apartment price of Gold Coast and Sydney have converged after Sydney has had a run up in prices. This should give confidence to buyers of Gold Coast apartments in the short to medium term, given the gap is at the widest it has been in the last 20 years.

Looking ahead

South-east Queensland’s property market seems to have weathered the worst of the economic storm and the oversupply of apartments in and around the Brisbane CBD.

The economic and demographic signs are now positive for both Brisbane and the Gold Coast:

Strong employment growth

Extremely strong outlook for the state economy (projections for State Final Demand)

Huge pipeline of infrastructure yet to be complete

Net interstate migration story.

If the latter plays out as expected, this should provide an enormous transfer of wealth from the southern states – and would have far reaching positive outcomes for the economy and property prices as a whole.

If the market can navigate 2018 safely, the ensuing years could potentially experience some of the strongest years of price growth for south-east Queensland property since the early 2000s.

Barn Wilson is an associate director for Stamford Capital. Barn has 20 years’ experience in financial services and is passionate about property and interest rate markets.