The Impact of Stamp Duty Discounts on the NSW Housing Market

On 27 July, the New South Wales government announced eligible first home buyers could access stamp duty exemptions on new home purchases worth up to $800,000.

New home builds will also see stamp duty discounts available for purchases between $800,000 and $1 million, where the discount reduces with a higher purchasing price.

The policy is a temporary, 12 month extension of existing stamp duty concessions from 1 August 2020.

Based on housing market trends that emerged from the initial introduction of stamp duty discounts and other first home buyer incentives, there a few trends we may expect to emerge from the new round of stamp duty discounts.

First home buyer demand will increase

Previous research suggests that first home buyer grants and incentives have had a “vacuum” effect, where first home buyer incentives are followed by large, but temporary, spikes in first home buyer activity.

This suggests the incentives bring forward purchases that may have happened anyway—and the fact that the new stamp duty discounts on offer will only be available for 12 months is likely to exacerbate this effect.

The increase in first home buyer participation over a limited time window may actually lead to an increase in values up to the cut off values for stamp duty concessions, because buyer competition could be increased in this segment while added incentives are on offer.

Furthermore, the reduced transaction costs associated with stamp duty exemptions mean borrowers have higher purchasing capacity, which may just be added onto the purchase price while first home buyer demand is elevated.

One important mitigating factor is that the demand shock created by Covid-19 may not be enough to increase first home buyer demand, however, at the very least, first home buyer participation would be higher than it otherwise would have been as a result of the stamp duty discount.

Price ‘clustering’ could move up to the $800,000 mark

Research of sales volumes by price suggests that sales volumes tend to “cluster” just under the cut-off point for complete stamp duty exemptions, so that first home buyers can avoid paying the tax.

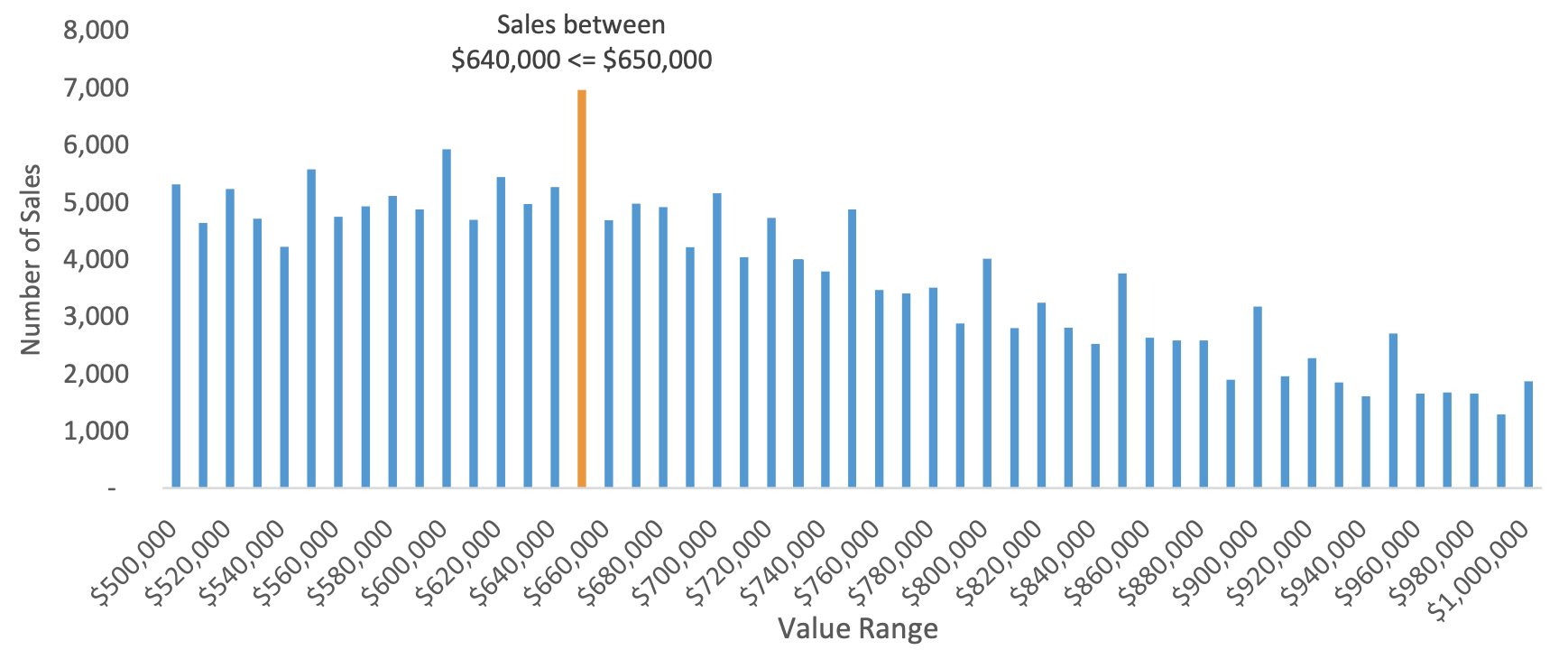

CoreLogic sales volume data across NSW shows that there is a bunching of sales between the $640,000 and $650,000 price point between July 2017 and June 2020.

The cut-off point for stamp duty exemption for first home buyers in this period was $650,000.

