Stockland's Annual Profit Increases 34% to $1.2 billion

Diversified property developer Stockland's annual profit has increased to $1.2 billion but surging electricity prices will dampen earnings growth for the group this financial year.

According to Stockland, rising power costs in its retail portfolio - its largest asset class - will slow earnings in 2017-18.

Growth in funds from operations, its preferred profit measure, is up 8.5 per cent to $802 million on FY16, and would be "slightly" lower next year than the 7.4 per cent increase recorded in the year to June to give it a better-than-expected 33.4¢ per security profit.

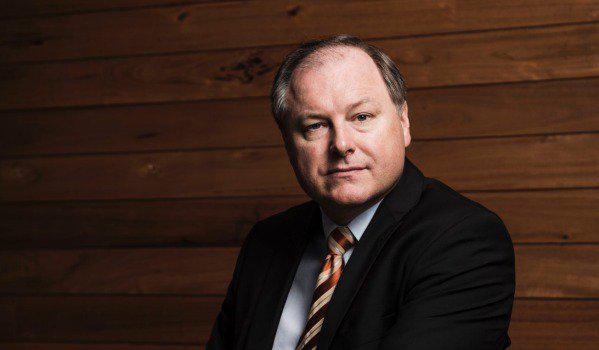

Stockland Managing Director and CEO Mark Steinert today announced a strong performance for the group for FY17, with the developer reporting growth in all core businesses, with residential operating profit up 17.4% on FY16.

Steinert said: “We’ve delivered another positive performance this financial year across our diversified business, by reinforcing our position as the leading creator of communities in Australia, strategically repositioning our assets and restocking the portfolio.

“All of our businesses contributed to this result. Our residential and retirement living businesses achieved record results, and commercial property delivered a good performance across the different asset classes, despite challenging conditions in the retail market."

Steinert said while earnings were boosted by the retirement and residential divisions, the rising cost of electricity would weigh on future earnings, although the group said it had contracts locked in until 2019. It is also the largest user of rooftop solar panels in the southern hemisphere.

Stockland commercial property executive John Schroder said east coast electricity costs have jumped by almost two-thirds.

"The issue for FY18 is electricity," Schroder said.

"The electricity increase in our portfolio across the nation is 48.4 per cent, or 60 per cent on the eastern seaboard.

"That also has an implication on occupancy costs and the ability to drive rent growth."

Stockland CEO Mark Steinert