Brisbane industrial developers have doubled down on their speculative offerings to the market, according to CBRE research.

More than 140,000sq m of speculative stock would enter the market this year—double the five-year average for the region.

Strong investor demand and capital investment in Brisbane’s industrial sector was underpinning the market confidence, according to CBRE research associate director Tom Broderick.

Broderick said Brisbane chalked up a record $1.5 billion in transactions last year with strong competition for available stock and about 260,000sq m of active leasing briefs.

“E-commerce penetration has accelerated over the past 18 months and is one of the key drivers of demand for floorspace,” Broderick said.

“Investors have responded by seeking to increase their exposure to the sector, however, there has been a lack of investment stock coming to market to fulfil this demand.

“As a result, many developers and institutional owners have decided to create new stock by building speculatively.”

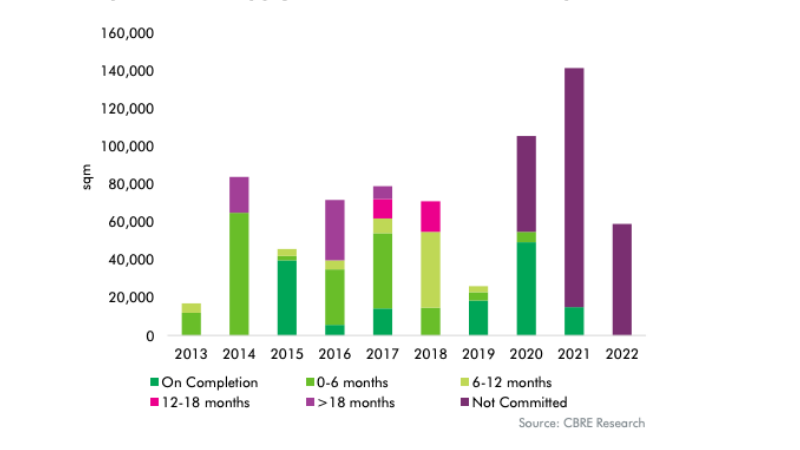

Speculative supply and lease start post-completion

CBRE Queensland director Peter Turnbull said about 75 per cent of the speculative stock developed in Brisbane since 2013 had leases commenced within a year of completion.

But, Turnbull said, tight land supply had driven industrial land values up 3.5 per cent per annum during the past five years with large institutional investors land banking and “putting upward pressure on pricing”.

CBRE research indicated about 67ha of new serviced industrial land had entered the market since 2016, but the absorption rate had averaged about 95ha per year, indicating a supply issue into the future.

Online retail penetration in Australia is at 13.3 per cent of all retail expenditure, and Australia Post data suggested online retail grew almost 50 per cent in 2020 in Queensland.

CBRE research associate director of research Tom Broderick said Toowoomba and Mackay had contributed significantly to e-commerce growth in Queensland, which boosted Brisbane’s position as a major distribution hub for the state.

Broderick said there had been an increased focus on export of manufactured food exports in Queensland during the past decade and it would continue to drive the development of specialised manufacturing and cold storage facilities.

Cold storage facilities are attractive to investors in the current environment given their exposure to the non-discretionary retail sector, and tenants are more “sticky” due to the overheads of fit-outs.

The report indicated that while there was substantial development of speculative stock under way, it was forecast to continue as fund managers looked to increase their exposure to the booming industrial sector.

Brisbane’s M1 corridor has the lowest vacancy rate of industrial and logistics precincts across the southeast corner at just 0.2 per cent, which CBRE research suggests would encourage greater development in the area over the next 24 months.

Delve into Australia's hottest asset class at The Urban Developer’s Industrial and Logistics vSummit. The one-day virtual summit is dedicated to Australia’s booming industrial and logistics sector. To register click here.