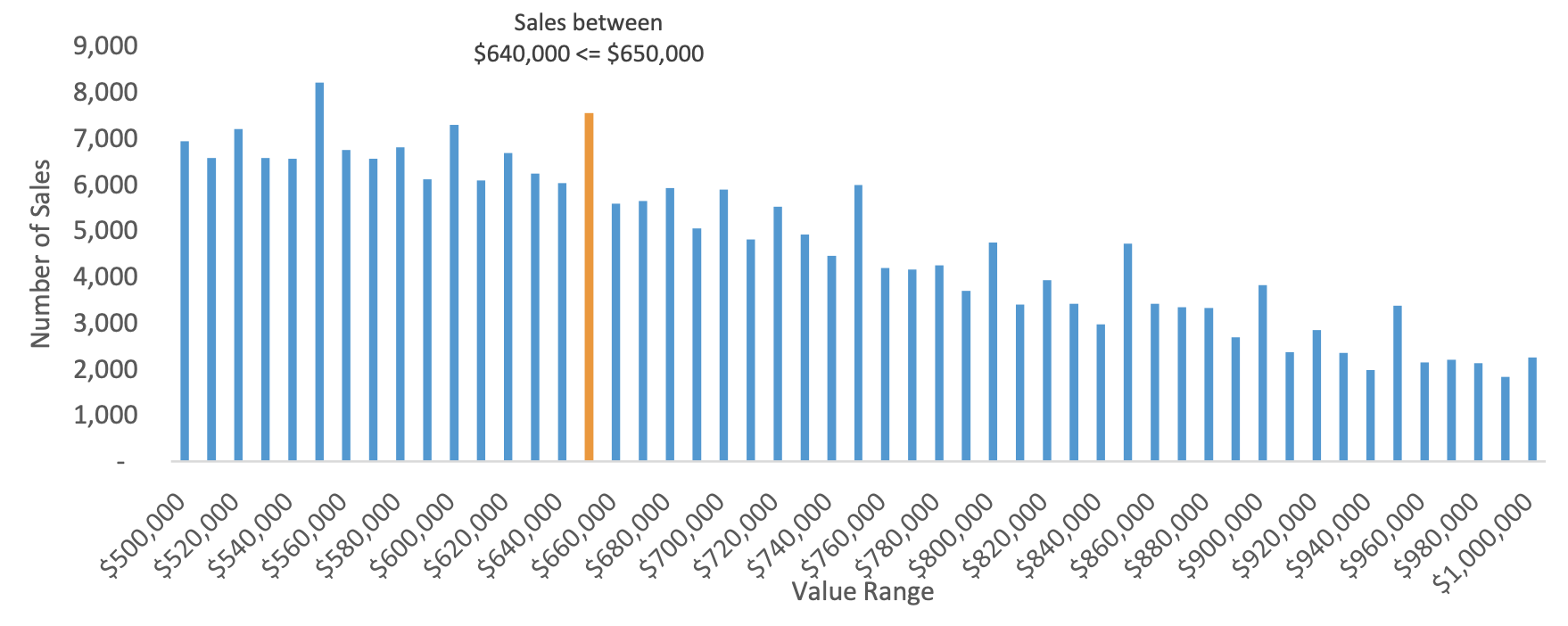

This is demonstrated in sales data charts which show the volume of sales across NSW by value range for the two years before and after the introduction of stamp duty discounts for sales up to $650,000.

NSW sales by value range, two years before concessions

^ Source: CoreLogic; volume of sales grouped by value ranges of $10,000, for prices between $500,000 and $1,000,000.

While the $650,000 price point seemed to be an anchoring point for buyers before the introduction of stamp duty exemptions, the difference in sales volumes is exacerbated after exemptions are introduced.

The number of sales at $640-650,000 was 32 per cent higher than the band below, and is 49 per cent higher than sales in the value band above.

This is a greater divergence than was observed between these value bands in the two years before the introduction of stamp duty exemptions.

As the stamp duty exemption increases to $800,000, this could see a broader range of properties increase in value up to this level.

This price inflation would be skewed toward new home builds where the discounts apply.

NSW sales by value range, two years after concessions

^ Source: CoreLogic; volume of sales grouped by value ranges of $10,000, for prices between $500,000 and $1,000,000.

The incentive to avoid tax could increase turnover now, but dampen it later

An interesting feature of the stamp duty discounts for first home buyers is that they extend to property values worth up to $1 million: this is likely to be beyond the typical first home buyer purchase point across NSW.

Deriving the average borrowing amount by first home buyers from ABS housing finance data suggests that a typical first home buyer purchase price averaged closer to $625,000 between July 2019 and May 2020.

By raising the threshold to $1 million, there is more diversity in the housing stock that first home buyers can access with stamp duty discounts, particularly across Sydney, where property values are higher than in other capital cities.

But by incentivising first home buyers into a more expensive, and presumably larger home earlier in life, first home buyers may stayput for longer, in order to avoid paying stamp duty on upsizing down the line.

This could extend hold periods, thus potentially reducing the amount of turnover that takes place in future.

Overall, the expected impact of this temporary discount in stamp duty should bring forward the purchase of property among first home buyers, and skew more first home buyers to new property.

This is good news for those in the construction industry, and, considering the broad range of industry sectors involved in residential construction, there should be a positive flow through to economic activity.

However, considering the potential for higher housing prices, stamp duty exemptions may be limited in helping first home buyers access cheaper housing.